Phoenix Arizona Employee Payroll Record is a comprehensive documentation system that tracks and manages the payment-related data of employees working in organizations located in Phoenix, Arizona. This record contains crucial details such as employee information, compensation rates, hours worked, deductions, and benefits. Maintaining accurate and up-to-date payroll records is essential for organizations to comply with federal and state regulations, ensure fair compensation, and facilitate efficient financial management. The Phoenix Arizona Employee Payroll Record serves as a reliable resource for employers, HR departments, and accounting teams to facilitate effective payroll processing and reporting. Key components included in the Phoenix Arizona Employee Payroll Record may consist of: 1. Employee Information: This includes the employee's full name, address, social security number, date of birth, and contact details. 2. Salary and Compensation: The record outlines the salary structure, pay rate, hourly wages, overtime rates, and details of any additional compensation such as bonuses or commissions. 3. Hours Worked: The record tracks the number of hours worked by each employee, including regular hours, overtime, vacation, sick leave, or other paid time off. 4. Withholding and Deductions: It encompasses details regarding tax withholding, retirement contributions, healthcare premiums, garnishments, and other deductions or contributions authorized by the employee. 5. Benefits and Allowances: This section specifies the employee's participation in various benefit programs, such as health insurance, retirement plans, flexible spending accounts, and any other allowances provided by the employer. 6. Paid Time Off: The record may encompass information on vacation days, personal leave, sick leave, and any other types of paid time off accrued or used by the employee. 7. Tax Information: It includes tax-related data such as the employee's filing status, number of allowances claimed, and any exemptions or exemptions claimed. Different types of Phoenix Arizona Employee Payroll Record might include variations based on the size and nature of the organization, industry-specific regulations, or unique employer policies. Some organizations may also include additional sections like training records, performance evaluations, disciplinary actions, and other relevant employee-related information. Organizations can choose between manual record keeping methods, spreadsheet-based systems, or advanced payroll software to create and maintain the Phoenix Arizona Employee Payroll Record. Deploying efficient payroll software streamlines the process, reduces errors, promotes data security, and ensures timely payment and compliance with federal and state payroll laws. Overall, the Phoenix Arizona Employee Payroll Record is an integral tool to facilitate accurate, efficient, and compliant payroll management for organizations operating in Phoenix, Arizona. Ensuring the accuracy and confidentiality of this record safeguards' employee rights, enhances organizational transparency, and supports successful financial management.

Phoenix Arizona Employee Payroll Record

Description

How to fill out Phoenix Arizona Employee Payroll Record?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Phoenix Employee Payroll Record, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the latest version of the Phoenix Employee Payroll Record, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Employee Payroll Record:

- Glance through the page and verify there is a sample for your area.

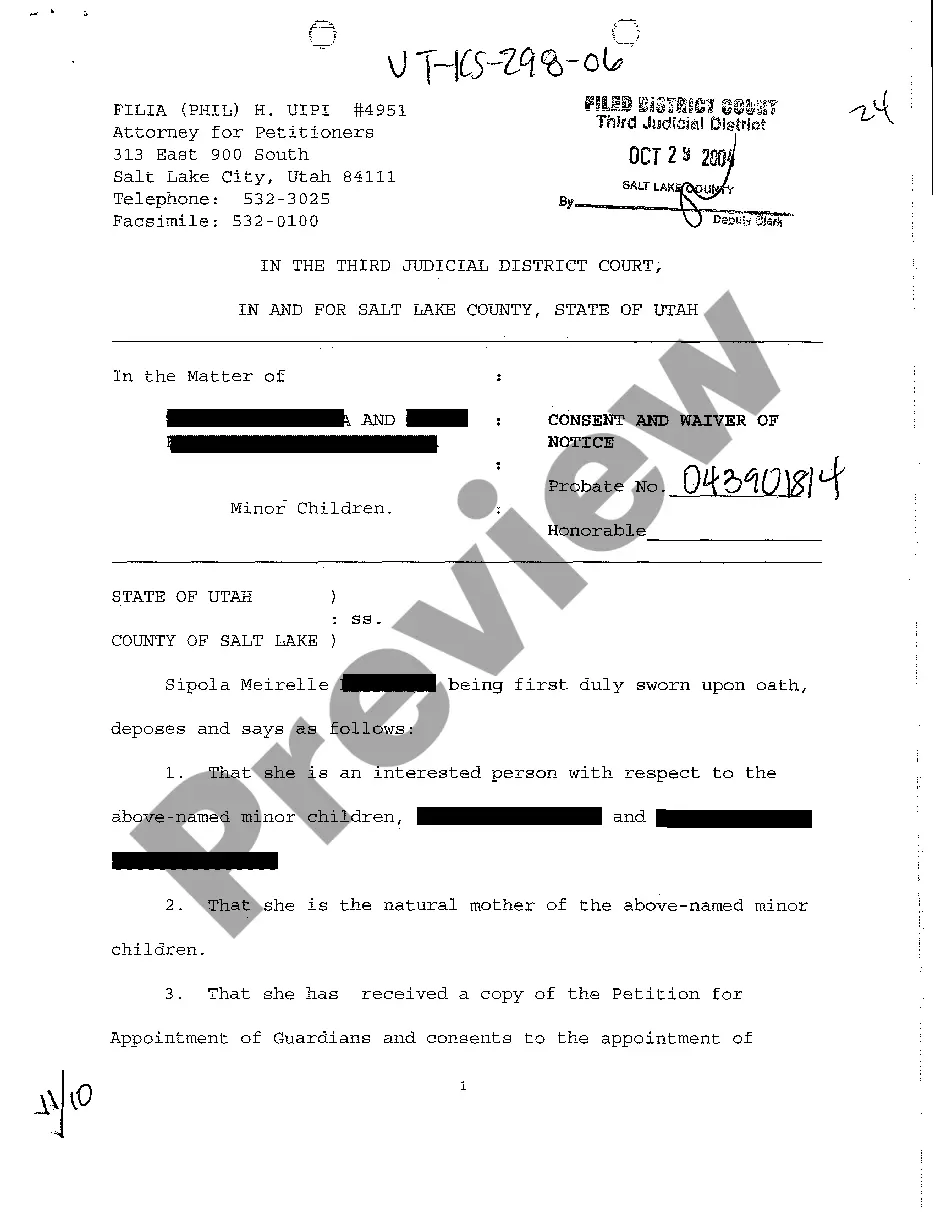

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Phoenix Employee Payroll Record and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!