Suffolk New York Mileage Reimbursement Form

Description

How to fill out Mileage Reimbursement Form?

Generating documents, such as Suffolk Mileage Reimbursement Form, to manage your legal matters is a challenging and lengthy endeavor.

Numerous situations necessitate an attorney’s participation, which also renders this task costly.

However, you can take charge of your legal matters and manage them independently.

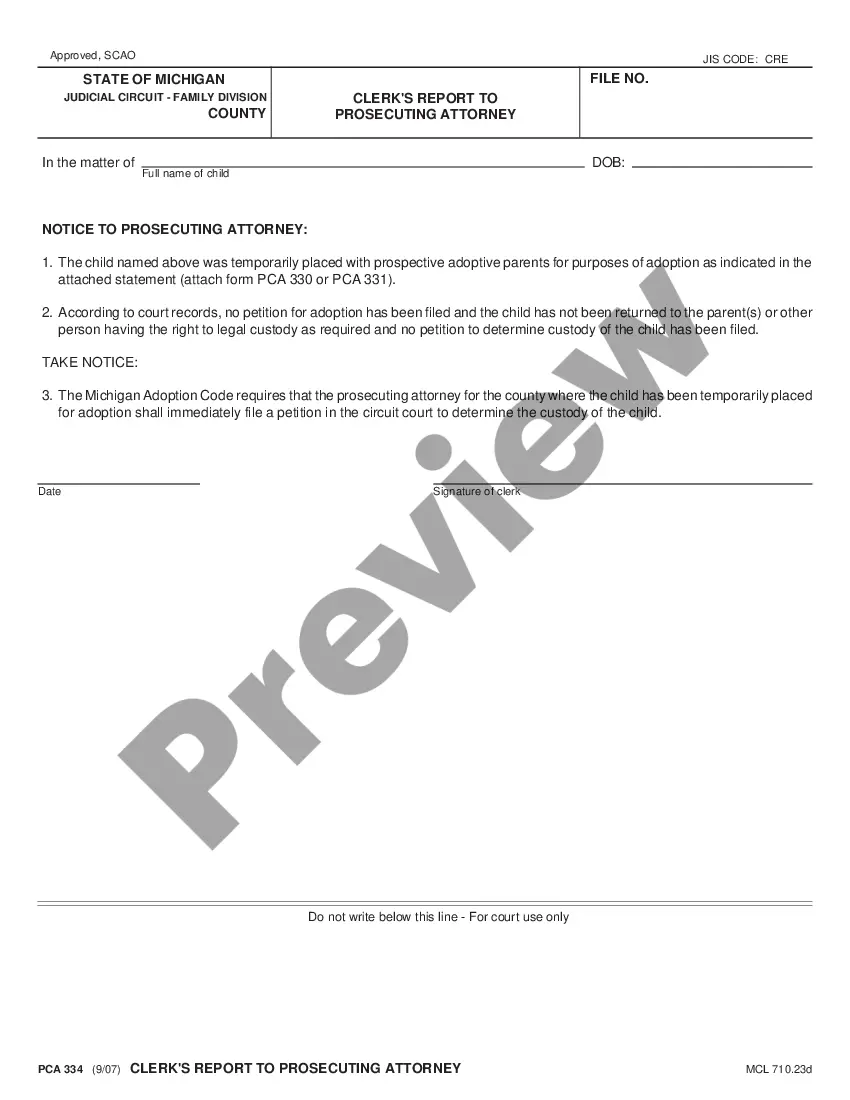

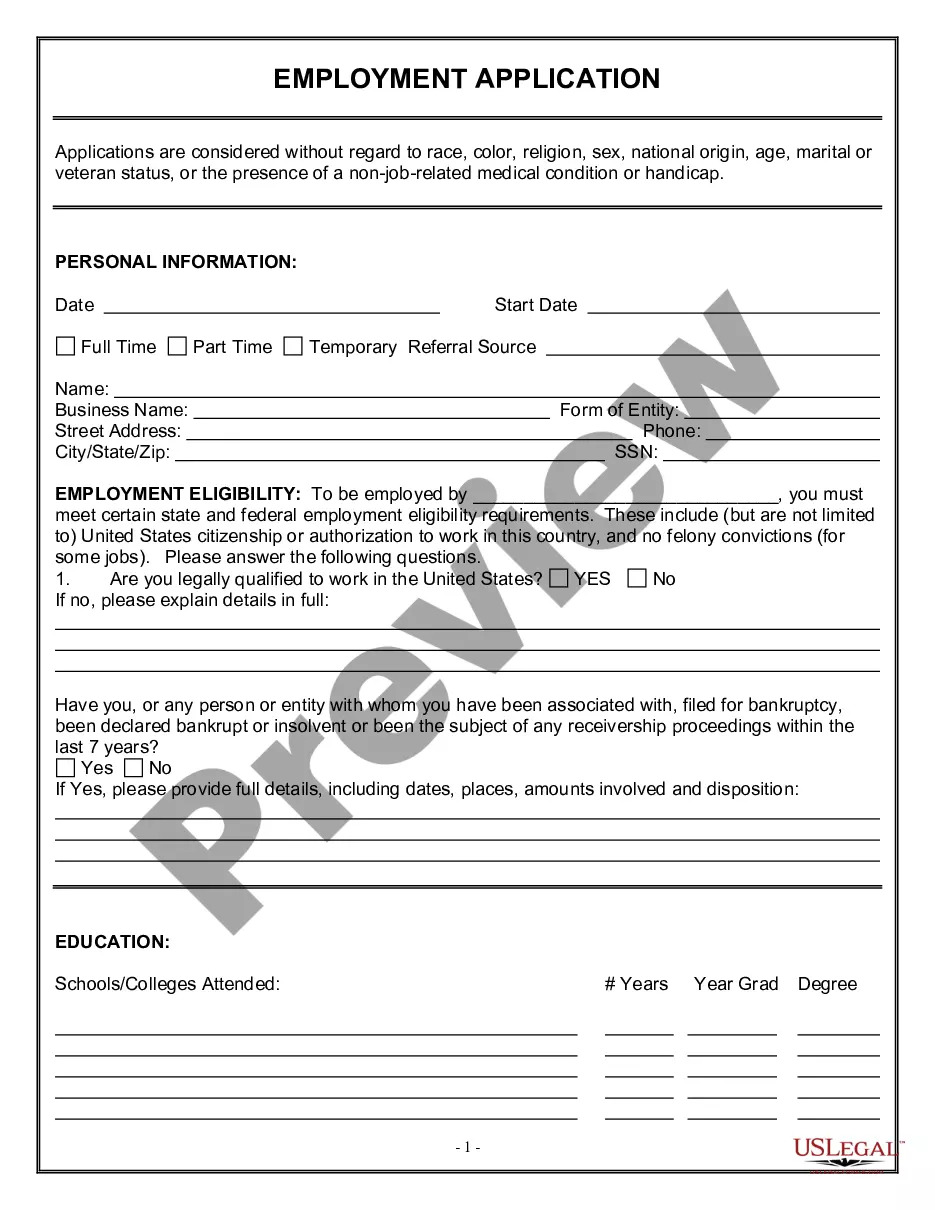

The registration process for new clients is quite simple! Here’s what you should do before obtaining the Suffolk Mileage Reimbursement Form: Confirm that your document complies with your state/county, as the rules for drafting legal documents may vary between states. Gather further details about the form by previewing it or reading a brief introduction. If the Suffolk Mileage Reimbursement Form isn’t what you wanted to discover, utilize the search bar in the header to find an alternative. Log In or register an account to begin using our website and obtain the form. Everything aligned on your side? Click the Buy now button and choose a subscription plan. Choose the payment platform and enter your payment details. Your form is all prepared. You can proceed to download it. It’s effortless to locate and purchase the required template with US Legal Forms. Countless businesses and individuals are already benefiting from our vast collection. Subscribe today if you wish to explore the additional benefits you can gain with US Legal Forms!

- US Legal Forms is ready to assist.

- Our website features over 85,000 legal templates designed for various situations and life events.

- We guarantee that each template adheres to the laws of every state, alleviating your concerns regarding potential legal compliance issues.

- If you are already acquainted with our offerings and possess a subscription with US, you recognize how simple it is to acquire the Suffolk Mileage Reimbursement Form.

- Just Log In to your account, retrieve the form, and adjust it to your specifications.

- Have you misplaced your form? No problem. You can access it in the My documents segment of your account, whether on desktop or mobile.

Form popularity

FAQ

The IRS requires that you maintain accurate records of your mileage for proper reimbursement. Typically, this involves keeping a log that includes the date, purpose of the trip, starting point, destination, and total miles driven. Completing the Suffolk New York Mileage Reimbursement Form can help you organize this information effectively.

SECTION OVERVIEW AND POLICIES Effective DatePersonal Vehicle Standard RateMotorcycle Mileage RateJanuary 1, 20220.5850.565January 1, 20210.5600.540January 1, 20200.5750.545January 1, 20190.5800.5509 more rows

The current mileage reimbursement rate is 53.5 cents and may be verified at the following link to the NYS Mileage Reimbursement Rate for personal vehicles.

With the high cost of gas and insurance today, and many of us having to travel for work I was curious to see how employers were compensating for the increased travel expenses. I was surprised to learn that New York State does not have a law requiring employers to pay a certain mileage rate.

On the bottom of the form locate the total mileage. Add the numbers entered in the round trip milesMoreOn the bottom of the form locate the total mileage. Add the numbers entered in the round trip miles column. As a reminder the mileage rate is 57.5 cents per mile.

Mileage records The name and address of where you have travelled to with dates. This could be in the form of a diary or spreadsheet listing the details in date order. Pay-slips or a statement confirming any mileage or travel allowance paid to you by your employer.

Calculate Get the miles traveled from the trip odometer, or subtract the original odometer reading from the new one. Divide the miles traveled by the amount of gallons it took to refill the tank. The result will be your car's average miles per gallon yield for that driving period.

As a rule, the per-kilometre rate we consider reasonable is the rate that an employer subject to income tax is authorized to deduct under Quebec tax laws and regulations....Reasonable per-kilometre rate. YearFirst 5,000 kilometresAdditional kilometres2020$0.59$0.532019$0.58$0.522018$0.55$0.492017$0.54$0.484 more rows

How to Fill out the Medical Mileage Form in Workers Comp - YouTube YouTube Start of suggested clip End of suggested clip On the bottom of the form locate the total mileage. Add the numbers entered in the round trip milesMoreOn the bottom of the form locate the total mileage. Add the numbers entered in the round trip miles column. As a reminder the mileage rate is 57.5 cents per mile.

More In Tax Pros PeriodRates in cents per mileSourceBusiness202057.5IR-2019-215201958IR-2018-2512018 TCJA54.5IR-2017-204 IR-2018-12710 more rows ?