Bronx New York Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Bronx New York Waiver Of Qualified Joint And Survivor Annuity - QJSA?

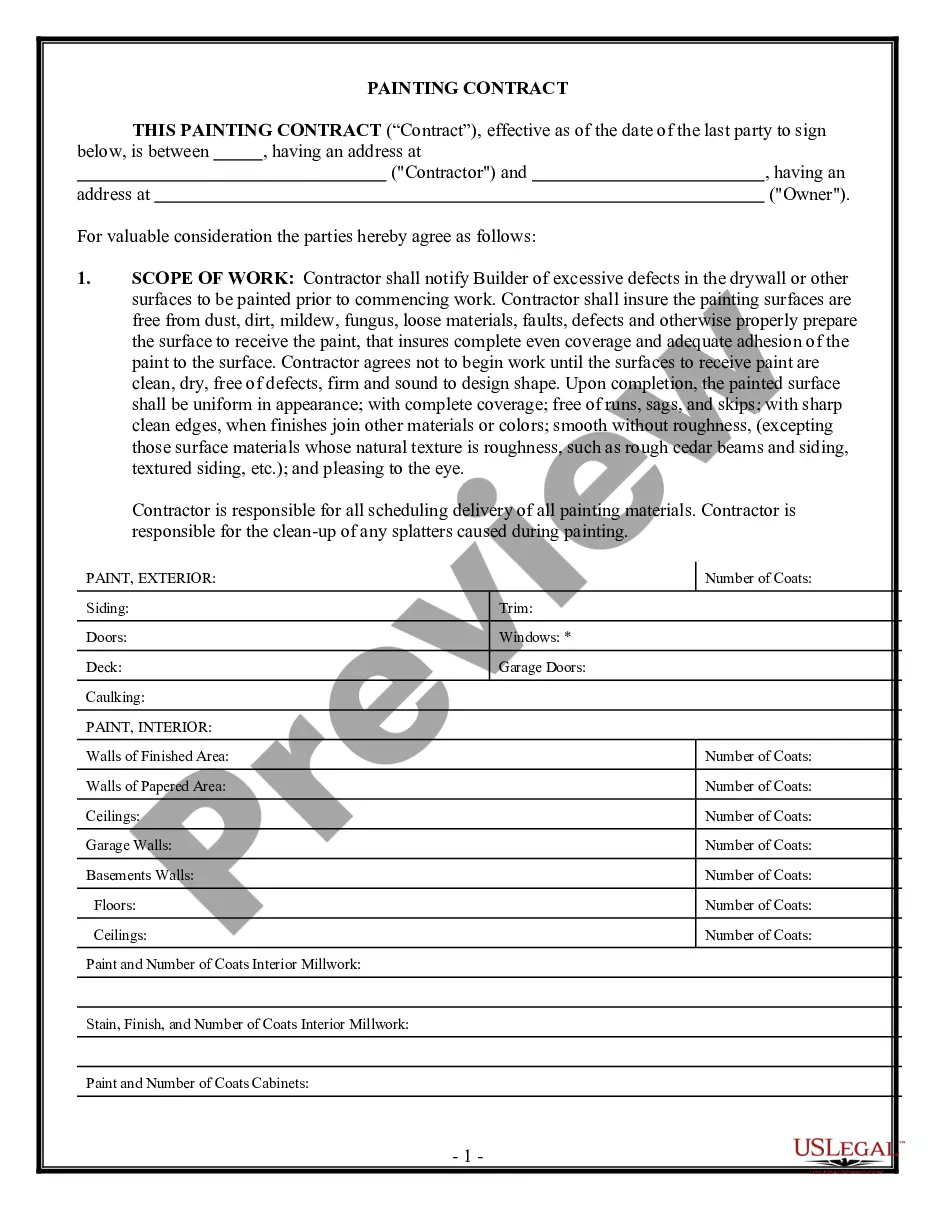

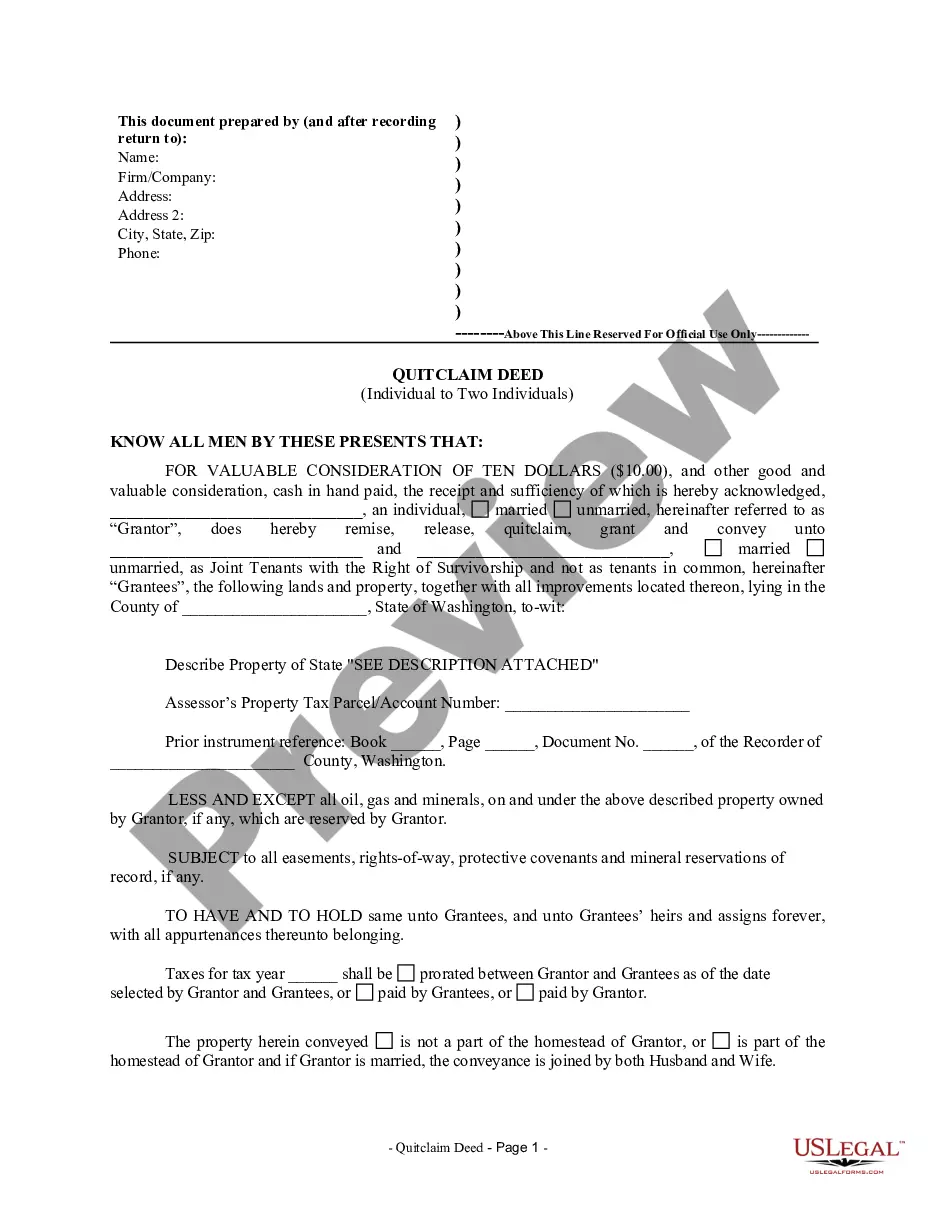

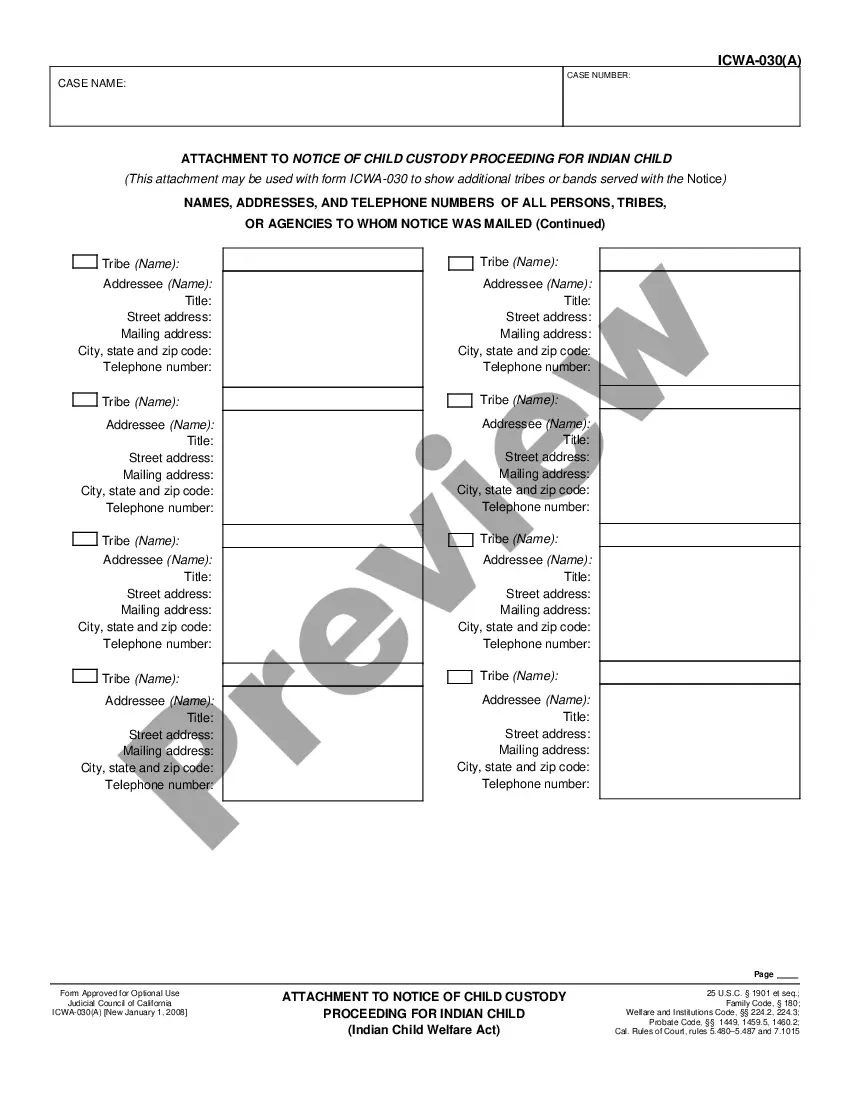

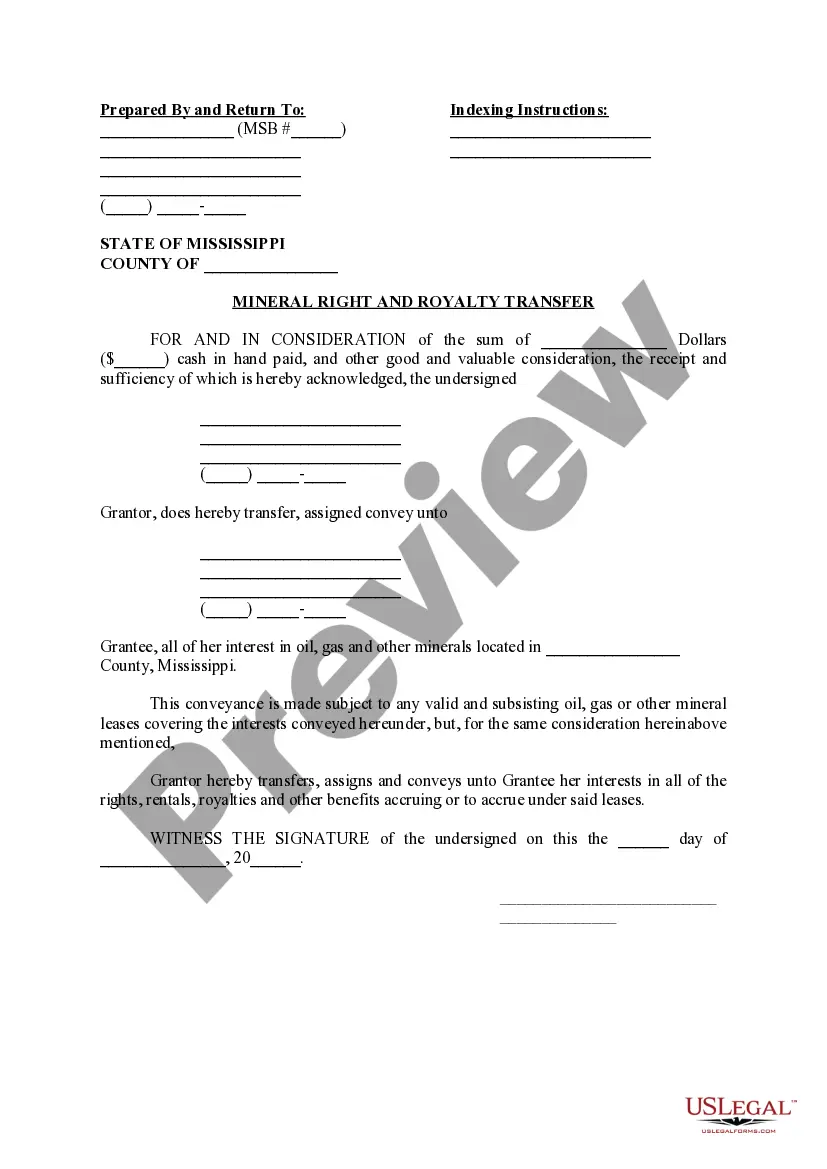

Draftwing forms, like Bronx Waiver of Qualified Joint and Survivor Annuity - QJSA, to take care of your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for various scenarios and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Bronx Waiver of Qualified Joint and Survivor Annuity - QJSA template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Bronx Waiver of Qualified Joint and Survivor Annuity - QJSA:

- Ensure that your form is specific to your state/county since the regulations for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Bronx Waiver of Qualified Joint and Survivor Annuity - QJSA isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our service and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

The Survivor Benefit Plan (SBP) allows a retiree to ensure, after death, a continuous lifetime annuity for their dependents. The annuity which is based on a percentage of retired pay is called SBP and is paid to an eligible beneficiary. It pays your eligible survivors an inflation-adjusted monthly income.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

What is joint and survivor annuity? A joint and survivor annuity is a type of immediate annuity that guarantees payments for as long as the annuity owner or the beneficiary lives. The payments from a joint and survivor annuity would last for the duration of the annuity owner's life plus the life of another person.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

A 50 percent joint and survivor annuity will pay the surviving annuitant half the payment amount that payees were receiving when both annuitants were alive. And a 75 percent joint and survivor annuity will pay three-quarters of that amount to the surviving annuitant.

More In Retirement Plans Alternatively, a participant who waives a QJSA may elect to have a qualified optional survivor annuity (QOSA). The amount paid to the surviving spouse under a QOSA is equal to the certain percentage (as chosen) of the amount of the annuity payable during the participant's life.

A qualified joint and survivor annuity (QJSA) provides a lifetime payment to an annuitant and spouse, child, or dependent from a qualified plan. QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits.

This benefit provides payments to the participant's spouse for his or her lifetime equal to a percentage (as specified in the Pension Plan) not less than one-half of the annuity that would have been payable during their joint lives. The participant may waive the Qualified Preretirement Survivor Annuity.

andsurvivor annuity pays you during your lifetime and then continues to pay your spouse or other named beneficiary. You might be able to choose either a 100, 75, or 50 percent jointandsurvivor annuity. The 100 percent option gives your survivor the same monthly benefit that you received.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.