Bexar County, Texas, is known for its thriving job market and entrepreneurial spirit. Many individuals in Bexar Texas choose to work as self-employed contractors due to the flexibility it offers. However, determining one's self-employed contractor status in Bexar Texas requires careful consideration and understanding of relevant factors and regulations. One crucial aspect of determining self-employed contractor status in Bexar Texas is examining the nature of the working relationship with the hiring party. The Internal Revenue Service (IRS) provides guidelines to differentiate between an employee and a self-employed contractor. Keywords like "IRS guidelines" and "nature of working relationship" are essential to comprehend the criteria used for this determination. The IRS focuses on three main categories when evaluating the relationship: behavioral control, financial control, and the type of relationship. Behavioral control assesses whether the hiring party has the right to control how and when the work is performed. Financial control examines whether the contractor has control over their own business expenses and investments. The type of relationship scrutinizes written contracts between the parties, employee benefits, and the permanency of the working relationship. In Bexar Texas, there are different types of self-employed contractor statuses that individuals can fall under, depending on their profession and specific work arrangement. Some common examples include freelance writers, independent consultants, gig economy workers, real estate agents, and construction contractors. Each category may have unique considerations when it comes to determining their self-employed status, which may require additional research and understanding. To determine self-employed contractor status in Bexar Texas correctly, individuals should also consider tax obligations. Self-employed contractors typically have different tax responsibilities than traditional employees, such as paying estimated taxes throughout the year and handling their Social Security and Medicare contributions. It is crucial to familiarize oneself with relevant tax rules and consult a tax professional or accountant for guidance to ensure compliance and avoid potential issues with the IRS. Moreover, obtaining proper licenses and permits may be necessary for specific self-employed contractor categories in Bexar Texas. For example, contractors involved in construction, home improvement, or electrical work may need to obtain specific licenses to operate legally in the county. Understanding and fulfilling these legal requirements are essential to operate as a self-employed contractor lawfully and protect both the contractor and their clients. In conclusion, determining self-employed contractor status in Bexar Texas involves considering various factors such as the nature of the working relationship, adherence to IRS guidelines, and compliance with tax and legal obligations. It is crucial to be well-informed about specific rules and regulations that apply to different categories of self-employed contractors in Bexar Texas to ensure smooth operations and avoid potential legal or financial pitfalls.

Bexar Texas Determining Self-Employed Contractor Status

Description

How to fill out Bexar Texas Determining Self-Employed Contractor Status?

Drafting documents for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Bexar Determining Self-Employed Contractor Status without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Bexar Determining Self-Employed Contractor Status on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Bexar Determining Self-Employed Contractor Status:

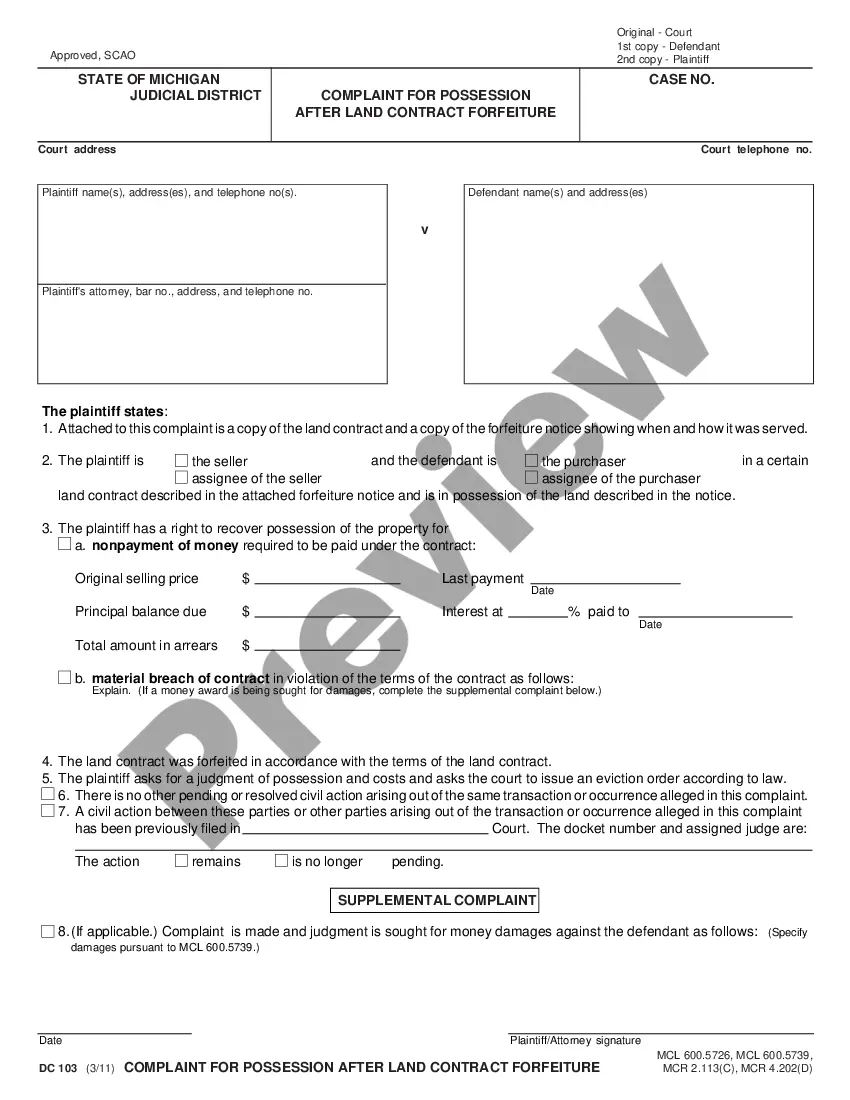

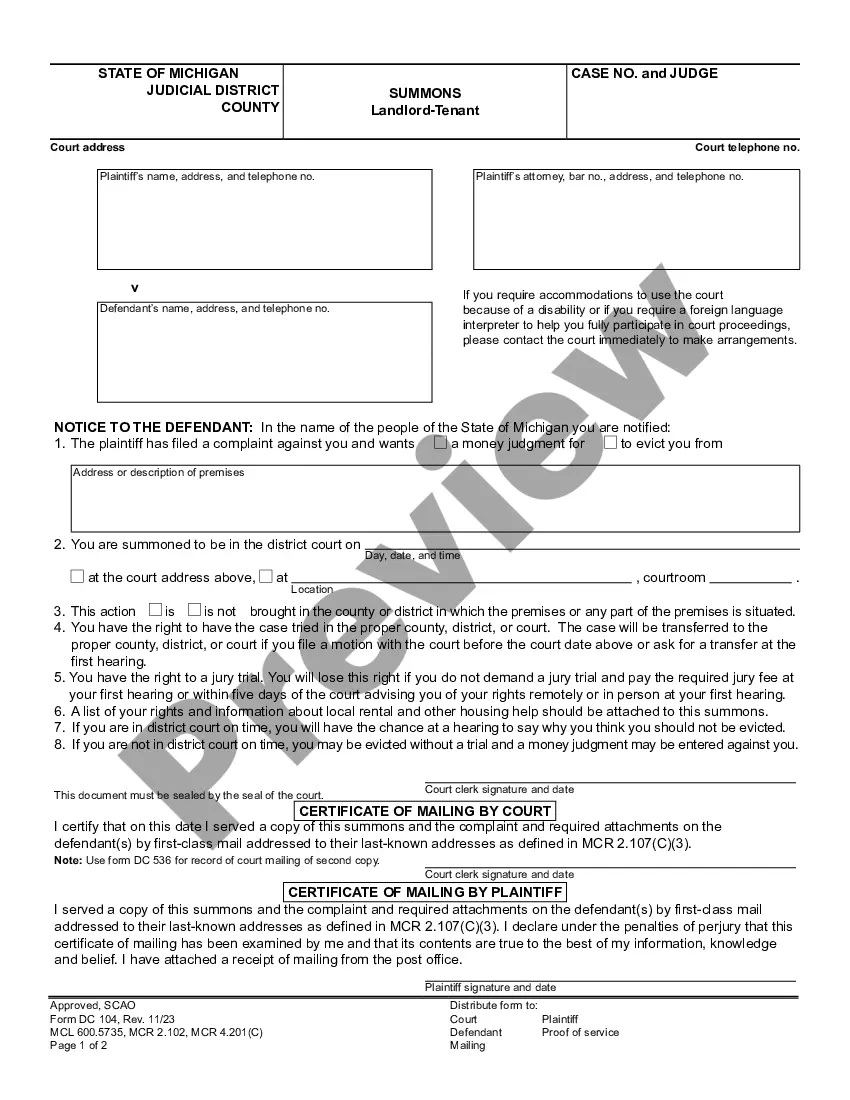

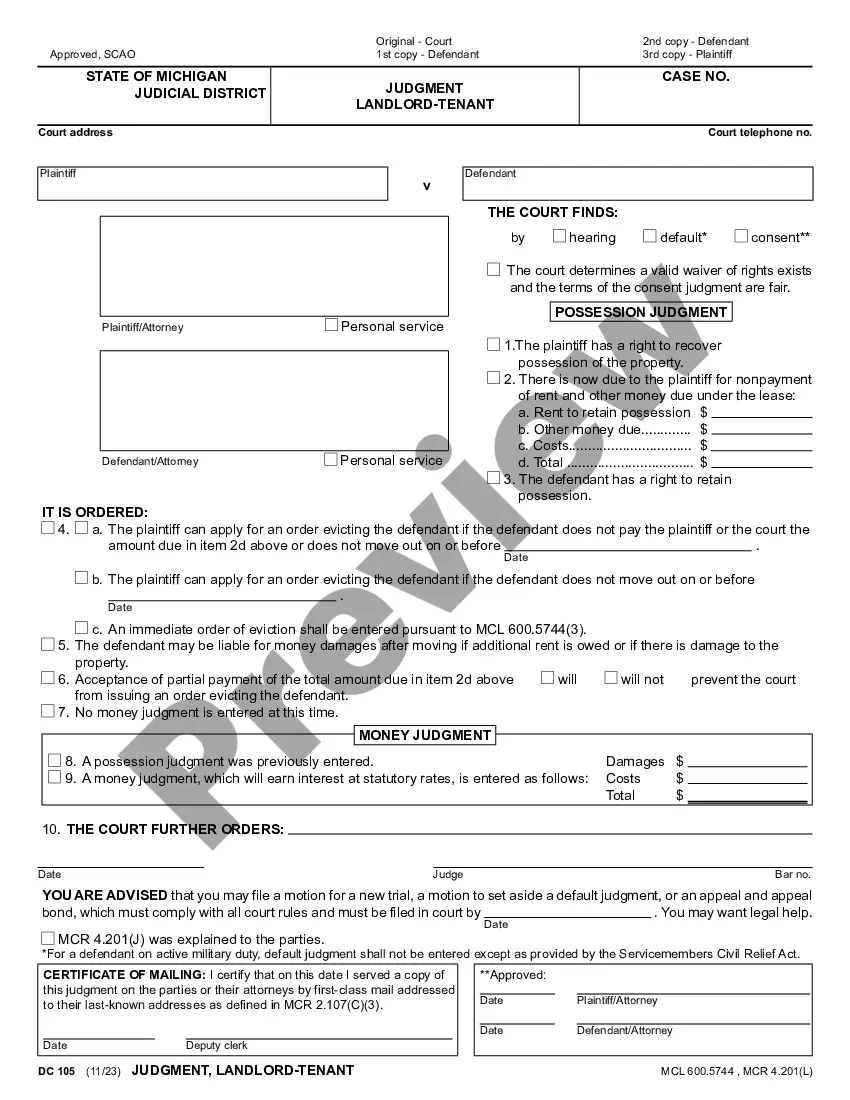

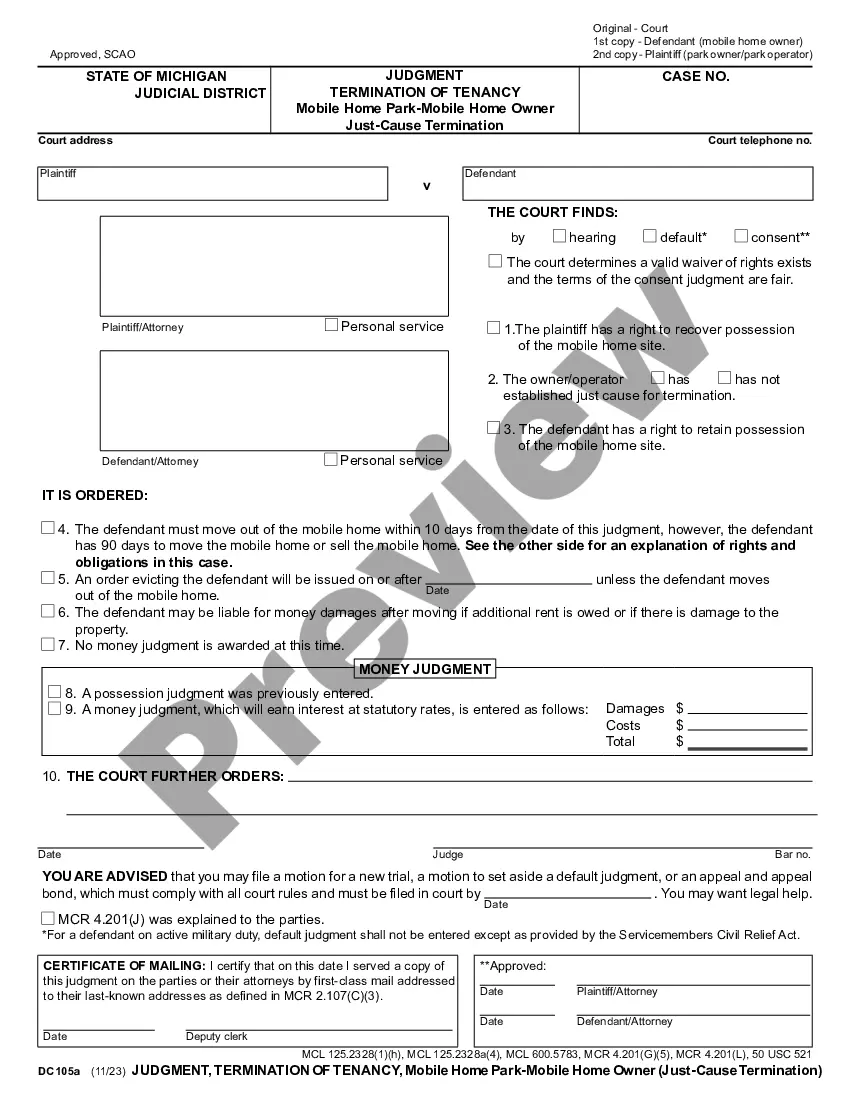

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!