San Diego, California, is a vibrant city located on the southwestern coast of the United States. Known for its stunning beaches, pleasant climate, and diverse culture, San Diego is one of the major cities in California. This article focuses on determining the self-employed contractor status in San Diego, California, and provides insights into various aspects related to this topic. Determining self-employed contractor status is crucial for both individuals and businesses operating in San Diego. It entails understanding the legal and financial implications of working as an independent contractor and the distinction between an employee and a self-employed contractor. One type of self-employed contractor status in San Diego is a freelancer. Freelancers are individuals who offer specialized services on a project or assignment basis. They often have multiple clients and work independently, setting their own hours and rates. Freelancers can include professionals such as graphic designers, writers, web developers, and consultants. Another type of self-employment in San Diego is a gig worker. Gig workers typically engage in short-term, flexible jobs that are often facilitated through online platforms or apps. These jobs may include ride-sharing, delivery services, or even short-term task assignments. Gig workers often have more control over their schedules, choosing when to work and for how long. Determining self-employed contractor status involves several factors that differentiate it from being an employee. Firstly, the degree of control over their work is essential. Independent contractors have a higher level of autonomy in decision-making, whereas employees must adhere to employer instructions. Secondly, independent contractors usually bear the financial risk associated with their work, while employees receive a fixed salary or wages. Tax responsibilities and benefits also vary between the two categories. For individuals in San Diego who wish to establish themselves as self-employed contractors, it is necessary to understand the legal requirements and obligations. They must ensure compliance with local, state, and federal regulations. Registering their business, obtaining the necessary licenses or permits, and filing the appropriate tax documentation are some critical steps to consider. Additionally, self-employed contractors in San Diego should carefully manage their finances and maintain proper documentation. This includes tracking their income, expenses, and applicable deductions to ensure accuracy in tax reporting. Seeking professional advice from accountants or tax experts who specialize in self-employment can be beneficial. In conclusion, San Diego, California, offers a thriving environment for self-employed contractors, including freelancers and gig workers. Understanding the various types of self-employment, distinguishing between being an employee and an independent contractor, and complying with legal requirements are crucial steps in establishing and maintaining self-employed contractor status in San Diego. Proper financial management and seeking professional advice can help navigate the complexities of self-employment and ensure a successful and compliant business venture.

San Diego California Determining Self-Employed Contractor Status

Description

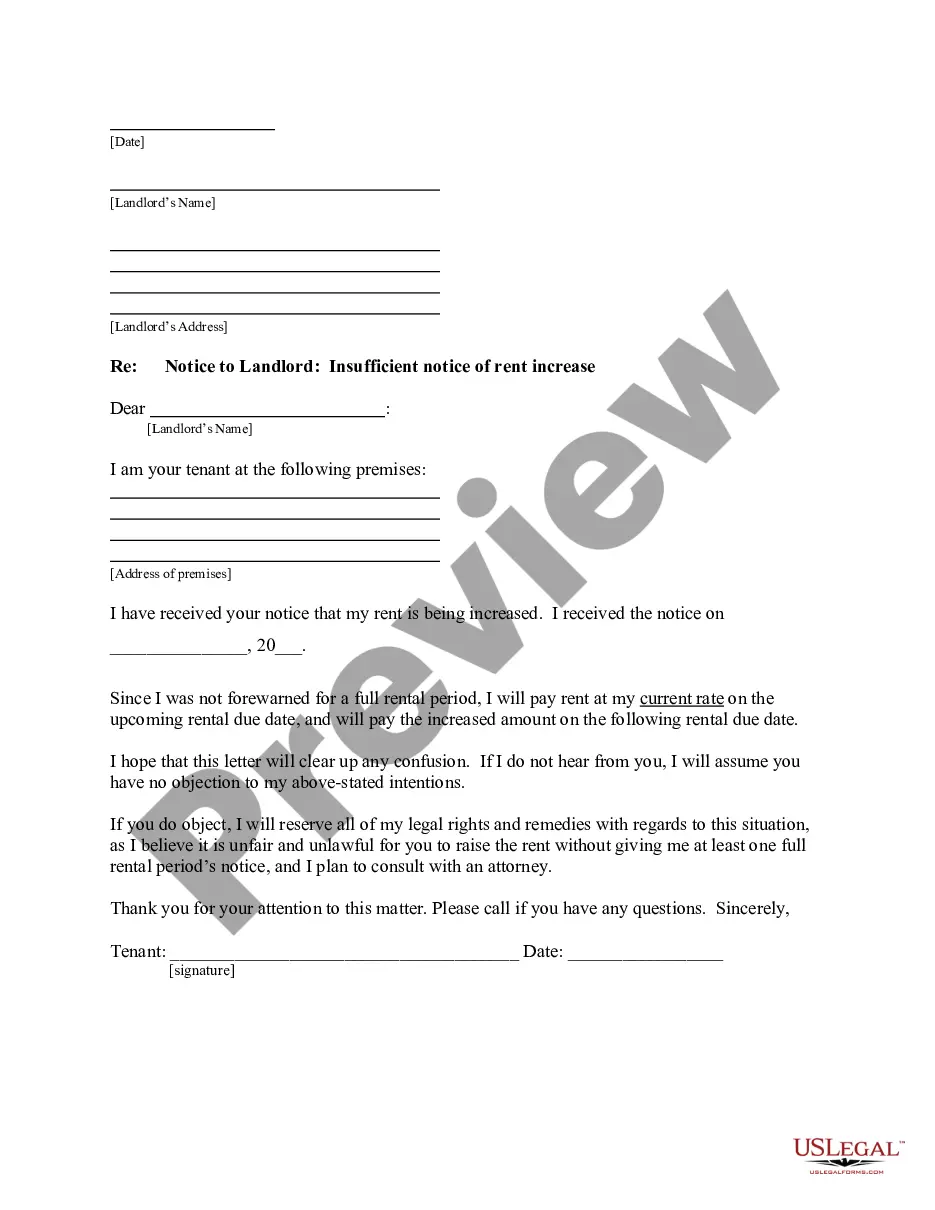

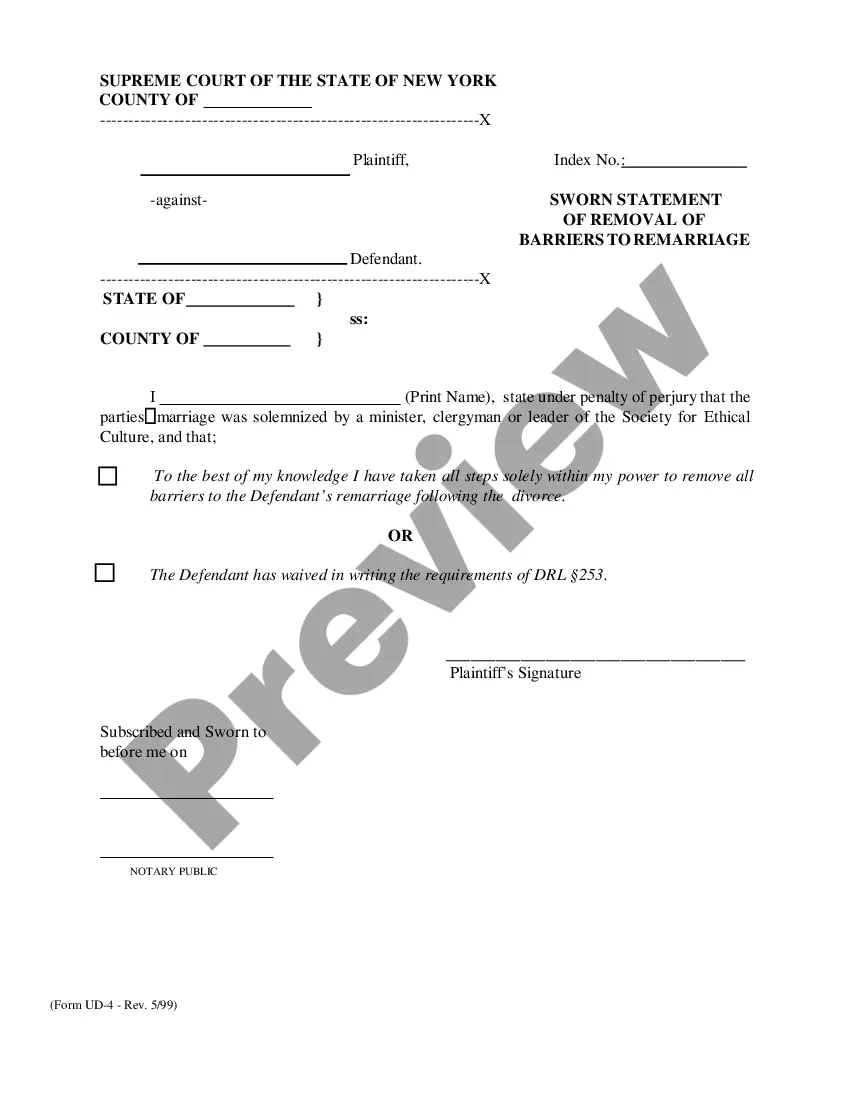

How to fill out San Diego California Determining Self-Employed Contractor Status?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Determining Self-Employed Contractor Status, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the current version of the San Diego Determining Self-Employed Contractor Status, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Diego Determining Self-Employed Contractor Status:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your San Diego Determining Self-Employed Contractor Status and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!