Travis, Texas: Determining Self-Employed Contractor Status In Travis, Texas, determining the status of self-employed contractors is an important aspect for businesses and individuals alike. Self-employed contractors play a significant role in the economy, offering specialized services and expertise to various industries. However, it is crucial to correctly classify these individuals to ensure compliance with tax laws and regulations. Keywords: Travis, Texas, self-employed contractor status, determining, classification, compliance, tax laws, regulations 1. Understanding Self-Employed Contractor Status in Travis, Texas: Determining the self-employed contractor status in Travis, Texas involves assessing various factors to distinguish between independent contractors and employees. This classification is essential as it impacts tax withholding, benefit eligibility, and legal responsibilities for both parties involved. 2. Factors Considered for Determining Self-Employed Contractor Status: Travis, Texas follows criteria set by the Internal Revenue Service (IRS) to evaluate whether an individual is an independent contractor or an employee. Key factors considered include control over work, financial arrangement, and behavioral aspects. This analysis ensures the right classification of workers and minimizes legal complications. 3. Control Over Work: One aspect crucial to determining self-employed contractor status in Travis, Texas is the level of control exercised by the hiring party. If the worker has significant control over how and when tasks are completed, it leans towards the independent contractor classification. On the other hand, if the hiring party directs and instructs the worker extensively, an employer-employee relationship might be established. 4. Financial Arrangement: Another vital aspect in Travis, Texas when deciding self-employed contractor status is the financial arrangement between the worker and the hiring party. Independent contractors commonly have a separate agreement or contract for their services, and payments are made based on project completion or pre-negotiated rates. Employees, however, receive regular wages or salaries with withholding for taxes and benefits. 5. Behavioral Aspects: Travis, Texas also considers behavioral aspects to determine self-employed contractor status. Independent contractors tend to have more freedom in choosing how to execute their tasks, providing their tools, and working for multiple clients simultaneously. Conversely, employees often work under direct supervision, utilizing the employer's resources and primarily focusing on one job. Types of Travis, Texas Determining Self-Employed Contractor Status: While there might not be distinct types of determining self-employed contractor status in Travis, Texas, it is worth noting that the assessment process can apply to various industries and job types. Whether in the construction sector, freelance writing, technology, or any other industry, correctly classifying workers ensures compliance with local and federal laws. In conclusion, determining self-employed contractor status in Travis, Texas is of utmost importance to maintain legal compliance and avoid any potential disputes. By assessing factors such as control over work, financial arrangement, and behavioral aspects, businesses and individuals can correctly classify workers as either independent contractors or employees, ensuring smooth operations and adherence to tax laws and regulations.

Travis Texas Determining Self-Employed Contractor Status

Description

How to fill out Travis Texas Determining Self-Employed Contractor Status?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Travis Determining Self-Employed Contractor Status.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Travis Determining Self-Employed Contractor Status will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to get the Travis Determining Self-Employed Contractor Status:

- Ensure you have opened the correct page with your localised form.

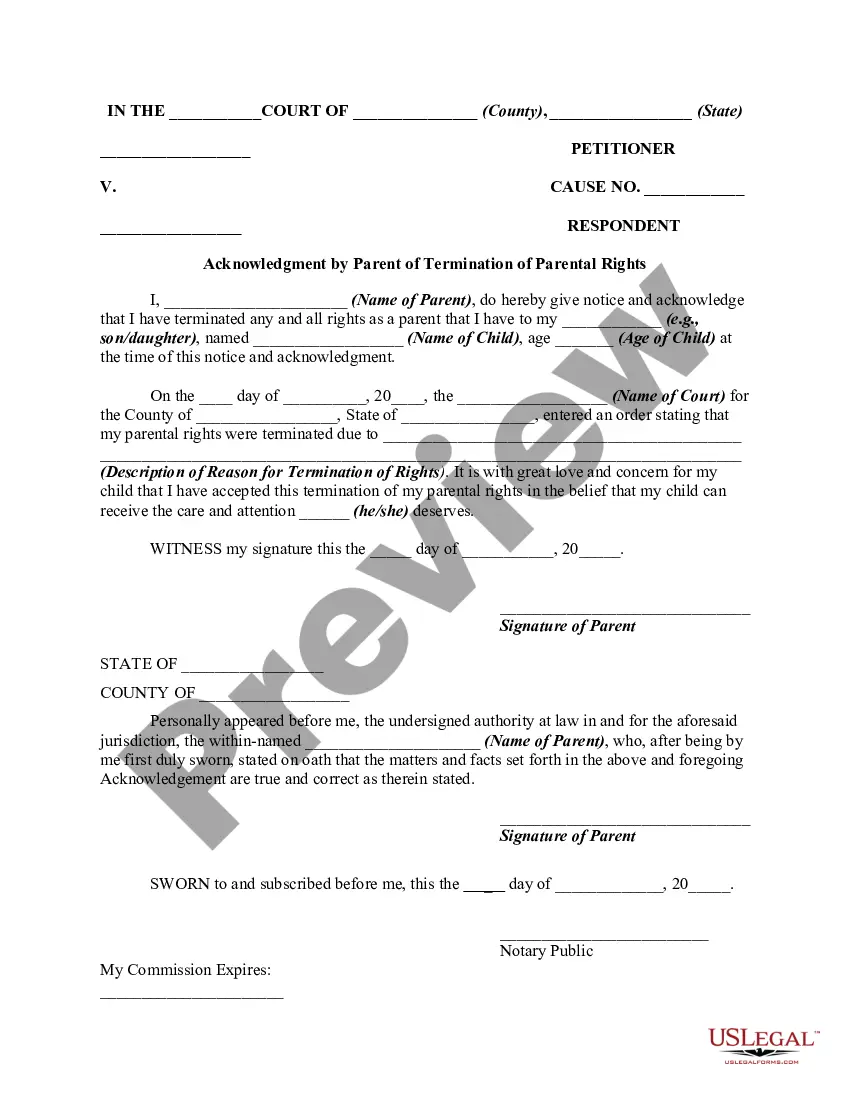

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Travis Determining Self-Employed Contractor Status on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!