Wake, North Carolina is a bustling city located in the eastern part of the state. It is recognized for its vibrant community, rich history, and extensive business opportunities. One crucial aspect of the local economy is the status of self-employed contractors. Determining whether an individual qualifies as a self-employed contractor in Wake, North Carolina involves several factors and considerations. To establish self-employed contractor status in Wake, North Carolina, various key elements need to be evaluated. These include factors such as the degree of control a worker has over their work, the level of independence they possess, and the overall nature of their business relationship with a company or client. It is imperative to assess these factors thoroughly to ensure compliance with local regulations and obligations. In Wake, North Carolina, there are different classifications for self-employed contractor status. These classifications help distinguish between various types of work arrangements and the legal implications associated with each. Some notable classifications include: 1. Independent Contractors: Independent contractors in Wake, North Carolina typically maintain a high level of control and independence over their work. They often operate their businesses independently, provide services to multiple clients, and determine their working hours and conditions. This distinction is important when assessing tax obligations, workers' compensation, and other legal considerations. 2. Freelancers: Wake, North Carolina recognizes freelancers as a specific subgroup of self-employed contractors. Freelancers usually work on a project or task basis and are not bound by long-term commitments to a single client or employer. Their work arrangement grants them the freedom to choose projects that align with their expertise and preferences. 3. Gig Economy Workers: The gig economy has flourished in Wake, North Carolina, with many individuals engaging in app-based or on-demand work arrangements. Gig economy workers often provide services through digital platforms, connecting with customers for short-term assignments. Understanding the distinct status of gig economy workers is crucial when considering labor laws, benefits, and other labor-related regulations. 4. Sole Proprietors: Sole proprietors in Wake, North Carolina are self-employed individuals who operate their own businesses alone. They assume full responsibility for their company's debts, liabilities, and profits. Wake, North Carolina offers specific regulations and licensing requirements for sole proprietors depending on the nature of their business activities. It is essential for both individuals and businesses operating in Wake, North Carolina to thoroughly understand the criteria and factors involved in determining self-employed contractor status. Seeking legal guidance to assess the specific circumstances of each case is highly recommended ensuring compliance with local laws and regulations.

Wake North Carolina Determining Self-Employed Contractor Status

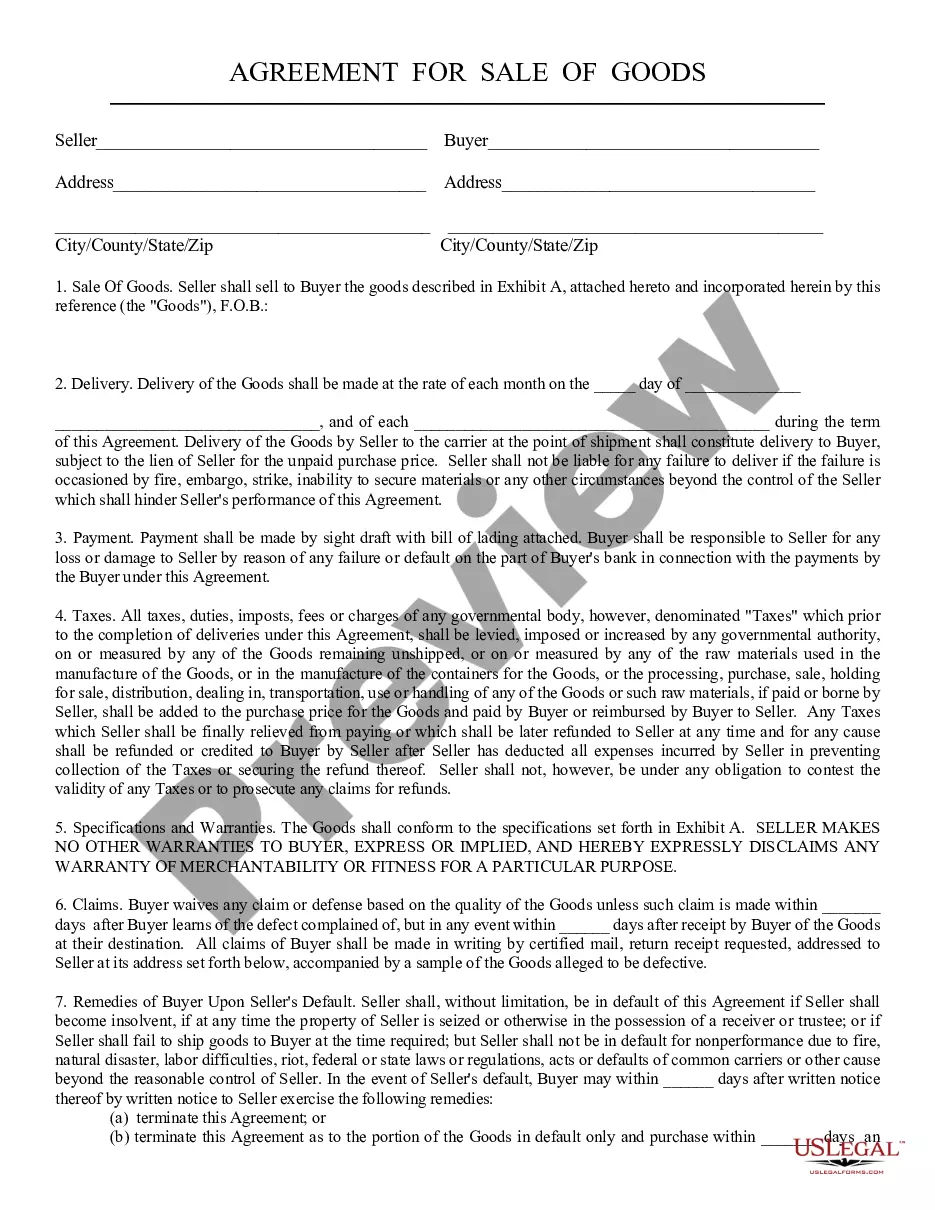

Description

How to fill out Wake North Carolina Determining Self-Employed Contractor Status?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Wake Determining Self-Employed Contractor Status.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Wake Determining Self-Employed Contractor Status will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Wake Determining Self-Employed Contractor Status:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Wake Determining Self-Employed Contractor Status on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!