Palm Beach Florida Self-Employed Independent Contractor Agreement

Description

How to fill out Self-Employed Independent Contractor Agreement?

Laws and statutes in every domain differ across the nation.

If you are not a lawyer, it is simple to become confused by various standards when it comes to formulating legal documents.

To sidestep expensive legal help when crafting the Palm Beach Self-Employed Independent Contractor Agreement, it is essential to have a validated template suitable for your area.

This is the easiest and most cost-effective method to obtain current templates for any legal necessities. Discover them all in a few clicks and maintain your documentation organized with the US Legal Forms!

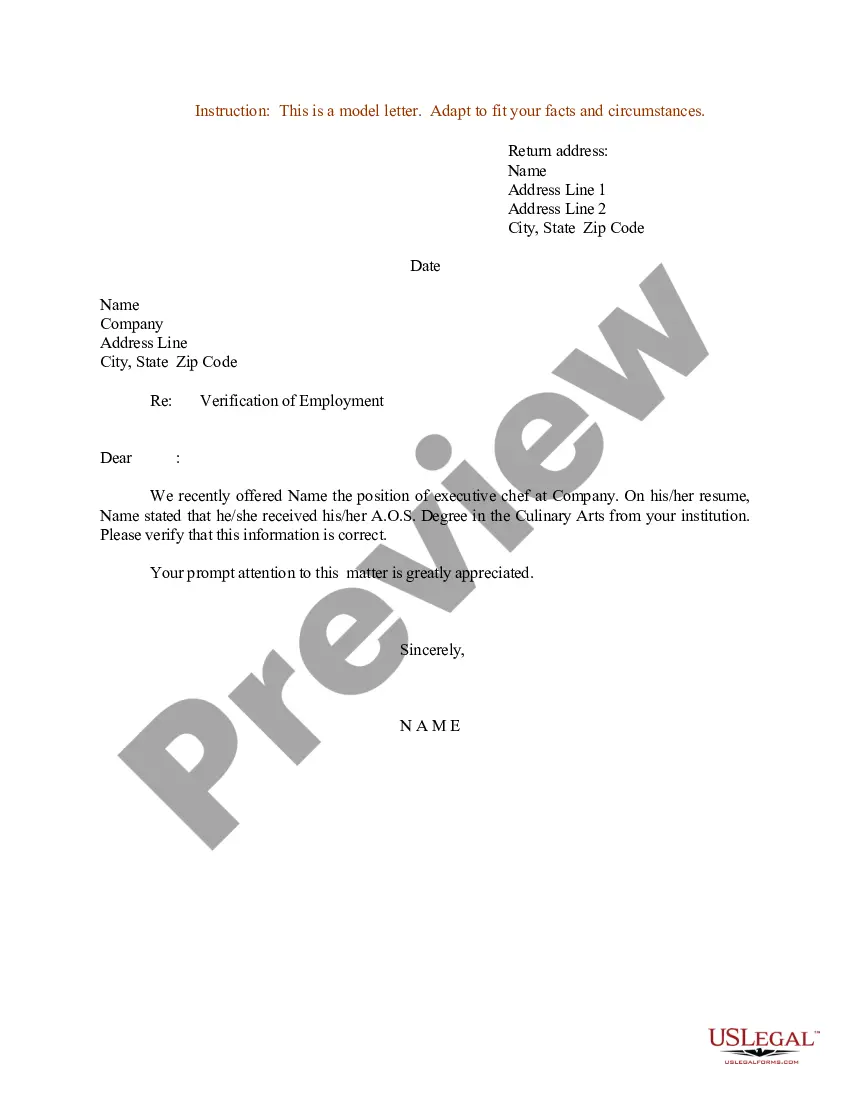

- Assess the page content to ensure you have located the correct sample.

- Utilize the Preview option or review the form description if accessible.

- Search for another document if there are discrepancies with any of your requirements.

- Click the Buy Now button to acquire the template once you identify the suitable one.

- Select one of the subscription plans and Log In or register for an account.

- Decide how you prefer to pay for your subscription (using a credit card or PayPal).

- Choose the format you would like to save the file in and click Download.

- Complete and sign the template in writing after printing it or execute everything electronically.

Form popularity

FAQ

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

How to become an independent contractor Identify your business structure.Choose and register your business name.Get business licenses and permit.Get a business number and find your taxation requirements.Get insurance for your business.Establish the requirements for your workplace safety.Manage your business well.

When the company supplies those things to its workers, the workers are considered employees. Independent contractors provide their own equipment, buy their own supplies and do their own industry training.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Assuming you are already registered with SARS personally, then by default your sole proprietorship will also be registered. If you are not yet registered with SARS, you can register at a physical SARS branch, or online through the SARS eFiling service.

(I) The independent contractor performs or agrees to perform specific services or work for a specific amount of money and controls the means of performing the services or work. (II) The independent contractor incurs the principal expenses related to the service or work that he or she performs or agrees to perform.

What information do I need for an Independent Contractor Agreement? What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

How to become an independent contractor understand your tax obligations. visit Self-Employed Australia for information about super, insurance and workers compensation. register a business name (this is optional if you're trading under your personal name)

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used