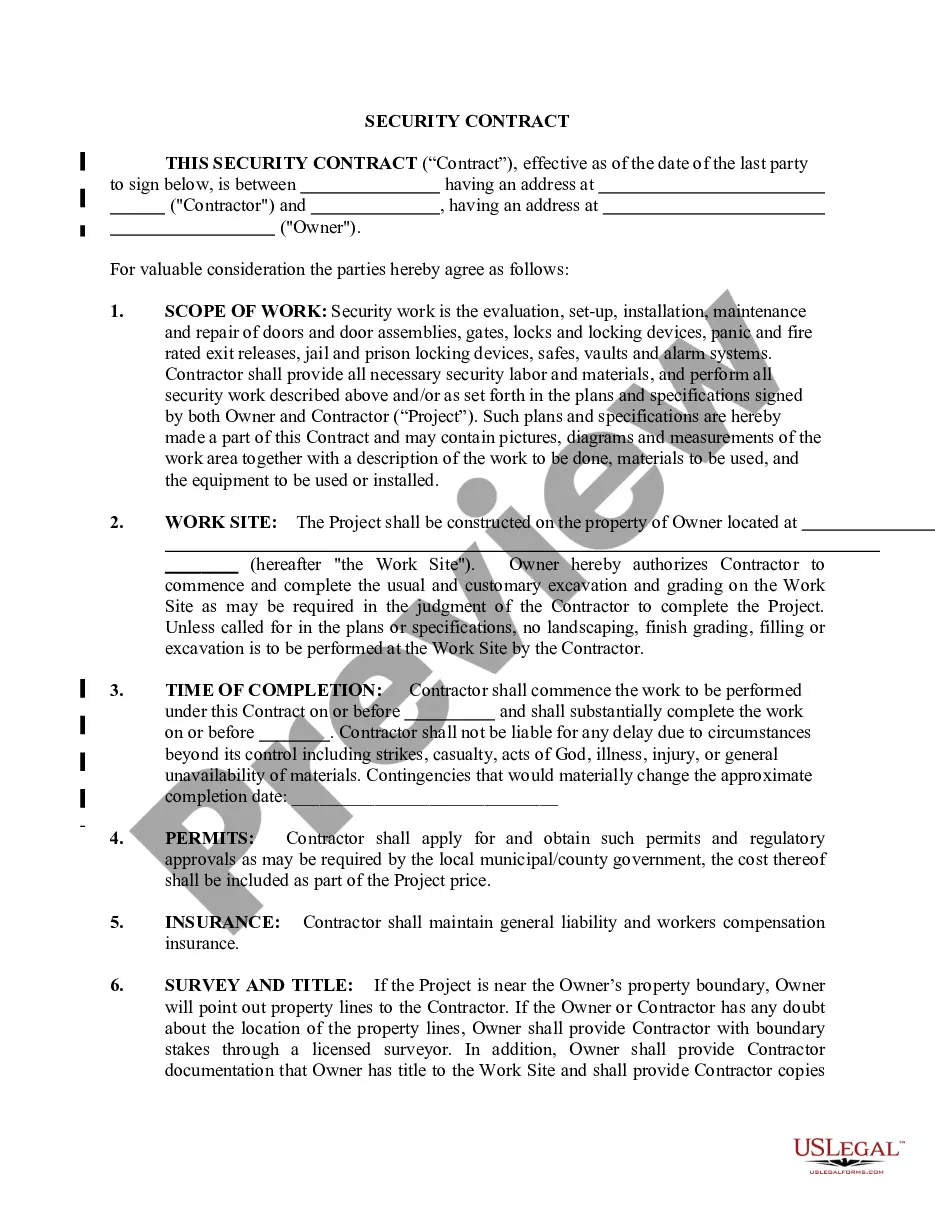

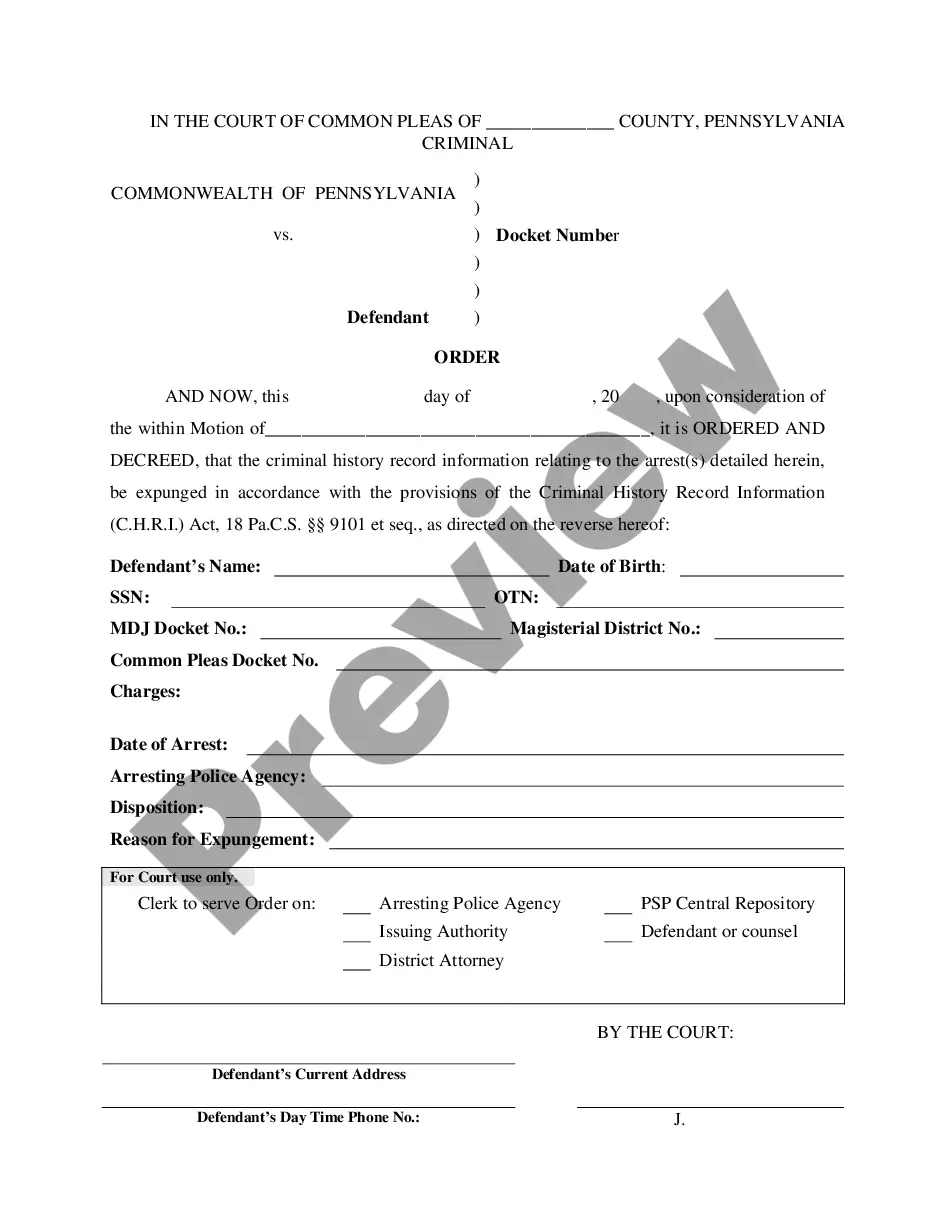

A Self-Employed Independent Contractor Agreement in Salt Lake City, Utah is a legally binding contract that defines the terms and conditions of a working relationship between a self-employed contractor and a client. This agreement ensures that both parties agree with the terms of the work, including payment, responsibilities, and expectations. It is crucial to have a written contract in place to avoid any misunderstandings or disputes down the line. There are several types of Salt Lake City, Utah Self-Employed Independent Contractor Agreements which are commonly used based on the specific needs and requirements of the parties involved. Here are a few examples: 1. General Independent Contractor Agreement: This is a comprehensive agreement that covers various aspects such as project scope, deliverables, payment terms, intellectual property rights, confidentiality, and termination clauses. 2. Construction Independent Contractor Agreement: Specifically tailored for contractors in the construction industry, this agreement outlines the tasks and obligations related to construction projects, timeframes, progress payments, relevant permits, and insurance coverage. 3. Professional Services Independent Contractor Agreement: This agreement is designed for independent contractors providing specialized professional services such as consulting, accounting, legal, or creative services. It includes provisions related to service fees, scope of work, liability limitations, and ownership of intellectual property created during the engagement. 4. Non-Disclosure and Non-Compete Independent Contractor Agreement: In cases where the contractor may have access to sensitive information or trade secrets, this agreement ensures confidentiality and restricts the contractor from competing against the client during and after the working relationship. 5. Sales and Marketing Independent Contractor Agreement: Tailored for sales representatives or marketing professionals, this agreement defines tasks related to sales targets, commission structures, marketing strategies, and the use of client's intellectual property. Regardless of the type of agreement, it is essential that all Salt Lake City self-employed independent contractor agreements include key elements such as the contractor's name, client's name, project description, compensation details, project timelines, independent contractor status clarification, dispute resolution methods, and termination clauses. By using a Salt Lake City Self-Employed Independent Contractor Agreement, both parties can have clear expectations, protect their rights, and establish a solid foundation for a successful working relationship. It is always advisable to consult with a legal professional to ensure that the agreement complies with relevant local, state, and federal laws and regulations.

Salt Lake Utah Self-Employed Independent Contractor Agreement

Description

How to fill out Salt Lake Utah Self-Employed Independent Contractor Agreement?

Do you need to quickly draft a legally-binding Salt Lake Self-Employed Independent Contractor Agreement or maybe any other document to take control of your own or business matters? You can go with two options: hire a professional to write a legal paper for you or create it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you receive neatly written legal papers without paying sky-high fees for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific document templates, including Salt Lake Self-Employed Independent Contractor Agreement and form packages. We offer templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, carefully verify if the Salt Lake Self-Employed Independent Contractor Agreement is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the document isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Salt Lake Self-Employed Independent Contractor Agreement template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the templates we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

What information do I need for an Independent Contractor Agreement? What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

How Do You Become Self-Employed? Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructionsPDF.

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Minimum rates of pay 2022 rights under working time and whistleblowing legislation 2022 protection from discrimination. Self-employed individuals generally only have contractual rights, but they may also be protected: from discrimination 2022 under data protection legislation as 'data subjects'.

What to Include in a Contract The date the contract begins and when it expires. The names of all parties involved in the transaction. Any key terms and definitions. The products and services included in the transaction. Any payment amounts, project schedules, terms, and billing dates.