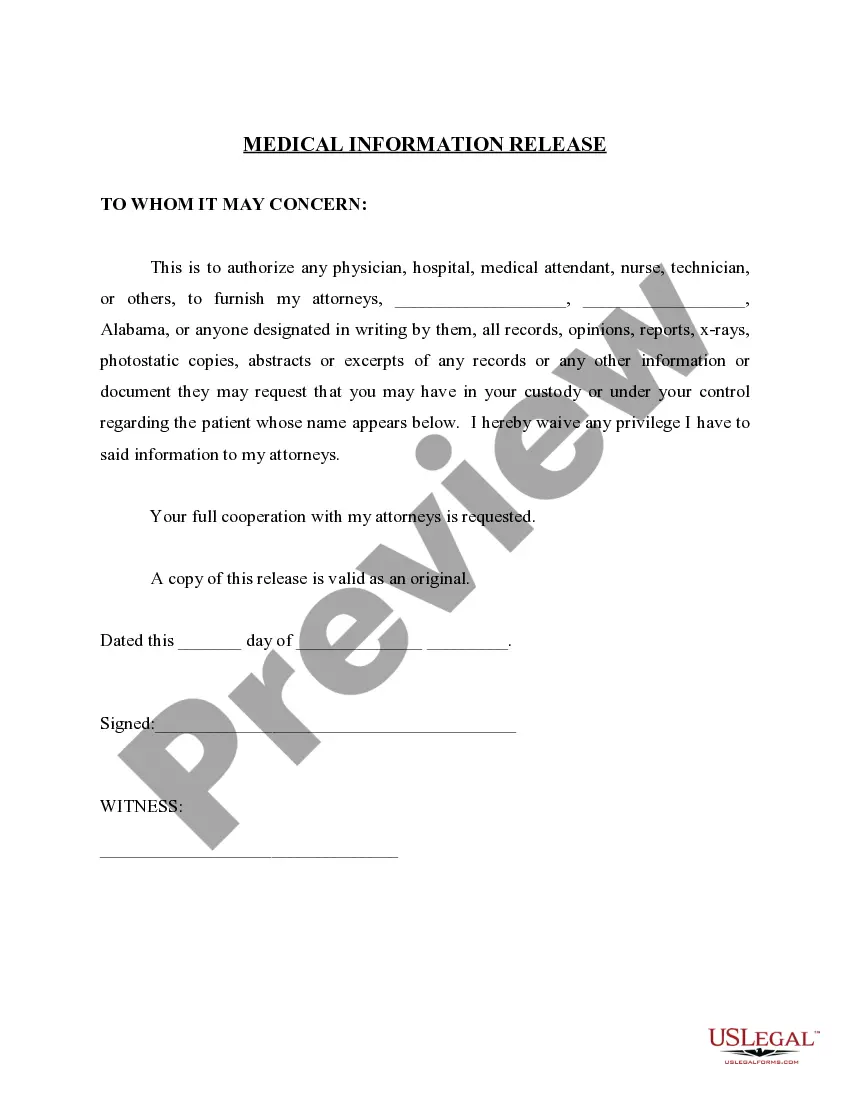

Cook Illinois Direct Deposit Authorization is a form that allows employees of Cook Illinois Corporation to authorize the direct deposit of their wages into their designated bank account. This convenient and secure method eliminates the hassle of manual paycheck distribution and ensures faster access to funds. The Cook Illinois Direct Deposit Authorization form includes relevant details such as the employee's name, social security number, employee identification number, address, and contact information. It also requires the employee to provide their bank account information, including the bank's name, routing number, and account number. This data is strictly confidential and is used solely for the purpose of depositing the employee's wages. By completing a Cook Illinois Direct Deposit Authorization, employees can enjoy numerous benefits. Firstly, it eliminates the need to physically visit a bank to deposit the paycheck, saving time and effort. Direct deposit also ensures a seamless payment process, even during periods of holidays or absence. Furthermore, employees have the flexibility to split their paycheck into multiple bank accounts, allocating specific amounts to savings or checking accounts if desired. It is important to note that Cook Illinois may offer different types of Direct Deposit Authorization forms designed to cater to specific employee needs. Some possible variations include: 1. Regular Direct Deposit Authorization: This is the standard form used by most employees. It authorizes the direct deposit of regular wages into a specified bank account. 2. Bonus Direct Deposit Authorization: This form allows employees to authorize the direct deposit of bonuses or additional compensation into a separate bank account, different from their regular wages. 3. Expense Reimbursement Direct Deposit Authorization: Designed for employees who frequently incur job-related expenses that require reimbursement, this form establishes a direct deposit arrangement for these specific reimbursements. 4. Retirement Contribution Direct Deposit Authorization: For employees participating in a retirement savings plan offered by Cook Illinois, this form facilitates the direct deposit of retirement contributions into the appropriate retirement account. 5. Leave Payout Direct Deposit Authorization: When employees leave Cook Illinois and are entitled to a payout of accrued vacation or sick days, this form allows for the direct deposit of the leave payout. By providing employees with different types of Direct Deposit Authorization forms, Cook Illinois ensures that its payroll system is flexible and adaptable to the unique circumstances of its workforce. This streamlines the payment process and enhances overall employee satisfaction.

Cook Illinois Direct Deposit Authorization

Description

How to fill out Cook Illinois Direct Deposit Authorization?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Cook Direct Deposit Authorization, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Cook Direct Deposit Authorization from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Cook Direct Deposit Authorization:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Authorized users cannot set up a bank account to use for direct deposit, although they can set up saved payment methods to use for making payments or scheduled installments.

Set up direct deposit Ask for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF). Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.

How to Fill Out the Direct Deposit Enrollment Form - YouTube YouTube Start of suggested clip End of suggested clip You must fill in every blank on the page the one exception is the email. Address if any otherMoreYou must fill in every blank on the page the one exception is the email. Address if any other information is missing the form will be returned to you you will then need to fill in the missing.

Instead of a voided check, you might be able to provide: A direct deposit authorization form.A voided counter check.A deposit slip with your banking information preprinted on it.A photocopy of a check or deposit slip for your account.

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due.

To begin, here are the five key steps to follow to benefit from direct deposit. Obtain a direct deposit authorization form.Fill in your account details.Confirm the amount of deposit.Attach a deposit slip or voided check.Submit the direct deposit form.

Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

Sign In to Online Banking. Click on any of your accounts. Select View and Print Payroll Direct Deposit from the right navigation. Select the account you want to deposit your payroll to from the dropdown, then click on View and Print and your customized form will be presented to you.

Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.