The Collin Texas Nonexempt Employee Time Report is a crucial document used by employers in Collin County, Texas, to track and record the work hours of their nonexempt employees. This report serves as a comprehensive record of the employee's time worked, ensuring accurate compensation and compliance with labor laws. The Collin Texas Nonexempt Employee Time Report captures essential details, such as the employee's name, job title, and department. It includes sections to document the employee's regular work hours, overtime hours, breaks, meal periods, and any other time-related information. By utilizing this report, employers can efficiently calculate and verify employee wages, ensuring legal compliance with overtime pay requirements as outlined by the Fair Labor Standards Act (FLEA). The report aids in determining any extra compensation owed to nonexempt employees who have worked beyond their regular hours or during designated overtime periods. In addition to regular and overtime hours, different types of Collin Texas Nonexempt Employee Time Reports might exist, depending on various factors such as specific industries, job roles, or company policies. These reports may include: 1. Collin Texas Nonexempt Employee Time Report — Daily: This report focuses on capturing time entries on a daily basis, typically for nonexempt employees working regular shifts. It includes fields for start and end times, breaks, and lunch periods. 2. Collin Texas Nonexempt Employee Time Report — Weekly: This report provides a more comprehensive summary of an employee's work hours over an entire week. It allows for a consolidated view of regular hours, overtime hours, and any time off taken, such as vacation or sick leave. 3. Collin Texas Nonexempt Employee Time Report — Project-based: This type of report is specific to industries where employees work on multiple projects or assignments with varying timeframes. It tracks the time spent on each project, ensuring accurate billing or cost allocation. 4. Collin Texas Nonexempt Employee Time Report — Remote Work: With the rise in remote work arrangements, this report caters to employees who work from home or other locations outside the employer's premises. It captures their work hours, breaks, and any additional details relevant to their remote work setup. Employers in Collin County, Texas, recognize the importance of accurately managing nonexempt employee time reporting ensuring fair compensation, legal compliance, and proper labor management. The Collin Texas Nonexempt Employee Time Report provides a detailed and organized record that assists both employers and employees in maintaining transparency and accountability in the workplace.

Collin Texas Nonexempt Employee Time Report

Description

How to fill out Collin Texas Nonexempt Employee Time Report?

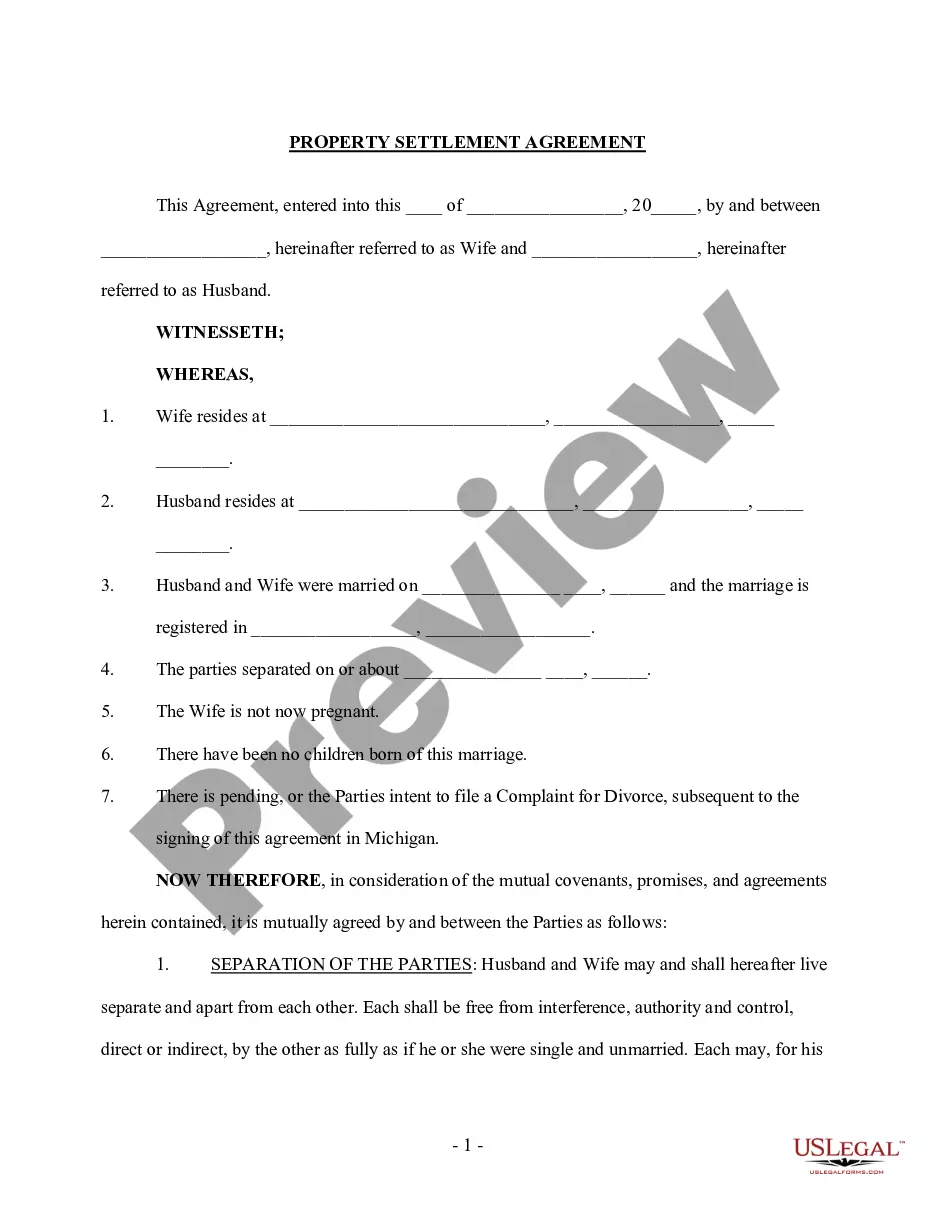

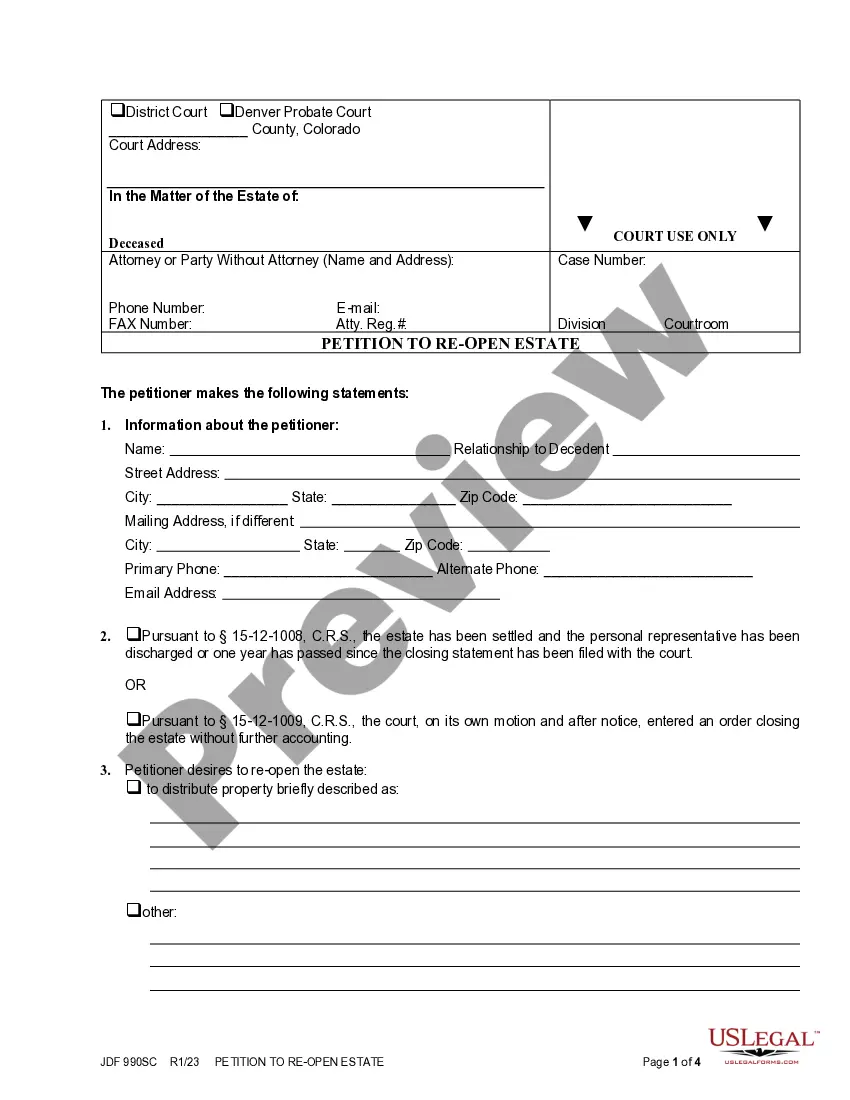

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Collin Nonexempt Employee Time Report, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Collin Nonexempt Employee Time Report from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Collin Nonexempt Employee Time Report:

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Labor Code §551 provides that ?every person employed in any occupation of labor is entitled to one day's rest therefrom in seven.? Similarly, §552 provides that ?no employer of labor shall cause his employees to work more than six days in seven.?

Exempt employees are exempt from California overtime laws. This means that, if you are an exempt employee, your employer does not need to pay you time and a half if you work: more than eight hours in a workday, or. more than 40 hours in a workweek, or.

In California, those who work 40 hours a week should earn a weekly salary of at least $520 or $27,040 annually. Nonexempt salaried workers who work more than 40 hours a week also get overtime ? an employer cannot require them to work more than that without overtime pay.

California sets a minimum salary for jobs to be classified as exempt. Jobs in California that pay less than $58,240 a year are generally classed as nonexempt. This figure, which is valid as of January 1, 2021, is double the state minimum wage of $14 an hour, multiplied by 52 40-hour workweeks.

Employees who are full-time exempt are employees who are paid an annual salary and are exempt from overtime regulations. These employees often have positions where it's common for them to work over 40 hours each week.

Exempt employees may not be eligible for overtime or breaks. However, exempt employees must be paid at twice the minimum hourly wage based on a 40-hour workweek. As an exempt employee, an employer could require the employee to work more than 40-hours per week without overtime pay.

Exempt employees in California generally must earn a minimum monthly salary of no less than two times the state minimum wage for full time employment. Simply paying an employee a salary does not make them exempt, nor does it change any requirements for compliance with wage and hour laws.

Both California and federal labor laws classify employees as either exempt or non-exempt workers. Non-exempt employees must receive a minimum wage. They also enjoy other benefits like rest breaks, meal breaks, and overtime pay. Exempt employees do not have these benefits, and they do not have to clock in.