The Hennepin Minnesota Nonexempt Employee Time Report is a detailed document used by employers in Hennepin County, Minnesota, to accurately record and report the working hours of their nonexempt employees. This time report plays a crucial role in ensuring compliance with state and federal labor laws, including minimum wage and overtime regulations. The Hennepin Nonexempt Employee Time Report captures essential details regarding employees' work hours, breaks, and any additional time worked outside their regular schedules. It provides a comprehensive overview of the number of hours worked by each employee, allowing employers to determine accurate compensation and ensure adherence to labor laws. This time report typically includes fields for employee information, such as name, employee identification number, department, and supervisor's name. It also includes the start and end times of the workday, as well as the total number of hours worked. Additionally, this report may have sections for recording breaks, meal periods, and any paid or unpaid time off taken by the employee. Different types of Hennepin Minnesota Nonexempt Employee Time Reports may vary based on the organization's specific needs and requirements. Some variations may include: 1. Standard Hennepin Nonexempt Employee Time Report: This is the most common type, capturing basic information such as employee details, daily work hours, breaks, and overtime. 2. Hennepin Nonexempt Employee Time Report with Cost Codes: Employers using cost codes for project management may include an additional section where employees allocate their hours to specific projects or tasks. This helps with tracking expense and ensures accurate billing or cost allocation. 3. Hennepin Nonexempt Employee Time Report with Paid Time Off (PTO) Tracking: Some organizations integrate PTO tracking within the time report, allowing employees to record their vacation, sick leave, or other time off taken during the pay period. This assists in managing leave balances and ensures accurate payroll calculations. 4. Hennepin Nonexempt Employee Time Report with Daily Tasks: Employers needing a detailed breakdown of employees' daily activities may include sections where employees list and track their tasks throughout the day. This enables better supervision and project management. Using the Hennepin Minnesota Nonexempt Employee Time Report helps maintain accurate records of employee working hours, ensuring fair compensation and compliance with labor laws in Hennepin County. It also aids in resource allocation, project management, and overall workforce productivity.

Hennepin Minnesota Nonexempt Employee Time Report

Description

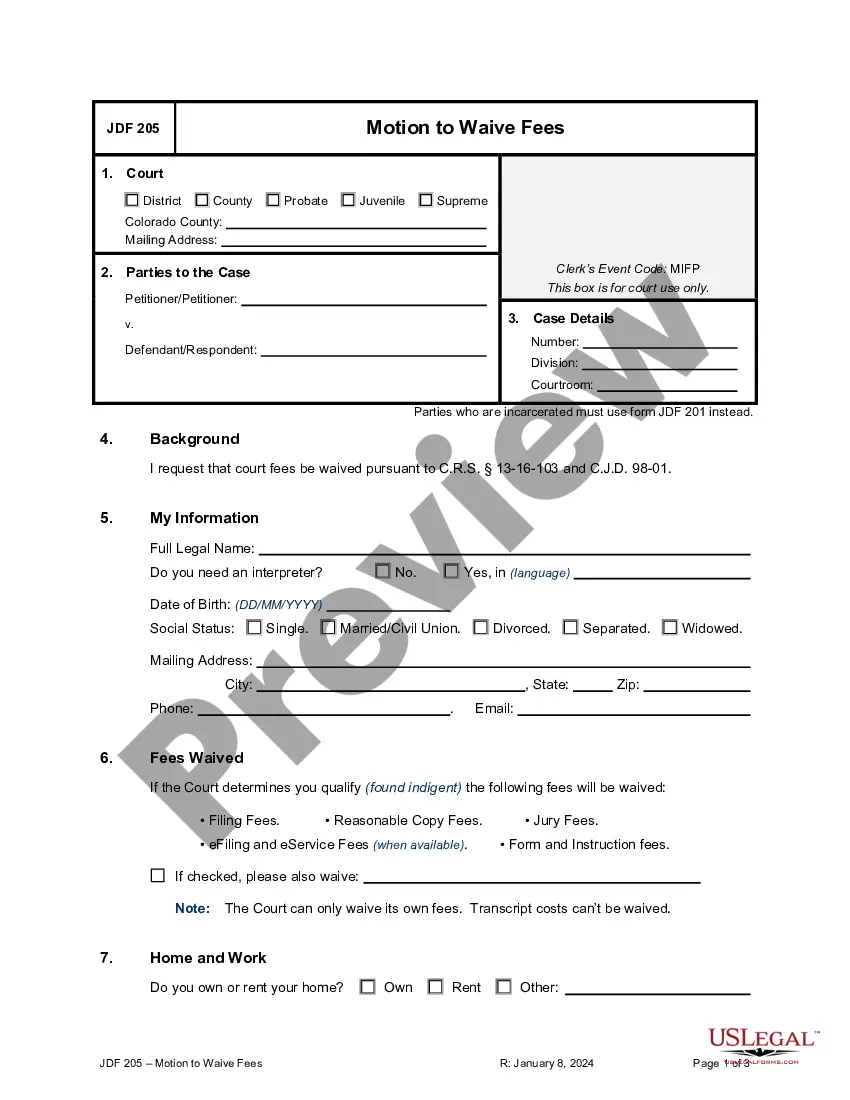

How to fill out Hennepin Minnesota Nonexempt Employee Time Report?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Hennepin Nonexempt Employee Time Report, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the current version of the Hennepin Nonexempt Employee Time Report, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Nonexempt Employee Time Report:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Hennepin Nonexempt Employee Time Report and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!