The Maricopa Arizona Business Reducibility Checklist is an invaluable tool for entrepreneurs and business owners in Maricopa, Arizona, to ensure they are taking advantage of all eligible tax deductions. This comprehensive checklist provides detailed guidance on the various expenses and expenditures that can be deducted to lower the overall taxable income of a business. By following the Maricopa Arizona Business Reducibility Checklist, businesses can maximize their tax savings and avoid potential penalties or audits. This checklist covers a wide range of deductible expenses in categories such as: 1. Business Operations: — Office rent anutilitiesie— - Business insurance premiums — Legal and professional fee— - Advertising and marketing expenses — Office supplies and equipment 2. Employee Expenses: — Wages ansalariesie— - Employee benefits (health insurance, retirement plans) — Payroll taxes and contribution— - Employee training and education expenses 3. Travel and Entertainment: — Business-related travel expenses (airfare, accommodation, meals) — Client entertainment and meal— - Vehicle expenses (mileage, fuel, maintenance) 4. Miscellaneous Expenses: — Business licenses and permit— - Business bank and credit card fees — Subscriptions and memberships related to the business — Bad debts and losses It is important to note that within the Maricopa Arizona Business Reducibility Checklist, there may be different types or versions specific to certain industries or business types. For example, there might be a separate checklist for retail businesses, service-based businesses, or manufacturing companies. These industry-specific checklists take into account unique deductions and expenses that pertain to each particular field. By utilizing the Maricopa Arizona Business Reducibility Checklist, businesses can ensure they are compliant with the local tax regulations while optimizing their deductions. It is recommended to consult with a certified tax professional or accountant to ensure accurate implementation of the checklist and to take advantage of all available deductions. Keeping detailed records and invoices for each deductible expense is crucial for successful tax filings and potential audits.

Maricopa Arizona Business Deductibility Checklist

Description

How to fill out Maricopa Arizona Business Deductibility Checklist?

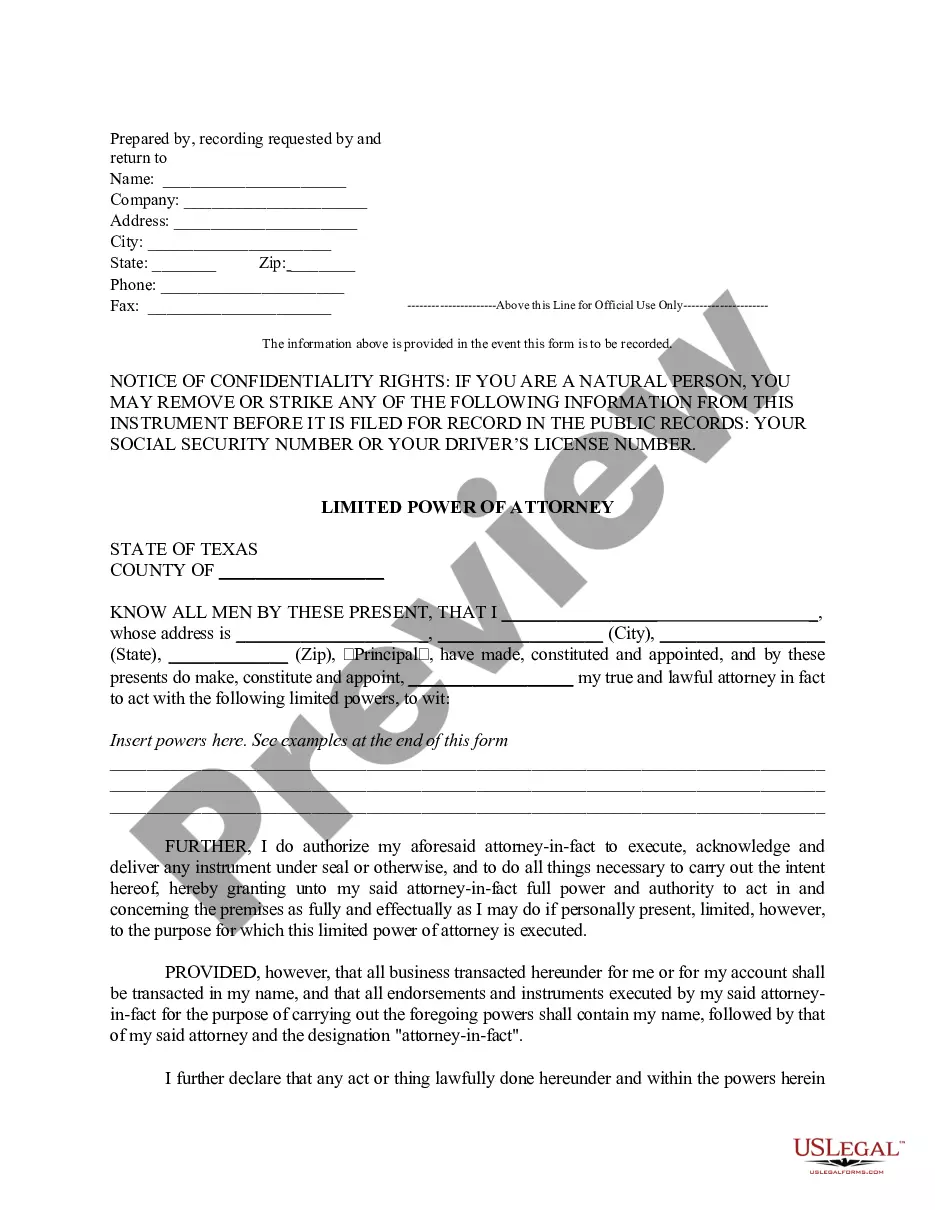

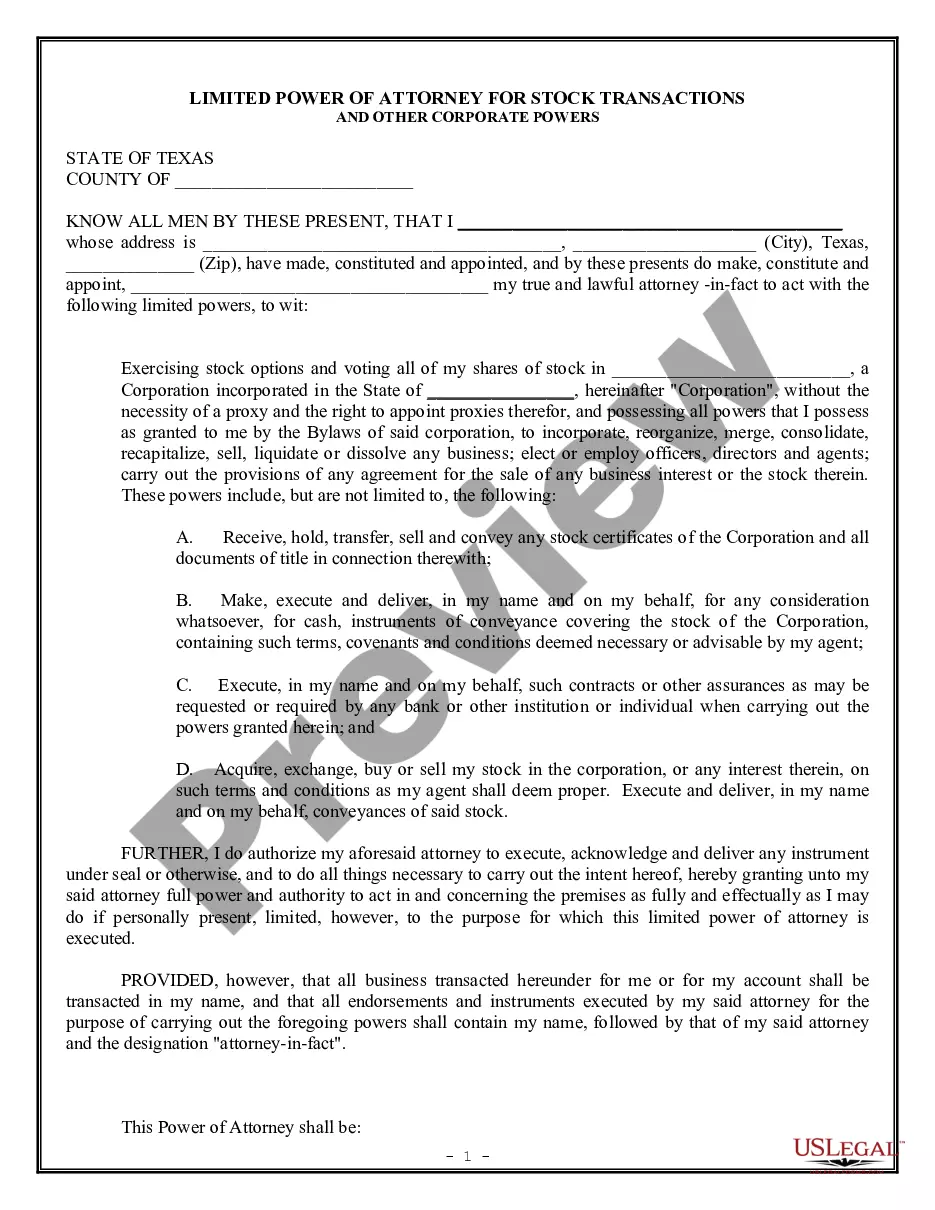

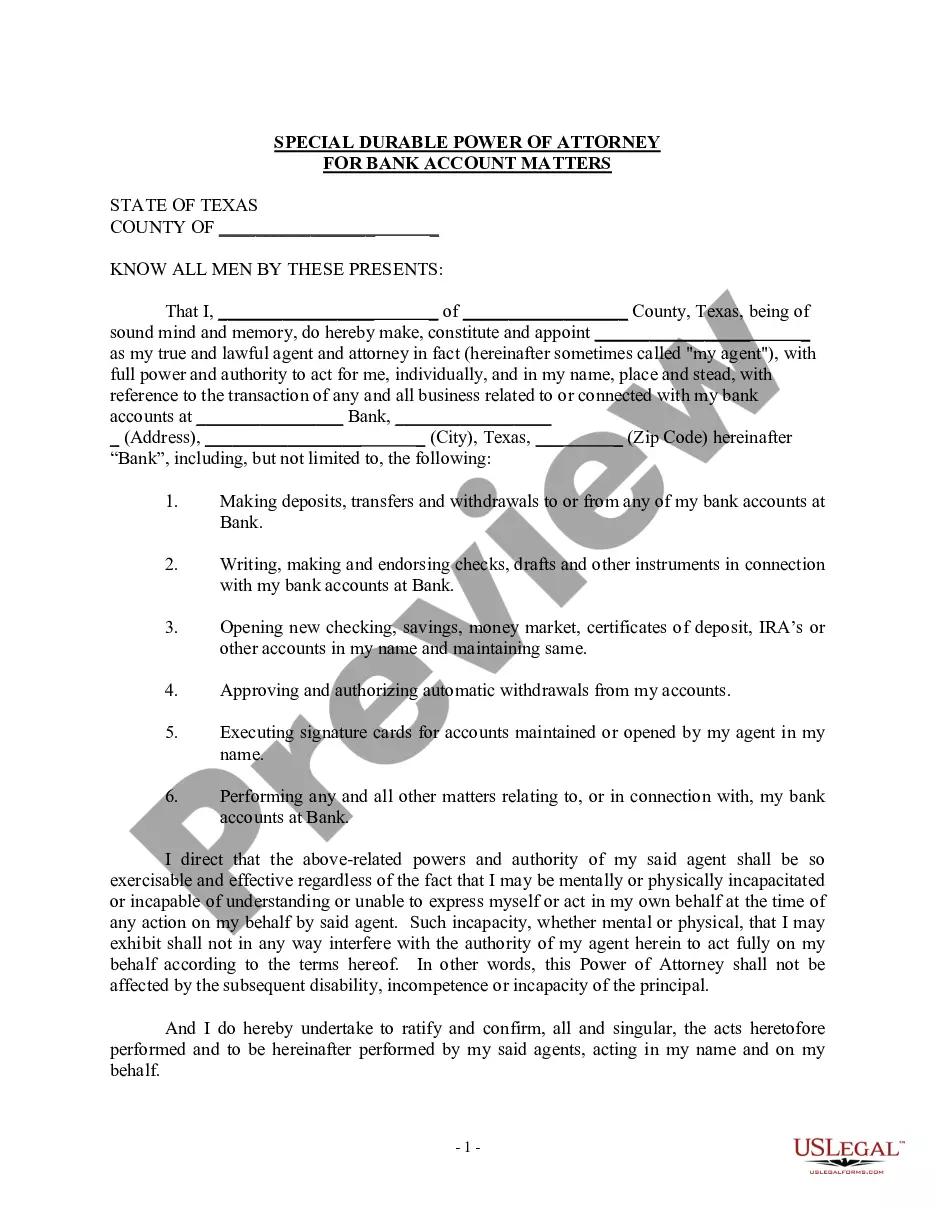

Draftwing documents, like Maricopa Business Deductibility Checklist, to manage your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for different scenarios and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Maricopa Business Deductibility Checklist template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Maricopa Business Deductibility Checklist:

- Make sure that your form is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Maricopa Business Deductibility Checklist isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our service and download the document.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!