Maricopa Arizona Wage Withholding Authorization is a legal document that allows an employer to deduct a specific amount of money from an employee's wages for various purposes as authorized by the state of Arizona. It is designed to ensure timely payments of child support, spousal maintenance, and other related obligations. This authorization is particularly essential when an individual fails to meet their financial responsibilities voluntarily. Employers in Maricopa County, Arizona, are required to comply with these regulations and abide by the specified guidelines. There are different types of Maricopa Arizona Wage Withholding Authorization, depending on the specific obligations being addressed. Some common types include: 1. Child Support Wage Withholding Authorization: This type of authorization is used to collect child support payments from a parent's income. It allows the employer to withhold the designated amount from the employee's wages and remit it to the appropriate state agency responsible for disbursing the funds to the custodial parent. 2. Spousal Maintenance Wage Withholding Authorization: In cases where the court orders spousal maintenance, this form of authorization enables the employer to withhold the necessary amount from the employee's wages and transfer it to the designated entity responsible for distributing the spousal support. 3. Tax Garnishment Authorization: In situations where an individual owes unpaid taxes, the tax authority may issue a wage withholding authorization to collect the owed amount directly from the employee's paycheck. This ensures the prompt payment of taxes owed, while minimizing the hassle for both the employer and the employee. 4. Medical Insurance Premium Wage Withholding Authorization: This type of authorization allows the employer to deduct the employee's share of medical insurance premiums from their wages. It ensures timely payment of health insurance premiums, preventing any lapse in coverage and ensuring that employees can continue to access necessary medical services. 5. Student Loan Wage Withholding Authorization: When employees have outstanding student loan debt, this authorization allows the employer to withhold a predetermined amount from their wages, ensuring regular repayment of the loan. It is crucial for both employers and employees in Maricopa, Arizona, to understand the various types of wage withholding authorizations, their legal implications, and the obligations they address. Compliance with these regulations helps to ensure transparency, accuracy, and consistency in wage withholding processes while supporting the financial well-being of individuals involved.

Maricopa Arizona Wage Withholding Authorization

Description

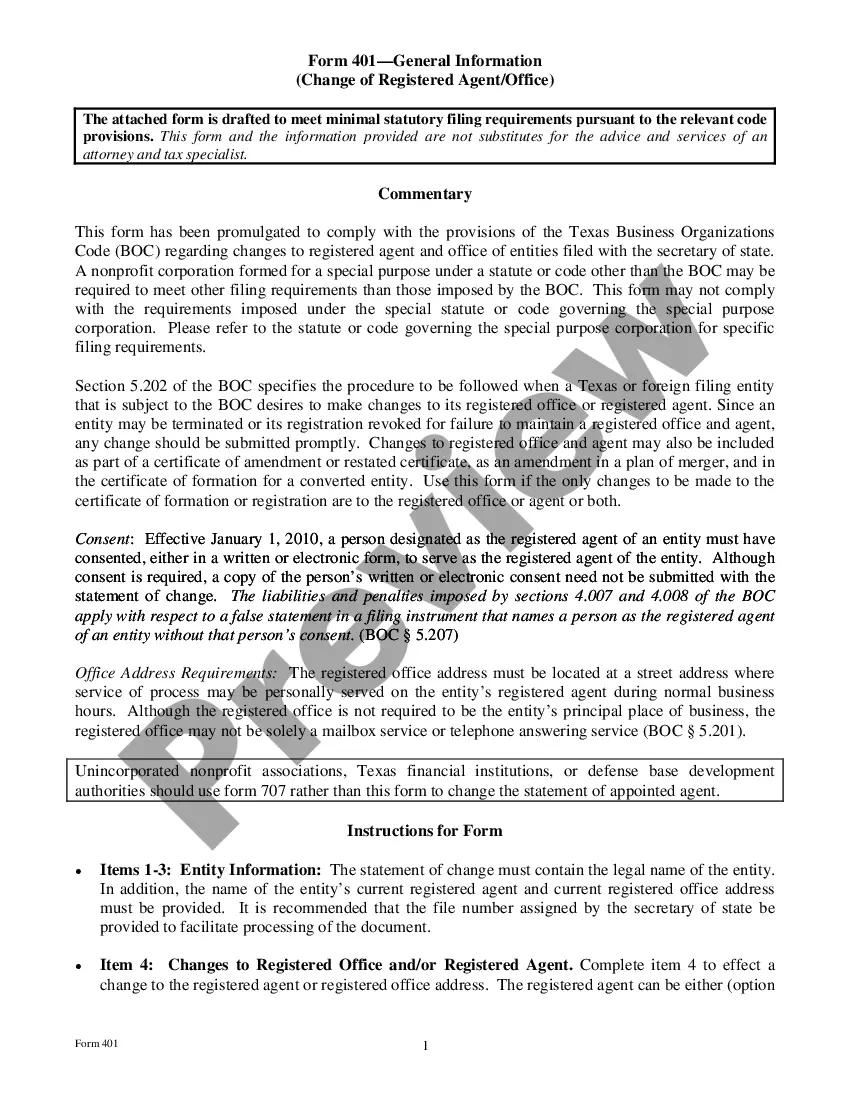

How to fill out Maricopa Arizona Wage Withholding Authorization?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the Maricopa Wage Withholding Authorization.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Maricopa Wage Withholding Authorization will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the Maricopa Wage Withholding Authorization:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Maricopa Wage Withholding Authorization on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Your ATLAS case number is listed on the court order and on all correspondence that we send to you. Or, you may obtain your ATLAS case number by telephone by contacting our Customer Service Department at 602-252-4045.

Where you want to start is by contacting the court clerk's office in the county in which the original order was filed. It is important to note that you should not go to the court clerk in the county you reside in if this was not the county where your divorce or where the court order for child support was filed.

An earnings withholding order is a court order issued by a judge that instructs an employer to garnish wages from one of their employees. These notices are issued when creditors have succeeded in obtaining a legal judgment against a debtor, who in this case is the employee.

How to Stop Child Support in Arizona When Both Parents Agree All parties must sign the Agreement to Stop the Income Withholding Order (and Support Order) in front of a Clerk of the Court or a Notary. If DCSS was involved in the child support case, a representative from the agency must also sign the agreement.

Since 1988, all Arizona child support orders have been issued with an automatic wage withholding order. Wage or income withholding orders are basically a form of wage garnishment.

An income withholding order is an order directing an employer or other payor of funds to withhold a monthly amount from the income of the person obligated to pay child support, spousal maintenance, child support and spousal maintenance arrearage, and/or interest.

In Arizona, support payments are made until the child is 18. If the child does not complete school by age 18, child support continues until he/she graduates from high school or turns 19, which ever comes first. Payments for support are received, recorded, and processed by the Support Payment Clearinghouse.

It can be done in an agreement that is signed by both parties. It will need to be sent to the Arizona Child Support Clearinghouse so that the account can be closed. If the state has an interest in your case, you will have to get the state's approval to waive past due support.

Wage Withholding - Income Withholding Order (IWO) Page Content. Once a court orders child support, either the court or the child support agency issues a Notice to Withhold that is served on the employer of the paying parent.