Wayne Michigan Wage Withholding Authorization is a legal document that allows for the automated deduction of wages from an employee's paycheck in order to satisfy a financial obligation. This process is commonly utilized by employers to enforce court-ordered child support, spousal support, or other wage garnishments. In Wayne County, Michigan, there are several types of Wage Withholding Authorization, each serving a specific purpose: 1. Child Support Wage Withholding: This type of authorization is primarily used to secure regular child support payments. It ensures that the obligated parent's employer deducts the specified amount from their paycheck and transfers it directly to the Michigan Department of Health and Human Services (MD HHS) Child Support Enforcement System. 2. Spousal Support Wage Withholding: Also known as alimony, spousal support wage withholding authorization enables the efficient collection of court-ordered spousal support payments. The employer deducts the agreed-upon amount from the obligated spouse's wages and forwards it to the recipient as per the court order. 3. Tax Debt Wage Withholding: In cases where an individual has outstanding tax liabilities to the State of Michigan or Internal Revenue Service (IRS), this type of wage withholding authorization allows the government to recoup the owed amount directly from the individual's paycheck. It helps ensure consistent repayment without the need for additional collection efforts. 4. Student Loan Wage Withholding: This type of authorization permits educational institutions or government agencies to collect outstanding student loan debt through wage garnishment. The employer deducts the predetermined amount and forwards it to the designated entity to facilitate timely repayment. 5. Creditor Wage Withholding: In certain instances, a creditor may obtain a Wage Withholding Authorization through a court order to collect unpaid debts. This enables them to deduct a portion of the debtor's wages until the outstanding balance is cleared, providing a convenient method for the creditor to recover the owed sum. It is important to note that the exact procedures and requirements for obtaining and implementing Wayne Michigan Wage Withholding Authorization may vary depending on the specific circumstance and governing laws. An individual must consult with legal professionals, such as attorneys specializing in family law, tax law, or debt collection, to ensure compliance with all relevant regulations and understand their rights and obligations.

Wayne Michigan Wage Withholding Authorization

Description

How to fill out Wayne Michigan Wage Withholding Authorization?

Preparing paperwork for the business or individual needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Wayne Wage Withholding Authorization without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Wayne Wage Withholding Authorization on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Wayne Wage Withholding Authorization:

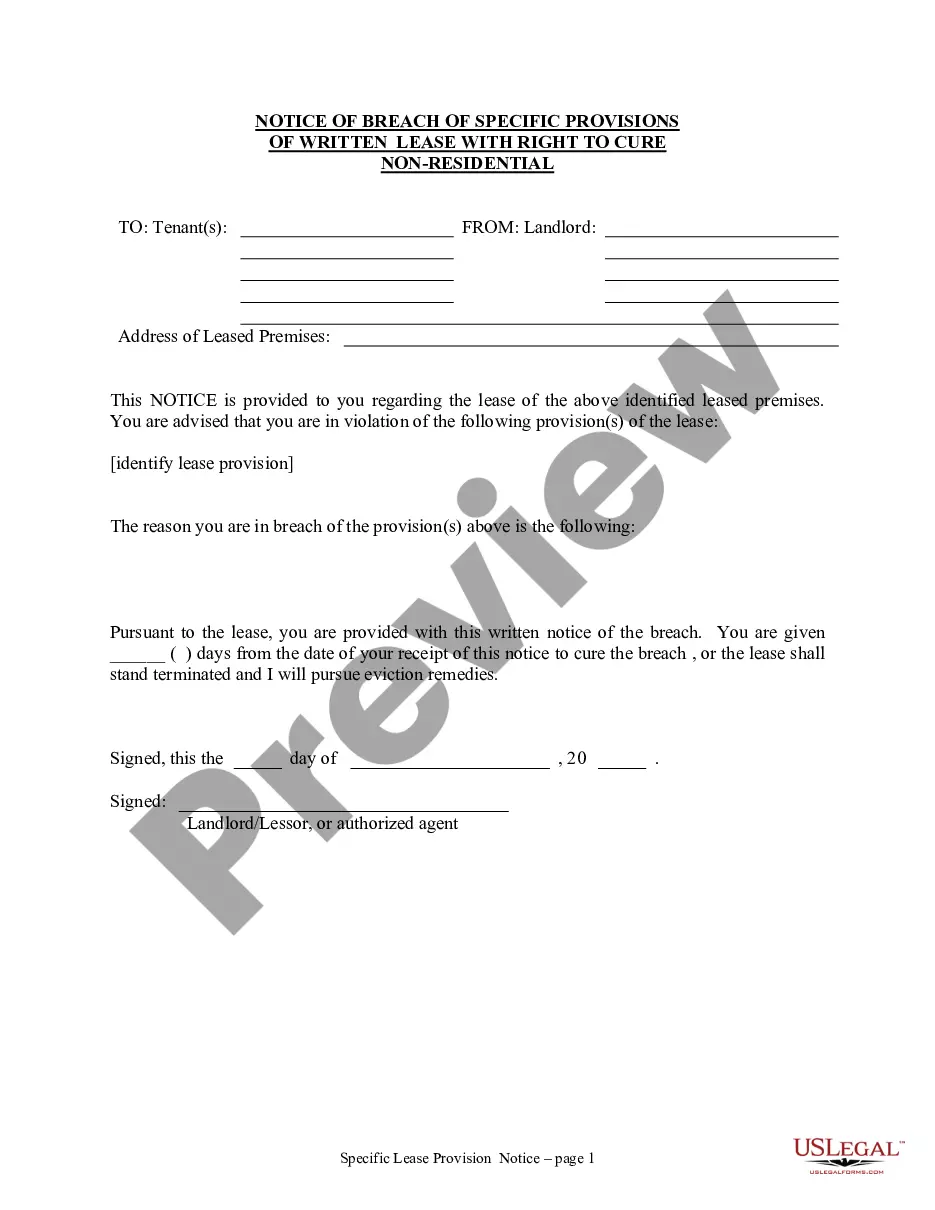

- Examine the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a few clicks!