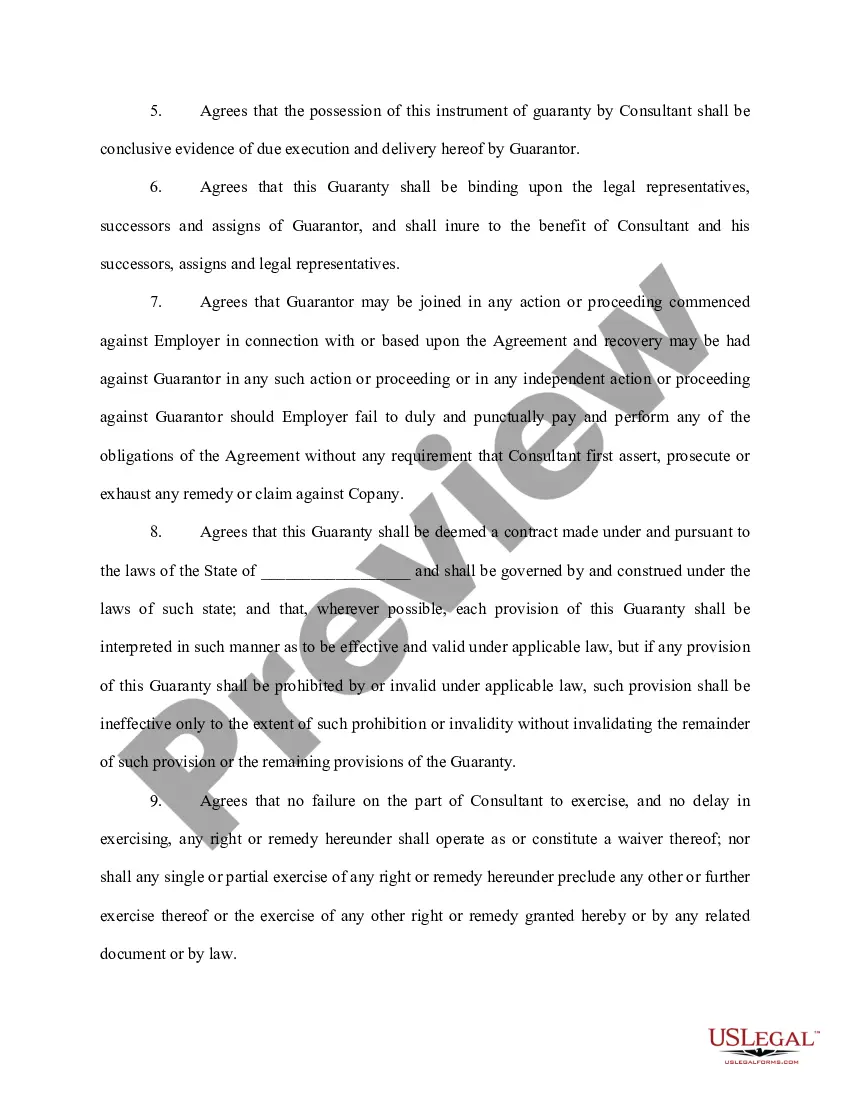

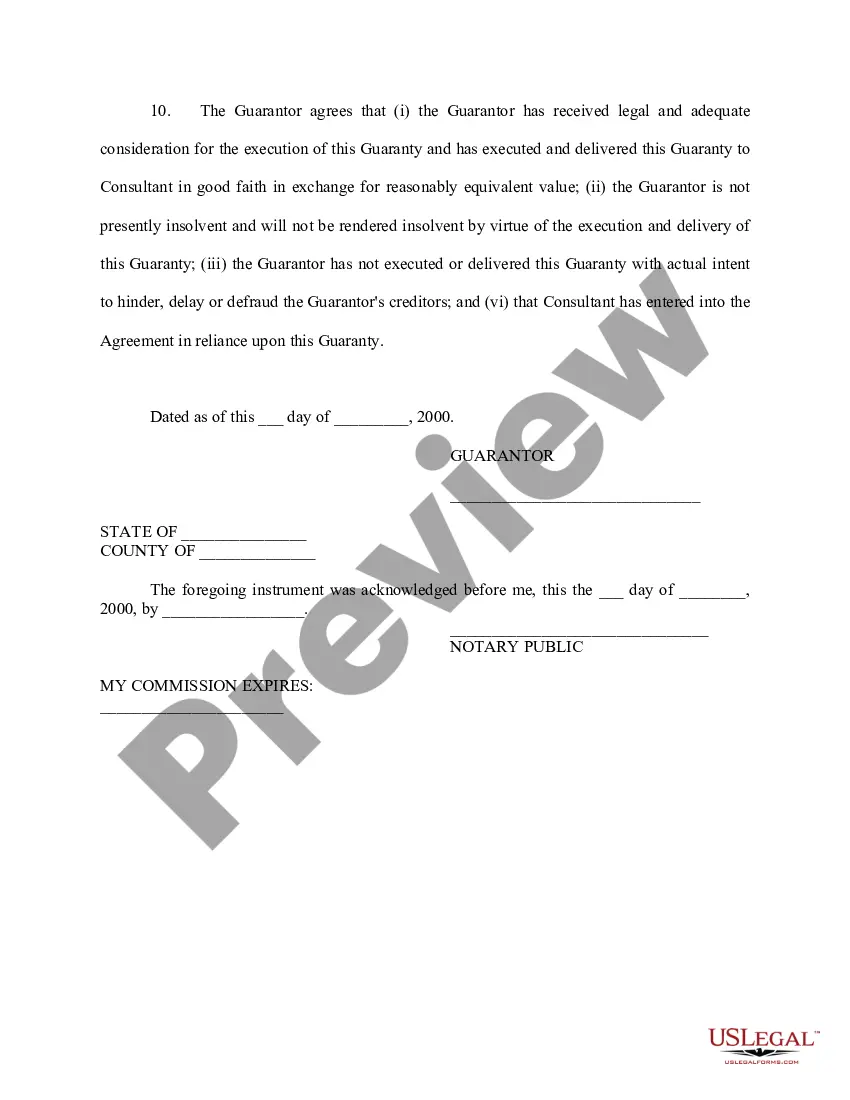

A Dallas Texas Personal Guaranty of Another Person's Agreement to Pay Consultant is a legally binding contract that adds an extra layer of security to a consultant's agreement with a client. In this scenario, an individual (the guarantor) agrees to take responsibility for the payment obligations of another person (the primary debtor) if they fail to meet their financial commitments to the consultant. The purpose of a Personal Guaranty is to mitigate the risk of non-payment by providing the consultant with an additional avenue for recovering owed funds. By entering into this arrangement, the guarantor assumes liability and ensures that the consultant will still receive compensation, even if the primary debtor defaults. Keywords: Dallas Texas, Personal Guaranty, Agreement, Pay Consultant, legally binding contract, security, consultant's agreement, client, individual, guarantor, payment obligations, financial commitments, primary debtor, non-payment, mitigate, risk, owed funds, liability, compensation, default. Different types of Dallas Texas Personal Guaranty of Another Person's Agreement to Pay Consultant may include: 1. Limited Personal Guaranty: This type of guaranty imposes a cap or restricts the liability of the guarantor to a specified maximum amount. It provides a level of protection to the guarantor by limiting their potential financial exposure. 2. Unlimited Personal Guaranty: In contrast to a limited guaranty, an unlimited personal guaranty holds the guarantor fully accountable for all the debts owed by the primary debtor to the consultant. The guarantor has no financial protection as their liability is not capped. 3. Joint and Several Personal guaranties: A joint and several personal guaranties involves multiple guarantors who are collectively and individually responsible for the full payment obligations of the primary debtor. This type of guaranty offers the consultant additional assurance by holding multiple parties liable for any potential default. 4. Corporate Personal Guaranty: In certain cases, a corporation or business entity may serve as the guarantor instead of an individual. This type of personal guaranty ensures that the consultant can seek payment from a more financially stable entity rather than relying solely on the primary debtor's personal assets. Keywords: Limited, Unlimited, Joint and Several, Corporate, financial exposure, liability, multiple guarantors, individual responsibility, collective responsibility, business entity, personal assets.

Dallas Texas Personal Guaranty of Another Person's Agreement to Pay Consultant

Description

How to fill out Dallas Texas Personal Guaranty Of Another Person's Agreement To Pay Consultant?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Dallas Personal Guaranty of Another Person's Agreement to Pay Consultant.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Dallas Personal Guaranty of Another Person's Agreement to Pay Consultant will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Dallas Personal Guaranty of Another Person's Agreement to Pay Consultant:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Dallas Personal Guaranty of Another Person's Agreement to Pay Consultant on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!