Maricopa Arizona Guaranty by Distributor to Corporation refers to a legal agreement where a distributor pledges to guarantee the payment of distributorship funds by the assignee to the corporation due to an assignment. This agreement often involves a distributor transferring their rights and obligations to a new assignee, and ensuring that the corporation receives the proper payments from the distributorship. In Maricopa Arizona, there are various types of Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment: 1. General Guaranty: This type of guaranty encompasses the overall payment of distributorship funds by the assignee to the corporation as a result of the assignment. It provides assurance that all financial obligations related to the distributorship will be met. 2. Specific Guaranty: A specific guaranty is focused on a particular assignment or transaction. It guarantees that the assignee will ensure payment of distributorship funds related to a specific assignment to the corporation. This type of guaranty is more narrow in scope and pertains to a specific agreement. 3. Limited Guaranty: A limited guaranty sets specific limits or conditions on the obligations of the distributor. It may restrict the guarantor's liability to a certain amount or define specific circumstances under which the guarantee is valid. This type of guaranty offers a limited level of protection to the corporation and may include provisions for exceptions or exclusions. 4. Continuing Guaranty: A continuing guaranty is not restricted to a single transaction or assignment but extends to future assignments or transactions as well. It pledges the distributor's ongoing responsibility for ensuring payment of distributorship funds by any assignee appointed by the corporation. The Maricopa Arizona Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment provides legal protection for corporations engaging in distributorship agreements. By obtaining a guaranty, corporations can mitigate risks associated with non-payment or default from distributors or assignees. It ensures a continuous flow of funds and promotes financial stability within distributorship relationships.

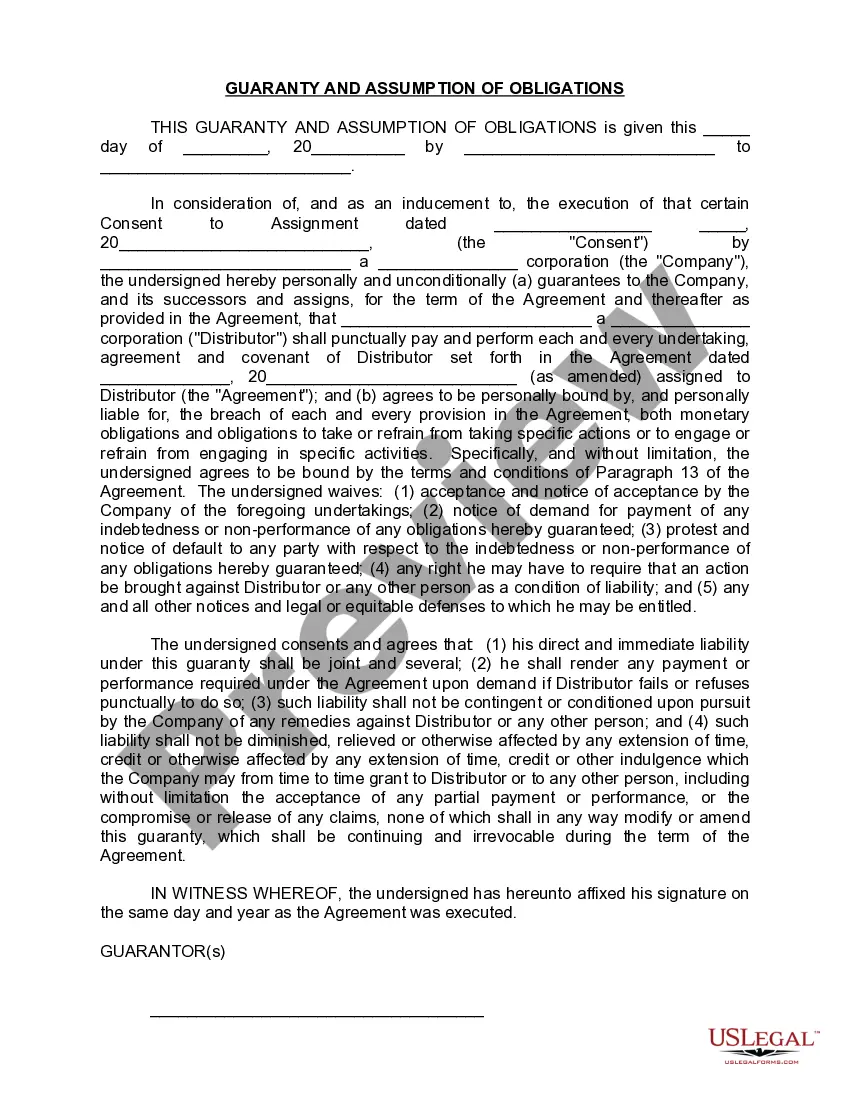

Maricopa Arizona Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment

Description

How to fill out Maricopa Arizona Guaranty By Distributor To Corporation Of Payment Of Distributorship Funds By Assignee Due To Assignment?

Whether you intend to open your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Maricopa Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Maricopa Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!