Montgomery Maryland Self-Employed Independent Contractor Employment Agreement — Commission for New Business: A Comprehensive Guide Introduction: The Montgomery Maryland Self-Employed Independent Contractor Employment Agreement is a legally binding contract that governs the relationship between a self-employed individual in Montgomery, Maryland, and a company or client with whom they enter into an agreement to provide services. This detailed description will shed light on the important aspects and key considerations of this type of agreement, primarily focusing on commissions for new business. Key Elements to Include in the Agreement: 1. Identification of Parties: The agreement should clearly state the names and addresses of both the self-employed contractor and the hiring party. 2. Scope of Work: A comprehensive description of the services the contractor will provide, specifically emphasizing the generation of new business and acquiring new clients. This may include sales, marketing, lead generation, networking, or other suitable methods for business development. 3. Commission Structure: The agreement must outline the commission structure, specifying how the contractor will be compensated for each new client or business opportunity they bring to the hiring party. This may include a percentage of sales, flat fees, or a tiered commission structure. 4. Payment Terms: Clearly delineate how and when the commission payments will be made, such as monthly, quarterly, or upon successful completion of the business transaction. 5. Exclusive or Non-Exclusive: Specify whether the contractor has the exclusive right to represent the hiring party or if they are free to engage in similar work for other clients during the term of the agreement. 6. Term and Termination: Define the duration of the agreement, whether it's for a fixed period or ongoing until termination. Include provisions for termination, such as breaches of the agreement, failure to meet targets, or mutual agreement. 7. Confidentiality and Non-Disclosure: Address any proprietary information the contractor may gain access to during the business relationship and stipulate terms of confidentiality. 8. Independent Contractor Relationship: Clearly state that the contractor is an independent contractor and not an employee of the hiring party. Highlight the lack of employee benefits and tax obligations that come with this independent status. 9. Governing Law and Jurisdiction: Indicate the applicable laws and the jurisdiction where any legal disputes will be resolved. Types of Montgomery Maryland Self-Employed Independent Contractor Employment Agreements: 1. Sales Representative Agreement: This specific type of agreement focuses on commission-based sales, including the acquisition of new clients, expanding market share, and meeting sales targets. 2. Business Development Agreement: This agreement emphasizes the contractor's role in identifying and pursuing new business opportunities, establishing strategic partnerships, and expanding the client base. 3. Marketing Consultant Agreement: Tailored for individuals with expertise in marketing, this agreement outlines the contractor's responsibilities for promoting the hiring party's products or services, generating leads, and driving new business. Conclusion: The Montgomery Maryland Self-Employed Independent Contractor Employment Agreement, with a focus on commissions for new business, offers a clear and structured framework for self-employed contractors to work autonomously while being fairly compensated for their efforts. By effectively incorporating the aforementioned elements, businesses and contractors can establish a mutually beneficial working relationship aligned with legal guidelines and best practices.

Montgomery Maryland Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Montgomery Maryland Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Montgomery Self-Employed Independent Contractor Employment Agreement - commission for new business, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Montgomery Self-Employed Independent Contractor Employment Agreement - commission for new business from the My Forms tab.

For new users, it's necessary to make several more steps to get the Montgomery Self-Employed Independent Contractor Employment Agreement - commission for new business:

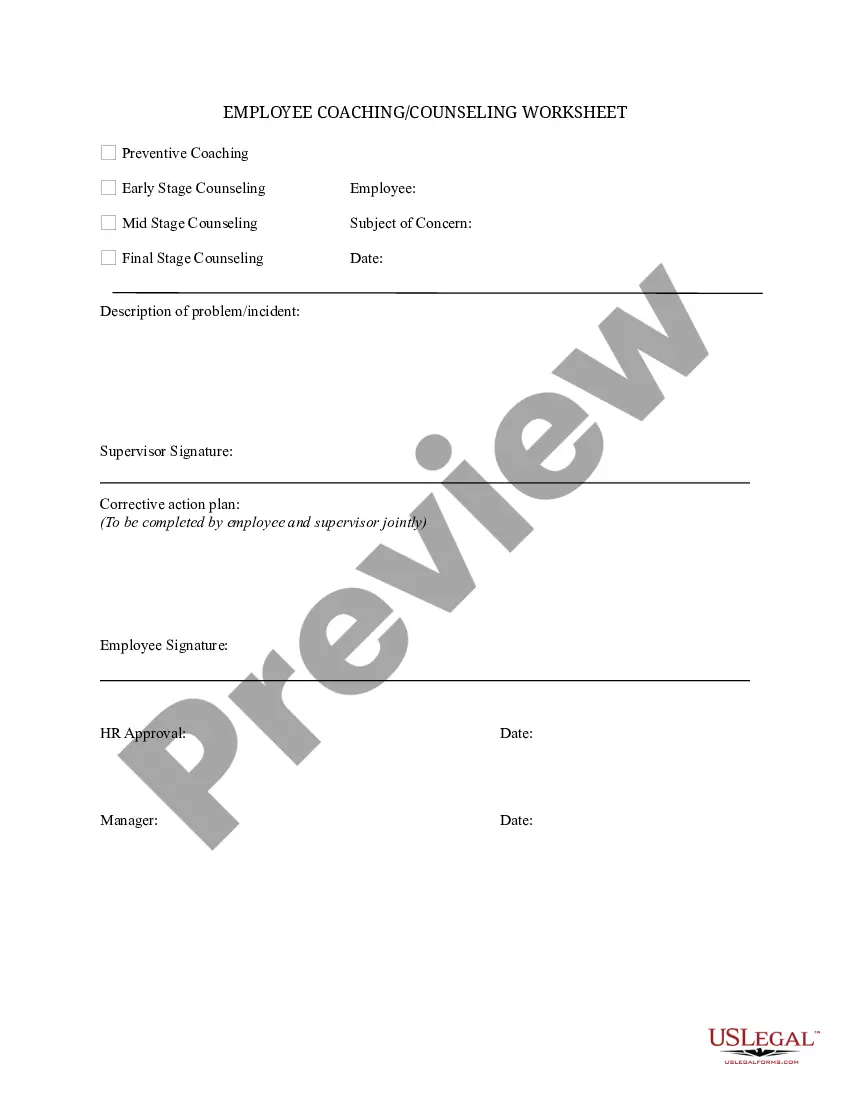

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!