The Cook Illinois Self-Employed Independent Contractor Employment Agreement — General is a comprehensive contract designed to establish a legal relationship between a self-employed individual and Cook Illinois Corporation, a transportation company based in Illinois. This agreement outlines the terms and conditions under which the independent contractor will provide their services to the company. The agreement begins by clearly identifying the parties involved, including their legal names and addresses. It then specifies the nature of the services to be rendered by the independent contractor, which may encompass various tasks related to transportation services, such as driving vehicles, maintaining them, or providing assistance to passengers. Key provisions included in the agreement cover the duration of the contract, the payment and invoicing terms, and the obligations and responsibilities of both parties. The duration can be specified as either a fixed term or an ongoing arrangement, depending on the needs of both parties. The payment terms outline the compensation structure, including the method and frequency of payment, any additional expenses the independent contractor is responsible for, and any incentives or bonuses that may apply. Crucial elements related to the independent contractor's responsibilities may include complying with all applicable laws, rules, and regulations, maintaining appropriate licenses and certifications, ensuring the safety and security of passengers, and maintaining confidentiality and privacy standards. Additionally, the independent contractor should be responsible for the costs associated with fuel, maintenance, and repairs of the vehicles used during the provision of services. The agreement may also cover issues such as insurance coverage, dispute resolution mechanisms, termination conditions, and non-compete clauses. Insurance provisions aim to protect both parties by ensuring that the independent contractor maintains appropriate levels of insurance coverage for liability and personal injuries. Dispute resolution mechanisms offer methods to resolve any conflicts that may arise during the contract period, while termination conditions describe the circumstances under which either party may end the agreement. While the Cook Illinois Self-Employed Independent Contractor Employment Agreement — General covers a wide range of transportation services, specific types of contracts within this agreement may include variations tailored to specific roles or services provided by the independent contractor. Some examples of specialized contracts could be the Cook Illinois Self-Employed Independent Contractor Employment Agreement — Driver, which would focus on individuals hired specifically to operate vehicles, or the Cook Illinois Self-Employed Independent Contractor Employment Agreement — Maintenance, targeting contractors responsible for the maintenance and repairs of the company's fleet. In summary, the Cook Illinois Self-Employed Independent Contractor Employment Agreement — General provides a clear framework for the engagement of self-employed individuals by Cook Illinois Corporation, ensuring that both parties understand their rights and obligations while undertaking transportation-related services. It is important for both the company and the independent contractor to thoroughly review and understand the agreement to ensure a mutually beneficial and legally compliant working relationship.

Cook Illinois Self-Employed Independent Contractor Employment Agreement - General

Description

How to fill out Cook Illinois Self-Employed Independent Contractor Employment Agreement - General?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cook Self-Employed Independent Contractor Employment Agreement - General, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the current version of the Cook Self-Employed Independent Contractor Employment Agreement - General, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Cook Self-Employed Independent Contractor Employment Agreement - General:

- Look through the page and verify there is a sample for your region.

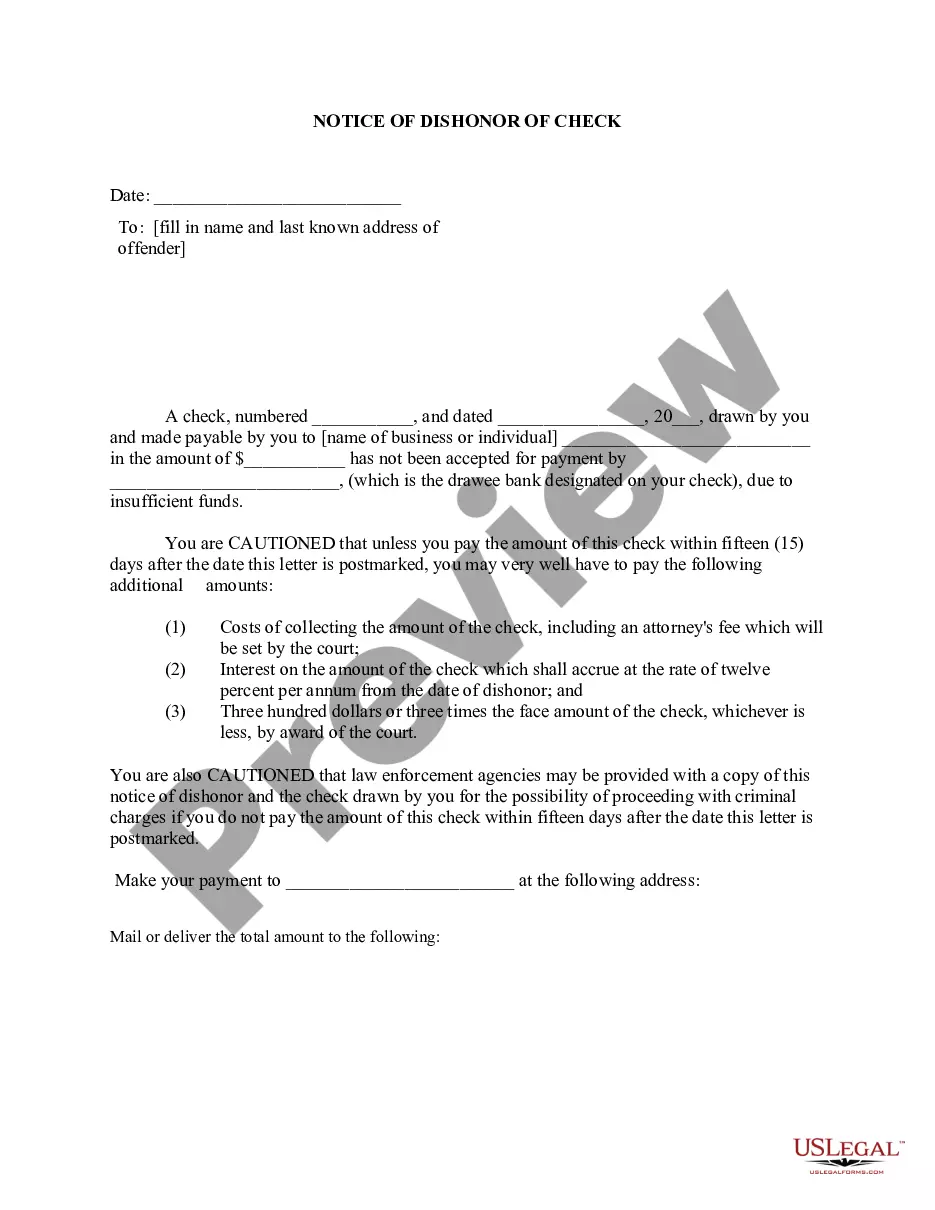

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Cook Self-Employed Independent Contractor Employment Agreement - General and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!