Queens New York Self-Employed Independent Contractor Employment Agreement — General is a legally binding document that outlines the terms and conditions of a self-employed independent contractor's engagement with a client or company in Queens, New York. This agreement helps establish clear expectations and responsibilities for both parties involved. The agreement covers various aspects of the employment arrangement, including the scope of services, compensation, payment terms, duration, termination, intellectual property rights, non-disclosure clauses, and dispute resolution mechanisms. It ensures that both the contractor and the client are on the same page regarding the project's scope, deliverables, and overall working relationship. Keywords: Queens New York, self-employed, independent contractor, employment agreement, general, terms and conditions, engagement, client, company, expectations, responsibilities, scope of services, compensation, payment terms, duration, termination, intellectual property rights, non-disclosure clauses, dispute resolution. Different types of Queens New York Self-Employed Independent Contractor Employment Agreement — General may include: 1. Professional Services Agreement: This type of agreement is suitable for self-employed professionals, such as consultants, freelancers, or other service-based providers in Queens, New York. 2. Work Agreement for Creative Professionals: This variation is specifically designed for self-employed individuals working in creative fields, such as writers, designers, photographers, and artists, who may have additional clauses covering copyright and usage rights. 3. Construction Contractor Agreement: This type of agreement caters to self-employed contractors who work in the construction industry in Queens, New York. It addresses construction-specific matters, such as safety regulations, materials, and project timelines. 4. Technology Services Agreement: For self-employed IT professionals, software developers, or technology consultants in Queens, New York, this agreement focuses on the provision of technology-related services, software development, maintenance, and support. 5. Sales Representative Agreement: This agreement is applicable for self-employed sales representatives or agents operating in Queens, New York. It outlines the terms and conditions of their engagement with a client or company to sell products or services. Remember that each agreement should be tailored to meet the specific needs of the contracting parties. It is recommended to consult with an attorney or legal professional to ensure compliance with local laws and regulations.

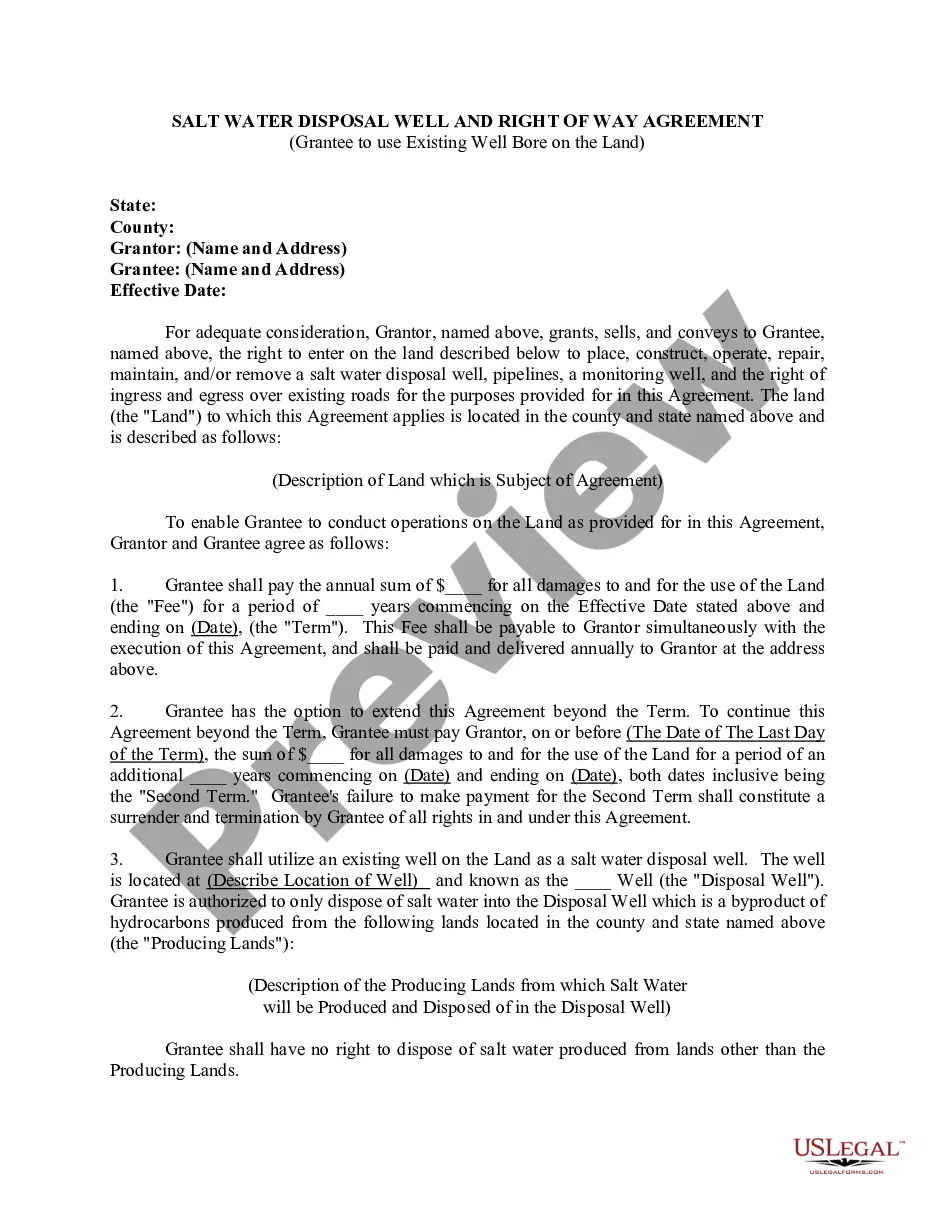

Queens New York Self-Employed Independent Contractor Employment Agreement - General

Description

How to fill out Queens New York Self-Employed Independent Contractor Employment Agreement - General?

If you need to find a reliable legal paperwork supplier to get the Queens Self-Employed Independent Contractor Employment Agreement - General, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it simple to find and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Queens Self-Employed Independent Contractor Employment Agreement - General, either by a keyword or by the state/county the form is created for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Queens Self-Employed Independent Contractor Employment Agreement - General template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less pricey and more reasonably priced. Create your first company, organize your advance care planning, create a real estate agreement, or complete the Queens Self-Employed Independent Contractor Employment Agreement - General - all from the comfort of your sofa.

Sign up for US Legal Forms now!