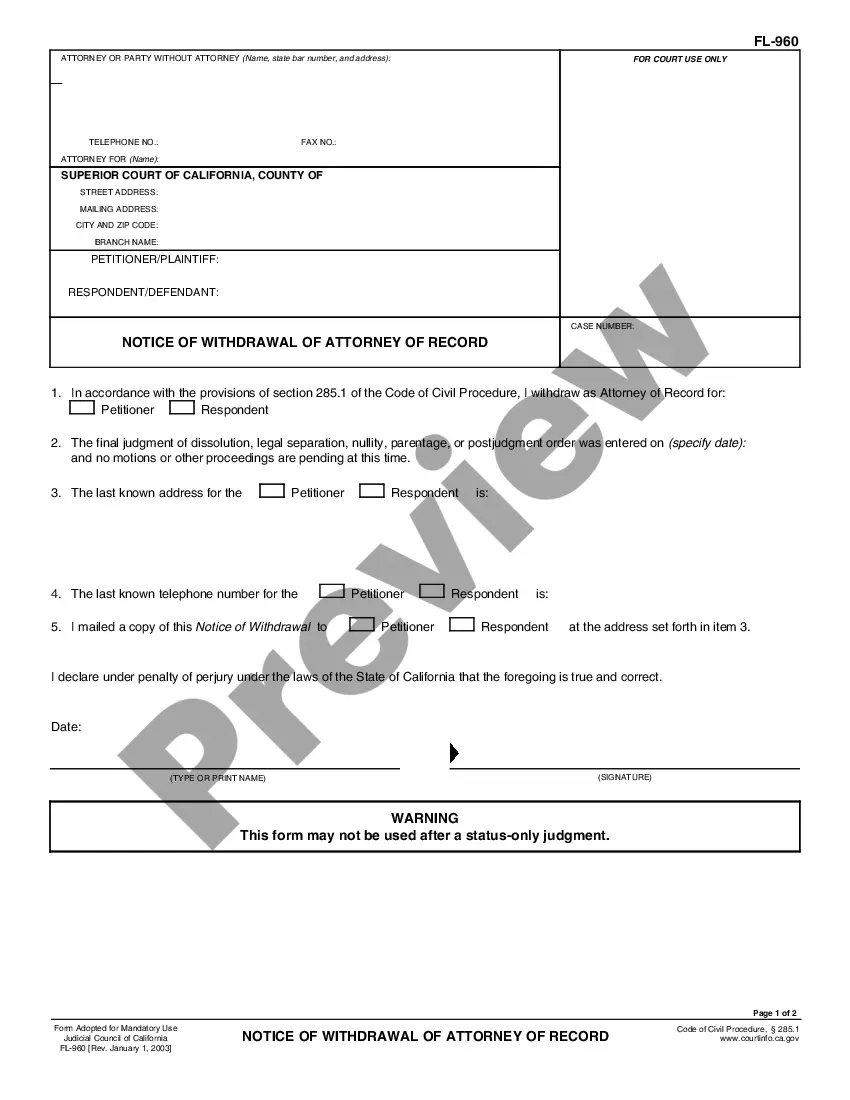

DESCRIPTION: A Dallas Texas Personal Guaranty is a legal document that serves as a guarantee of a contract for the lease or purchase of real estate in the Dallas, Texas area. This agreement ensures that the party signing the guaranty, known as the Guarantor, will be held financially accountable for any obligations or liabilities that may arise from the lease or purchase contract. Whether it's a residential or commercial real estate transaction, a Personal Guaranty acts as an assurance for landlords or sellers, providing them with an extra layer of protection in case the tenant or buyer defaults on the contract terms. This document helps to alleviate any financial risks associated with non-payment or breach of the agreement. Different types of Dallas Texas Personal Guaranty — Guarantee of Contract for the Lease and Purchase of Real Estate may include: 1. Commercial Personal Guaranty: This type of guaranty is used when the lease or purchase contract involves commercial real estate, such as retail spaces, office buildings, or industrial properties. It ensures that the Guarantor will personally cover any financial obligations resulting from the agreement. 2. Residential Personal Guaranty: When entering a lease or purchase contract for residential real estate, such as apartments, houses, or condominiums, a residential personal guaranty can be utilized. This agreement safeguards the landlord or seller by holding the Guarantor responsible for any defaults on the contract, such as late rent payments or property damage. 3. Purchase Personal Guaranty: In the case of purchasing real estate, this type of personal guaranty acts as a guarantee for the fulfillment of the buyer's obligations, including timely payment of the purchase price or any other contractual terms specified in the agreement. 4. Lease Personal Guaranty: When leasing a property, a lease personal guaranty ensures that the tenant will fulfill their contractual obligations, such as paying rent, maintaining the property, or adhering to any other terms agreed upon in the lease agreement. Dallas Texas Personal Guaranty agreements are legally binding contracts that must be carefully reviewed and understood by all parties involved. It is advisable to consult with a qualified attorney or legal professional to ensure that the guaranty accurately reflects the intentions of all parties and complies with local laws and regulations. Overall, a Dallas Texas Personal Guaranty provides security and peace of mind to landlords, sellers, and other parties involved in lease or purchase contracts, assuring them that their financial interests are protected in case of default or breach.

Dallas Texas Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Dallas Texas Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you need to find a reliable legal paperwork supplier to find the Dallas Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support team make it easy to find and complete various papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse Dallas Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Dallas Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or complete the Dallas Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate - all from the comfort of your sofa.

Sign up for US Legal Forms now!