A Chicago Illinois Personal Guaranty — Guarantee of Lease to Corporation is a legally binding agreement that is commonly used in commercial real estate transactions. In such transactions, a corporation may require a personal guaranty from an individual to ensure that the corporation's lease obligations are fulfilled. This personal guaranty serves as an additional layer of security for the corporation's landlord, protecting their interests in case of default or non-payment. The Chicago Illinois Personal Guaranty — Guarantee of Lease to Corporation encompasses various essential details. Firstly, it identifies the involved parties, including the corporation, individual guarantor, and the landlord. Secondly, it clearly outlines the terms and conditions of the lease agreement between the corporation and the landlord. The personal guaranty lays down the responsibilities and obligations of the guarantor, ensuring the fulfillment of the lease agreement. Keywords: Chicago Illinois, personal guaranty, guarantee of lease, corporation, commercial real estate, transactions, legally binding agreement, lease obligations, additional layer of security, landlord, default, non-payment, involved parties, terms and conditions, responsibilities, obligations. Different types or variations of the Chicago Illinois Personal Guaranty — Guarantee of Lease to Corporation may include: 1. Unlimited Personal Guaranty: This type of guaranty holds the individual guarantor personally responsible for all lease obligations and potential damages, irrespective of the corporation's financial position. It provides the maximum level of protection to the landlord. 2. Limited Personal Guaranty: In contrast to the unlimited guaranty, the limited guaranty restricts the personal liability of the individual guarantor. It may specify a maximum dollar amount or limit the guarantor's responsibility to certain lease provisions, such as rent payment. 3. Conditional Personal Guaranty: This type of guaranty becomes effective only under specific circumstances, such as the corporation's default or bankruptcy. The guaranty may outline the triggers that activate the personal liability of the guarantor. 4. Continuing Personal Guaranty: A continuing guaranty remains in effect for the entire term of the lease, regardless of any changes or modifications made to the lease agreement. It ensures that the personal liability of the guarantor persists even if the lease terms are altered. 5. Individual-Corporate Guaranty: This guaranty combines the personal liability of the individual guarantor with the corporate backing. Both the individual and the corporation become joint guarantors, sharing the responsibility of fulfilling the lease obligations. It is crucial for all parties involved in such transactions to seek legal advice to draft and understand the terms of the Chicago Illinois Personal Guaranty — Guarantee of Lease to Corporation effectively.

Chicago Illinois Personal Guaranty - Guarantee of Lease to Corporation

Description

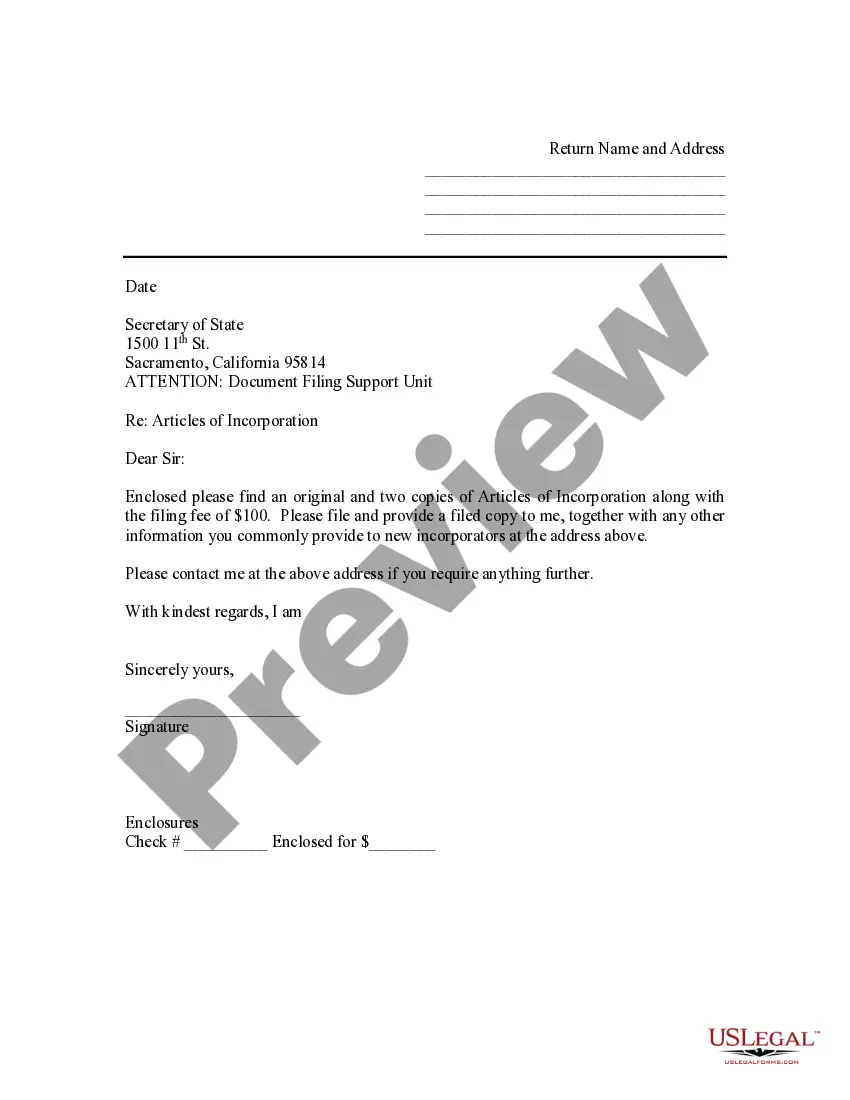

How to fill out Chicago Illinois Personal Guaranty - Guarantee Of Lease To Corporation?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Chicago Personal Guaranty - Guarantee of Lease to Corporation is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Chicago Personal Guaranty - Guarantee of Lease to Corporation. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Personal Guaranty - Guarantee of Lease to Corporation in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

The most common type of limited guaranty is the 12-month rolling guaranty. This means, after a certain amount of time has passed during the lease term, the business owners' liability is limited to 12-months of rent payments vs. the entire amount of the lease obligation.

A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.

A lease guarantee is an official agreement signed by the landlord, tenant, and in addition, a third party who meets the monetary requirements of the landlord. A lease guarantor serves as a financial intermediary and is responsible for the tenant's defaults, which protects the tenant from eviction.

You Can Use These 5 Steps to Negotiate a Personal Guarantee You Need to Know What You're Signing. There can be a wide variance in the terms of a PG.Know Who You Are Signing With.Determine an Acceptable Level of Risk.Negotiate the PG Terms.Keep the Door Open to Future PG Negotiations.

Request a time-limited guarantee. Ask your landlord to reduce the period covered by the personal guarantee to one or two years, rather than the entire term of the rental.

Director Guarantees are usually required in loan, lease or other finance arrangements if the company is small and has limited assets. If there are concerns about the company's ability to pay, the lender or landlord may seek additional security that could be seized to settle any outstanding debt.

A personal guaranty is not enforceable without consideration In fact, no contract is enforceable without consideration. A personal guaranty is a type of contract. A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of ?consideration? to the other party.

Updated July 6, 2020: A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

Show proof of consistent revenues and profits (P&L statements, balance sheets, etc) Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time. Try to renegotiate the guarantee terms.