Harris Texas Personal Guaranty — Guarantee of Lease to Corporation is a legal agreement designed to secure the lease obligations of a corporation by requiring a personal guarantor. This ensures that in case the company fails to fulfill its lease obligations, the personal guarantor will be held responsible and liable for any outstanding rent or damages. The Harris Texas Personal Guaranty is a powerful tool for landlords or property owners to minimize the risk associated with renting their property to a corporation. By including a personal guarantor, property owners can have additional financial security, knowing that they have an additional party to hold accountable for any breaches of the lease agreement. Some key elements of the Harris Texas Personal Guaranty — Guarantee of Lease to Corporation are: 1. Parties involved: The agreement outlines the names and addresses of both the corporation (the Tenant) and the personal guarantor involved in the lease. 2. Guarantee of lease obligations: The personal guarantor pledges to be fully responsible for fulfilling all the obligations of the lease agreement, including payment of rent, maintenance costs, repairs, and any other expenses mentioned in the lease. 3. Joint and several liabilities: This clause ensures that both the corporation and the personal guarantor are jointly and severally responsible for the obligations of the lease. This means that the landlord can pursue either party for the full amount owed, providing flexibility in seeking recovery. 4. Termination and modification: The agreement may include provisions regarding termination or modification, stating under what circumstances the guarantor's obligation can be lifted or altered. 5. Indemnification: The personal guarantor agrees to indemnify and hold harmless the landlord against any claims or losses resulting from the corporation's failure to fulfill its lease obligations. As for the different types of Harris Texas Personal Guaranty — Guarantee of Lease to Corporation, they can vary based on the specific terms and conditions mentioned in the agreement. Some variations may include: 1. Limited Guaranty: This type of personal guaranty may restrict the personal guarantor's liability to a specific amount or period, providing some level of financial protection. 2. Unlimited Guaranty: In this case, the personal guarantor assumes unlimited liability, meaning they can be held accountable for the full amount of the lease obligations without any set limit. 3. Conditional Guaranty: This type of guaranty may be subject to certain conditions, such as the corporation defaulting on its obligations or other specified events. 4. Collateralized Guaranty: Here, the personal guarantor may pledge specific assets as collateral to secure the lease obligations, providing additional security to the landlord. In summary, the Harris Texas Personal Guaranty — Guarantee of Lease to Corporation is a comprehensive legal agreement that outlines the personal guarantor's role in securing the obligations of a lease between a corporation and a landlord. With different variations available, property owners can tailor the agreement based on their specific needs and level of risk tolerance.

Harris Texas Personal Guaranty - Guarantee of Lease to Corporation

Description

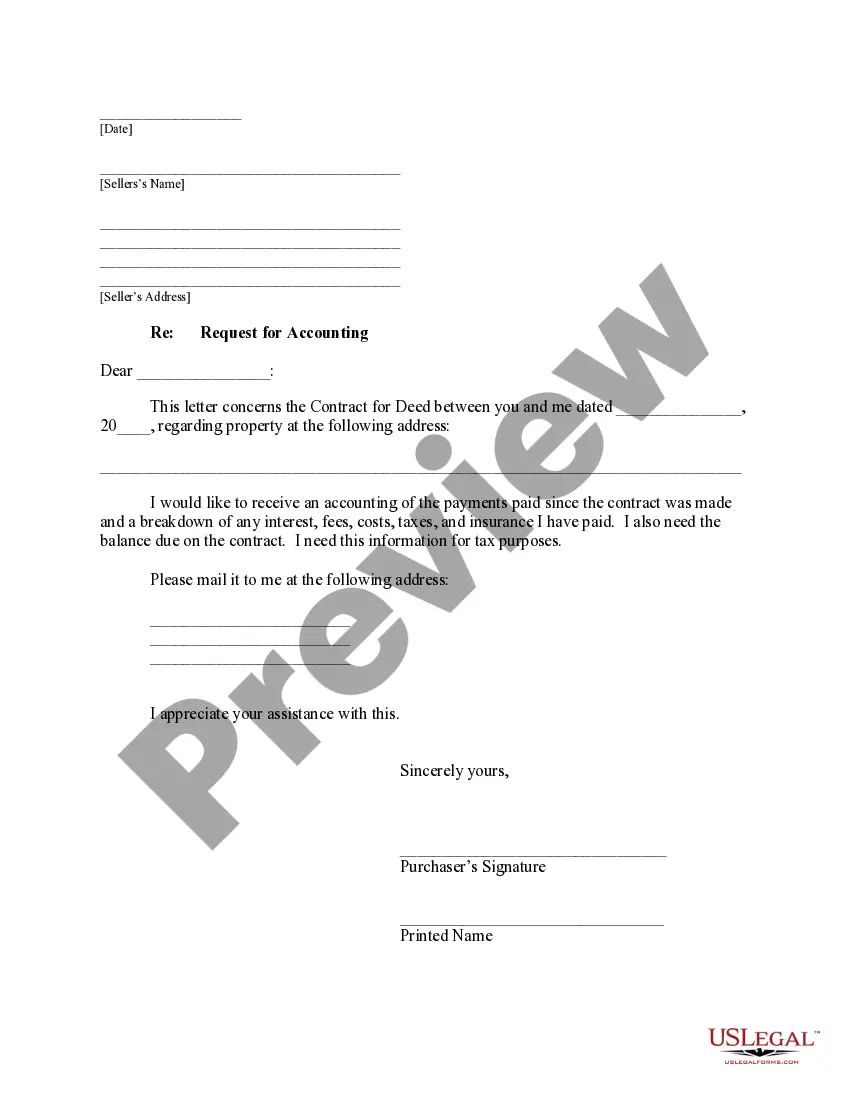

How to fill out Harris Texas Personal Guaranty - Guarantee Of Lease To Corporation?

Do you need to quickly create a legally-binding Harris Personal Guaranty - Guarantee of Lease to Corporation or maybe any other form to handle your own or corporate affairs? You can go with two options: hire a professional to write a legal paper for you or create it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific form templates, including Harris Personal Guaranty - Guarantee of Lease to Corporation and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, carefully verify if the Harris Personal Guaranty - Guarantee of Lease to Corporation is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the search over if the template isn’t what you were seeking by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Harris Personal Guaranty - Guarantee of Lease to Corporation template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the templates we provide are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Corporate credit cards. Instead, by using a credit that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.

How to Limit a Personal Guarantee Refuse to sign or simply cross out the guarantee language.Define when the personal guarantee would go into effect.Decrease personal guarantee with improved business performance or passage of time.Limit a guarantee.Revoke old guarantees.Suggest terms of relief.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

Personal guarantees are usually enforceable. The typical route would be for the lender to take the guarantor to court to request the enforcement of a judgement against their personal assets. Once a lender takes legal action, the enforcement of a personal guarantee can be a quick process.

The main technical requirement for a guarantee to be valid is that it must be in writing and signed by the guarantor or a person authorised on the guarantor's behalf.

A corporate guarantee is a contract between a corporate entity or individual and a debtor. In this contract, the guarantor agrees to take responsibility for the debtor's obligations, such as repaying a debt.

According to the Restatement, a party may enforce a guaranty under one of three theories: A promise to be surety for the performance of a contractual obligation, made to the obligee, is binding if: The promise is in writing and signed by the promisor and recites a purported consideration; or.

Consult with an attorney on what your options are. Show proof of consistent revenues and profits (P&L statements, balance sheets, etc) Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time.

Essentially, a personal guarantee in a commercial lease is pretty much what it sounds like: it makes you personally liable for rent if the business can't pay. That means if the business falls on some hard months or is ultimately unsuccessful, the landlord can sue you for any unpaid rent from the commercial lease.