Mecklenburg North Carolina Personal Guaranty — Guarantee of Lease to Corporation: A Comprehensive Overview In Mecklenburg County, North Carolina, a Personal Guaranty for a Corporation's Lease serves as a vital legal agreement that provides additional security and assurance to landlords or property owners when entering into lease agreements with corporations. This guarantee ensures that the obligations under the lease will be fulfilled by the corporation, even if it defaults on its lease obligations or fails to make timely rental payments. Key Terms and Provisions: 1. Personal Guaranty: It is a legally binding document signed by an individual (the guarantor) who agrees to be personally liable for the financial obligations and performance of a lease agreement entered into by the corporation. The guarantor pledges their own assets as collateral, offering an extra layer of financial security to the landlord or property owner. 2. Corporation: The entity that enters into the lease agreement and is responsible for fulfilling its terms and conditions. The corporation benefits from entering into a lease, acquiring a space for its business operations while limiting the personal liability of its shareholders. 3. Lease Agreement: It is a legal contract between the landlord or property owner and the corporation, outlining the terms and conditions under which the property will be leased. The agreement covers various aspects such as the lease duration, rental payments, maintenance responsibilities, renewal options, and other specific provisions. Types of Mecklenburg North Carolina Personal Guaranty — Guarantee of Lease to Corporation: 1. Limited Guaranty: In this type of guaranty, the guarantor's liability is limited to a specific amount or a certain time period. It may include a cap on the total liability or define a specific duration for which the guarantor remains liable. 2. Unlimited Guaranty: An unlimited guaranty, also known as an absolute guaranty, imposes no limitations on the guarantor's liability. The guarantor becomes fully responsible for fulfilling all obligations under the lease agreement, irrespective of the corporation's ability to meet them. 3. Conditional Guaranty: A conditional guaranty establishes specific triggering events that activate the guarantor's liability. For example, defaulting on rental payments, breaching lease terms, or declaring bankruptcy by the corporation could activate the guarantor's liability. 4. Continuing Guaranty: A continuing guaranty covers the lease agreement and its extension or renewal periods. Even if the lease is extended or renewed, the guarantor's liability remains in effect until the lease terminates or specific conditions are met. 5. Joint and Several guaranties: In certain cases, multiple individuals may guarantee the lease obligations of the corporation jointly and severally. This means that each guarantor is individually responsible for the entire obligations of the lease, permitting the landlord greater flexibility in pursuing recovery from any or all guarantors. In conclusion, a Mecklenburg North Carolina Personal Guaranty — Guarantee of Lease to Corporation safeguards the interests of landlords or property owners in lease agreements with corporations. By providing an additional layer of personal liability, the guaranty ensures the fulfillment of lease obligations, being an essential legal tool that enhances the security and reliability of lease transactions.

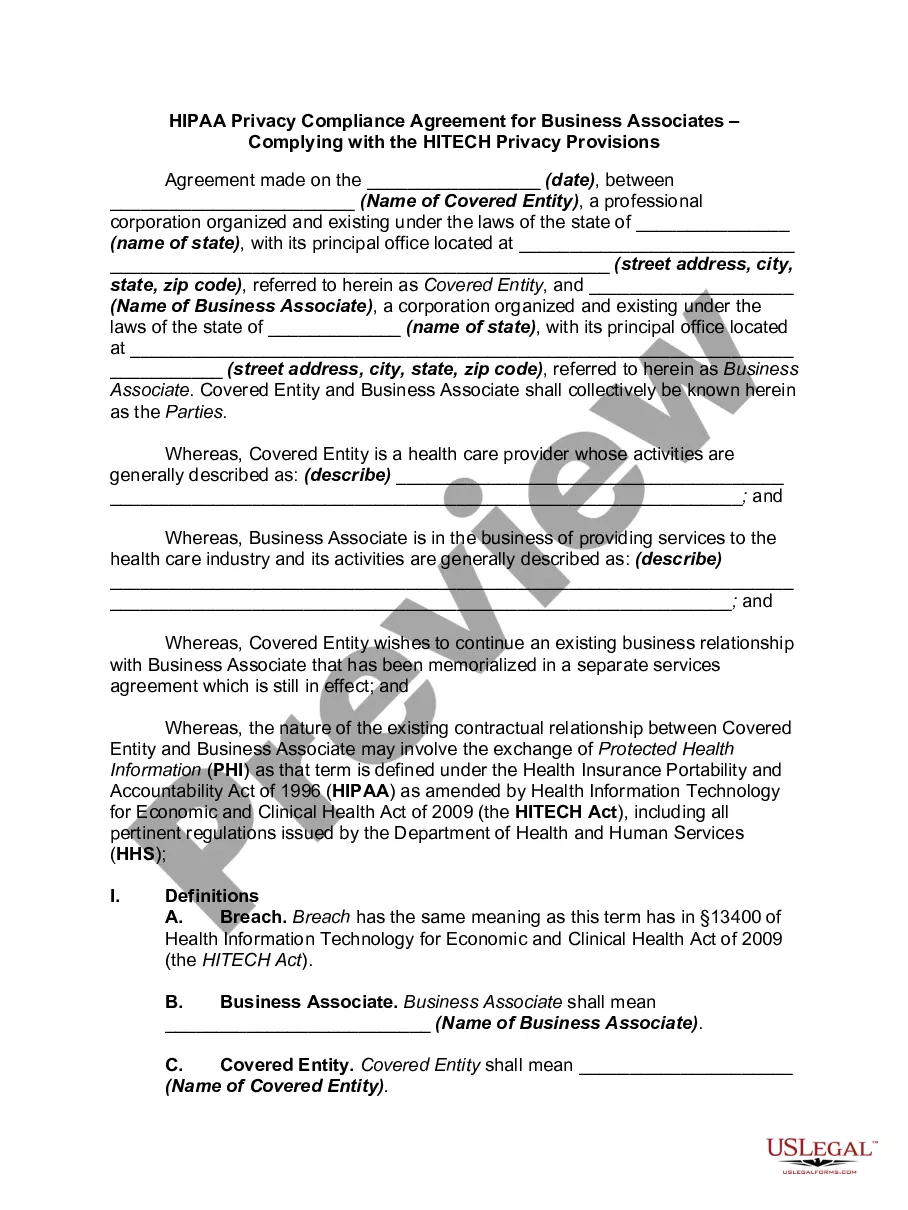

Mecklenburg North Carolina Personal Guaranty - Guarantee of Lease to Corporation

Description

How to fill out Mecklenburg North Carolina Personal Guaranty - Guarantee Of Lease To Corporation?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business objective utilized in your region, including the Mecklenburg Personal Guaranty - Guarantee of Lease to Corporation.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Mecklenburg Personal Guaranty - Guarantee of Lease to Corporation will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Mecklenburg Personal Guaranty - Guarantee of Lease to Corporation:

- Make sure you have opened the right page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Mecklenburg Personal Guaranty - Guarantee of Lease to Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!