Cook Illinois Farm Lease or Rental — General is a type of contract that outlines the terms and conditions between a landlord (lessor) and a tenant (lessee) for the rental or lease of a farm in Cook County, Illinois. This agreement aims to establish a clear understanding and legal framework regarding the use, maintenance, and payment obligations associated with the farm property. The Cook Illinois Farm Lease or Rental — General covers various aspects, including the duration of the lease, rights and restrictions on the use of the land, payment details, maintenance responsibilities, and dispute resolution procedures. The lease may vary depending on the specific requirements, duration, and location of the farm property. Key provisions often present in a Cook Illinois Farm Lease or Rental — General contract include: 1. Parties involved: Clearly identifying the lessor (landlord) and lessee (tenant) with their contact information. 2. Lease term: Specifying the start and end dates of the lease agreement, including any renewal or termination provisions. 3. Rent and payment terms: Stating the amount of rent, payment frequency (monthly, annually), due date, and acceptable payment methods. 4. Property description: Providing an accurate description of the farm property, including acreage, boundaries, and any specific buildings or facilities. 5. Use and restrictions: Outlining the permitted use of the land, such as agricultural activities or livestock raising, as well as any restrictions or prohibited uses. 6. Maintenance responsibilities: Defining the responsibilities of each party regarding property maintenance, repairs, and upkeep, including any provisions for property improvements or modifications. 7. Utilities and services: Clarifying the obligations regarding utility payments, such as water, electricity, and waste disposal, and specifying who is responsible for arranging and covering the costs. 8. Insurance requirements: Specifying the types and amount of insurance coverage the lessee must acquire for the duration of the lease, including liability insurance for farm activities. 9. Termination conditions: Detailing the process for early termination or lease extension, along with any penalties or notice periods required. 10. Dispute resolution: Outlining the procedure for resolving disputes, either through mediation, arbitration, or litigation, and designating the applicable jurisdiction. It's important to note that there might be variations or additional clauses in different types of Cook Illinois Farm Lease or Rental — General agreements based on specific farm-related activities or the preferences of the parties involved. Some variations may include specialized leases for crop farming, livestock production, organic farming, or agro-tourism ventures. Before entering into a Cook Illinois Farm Lease or Rental — General agreement, it is advisable for both parties to seek legal advice and ensure that all terms and conditions are clearly understood and agreed upon.

Cook Illinois Farm Lease or Rental - General

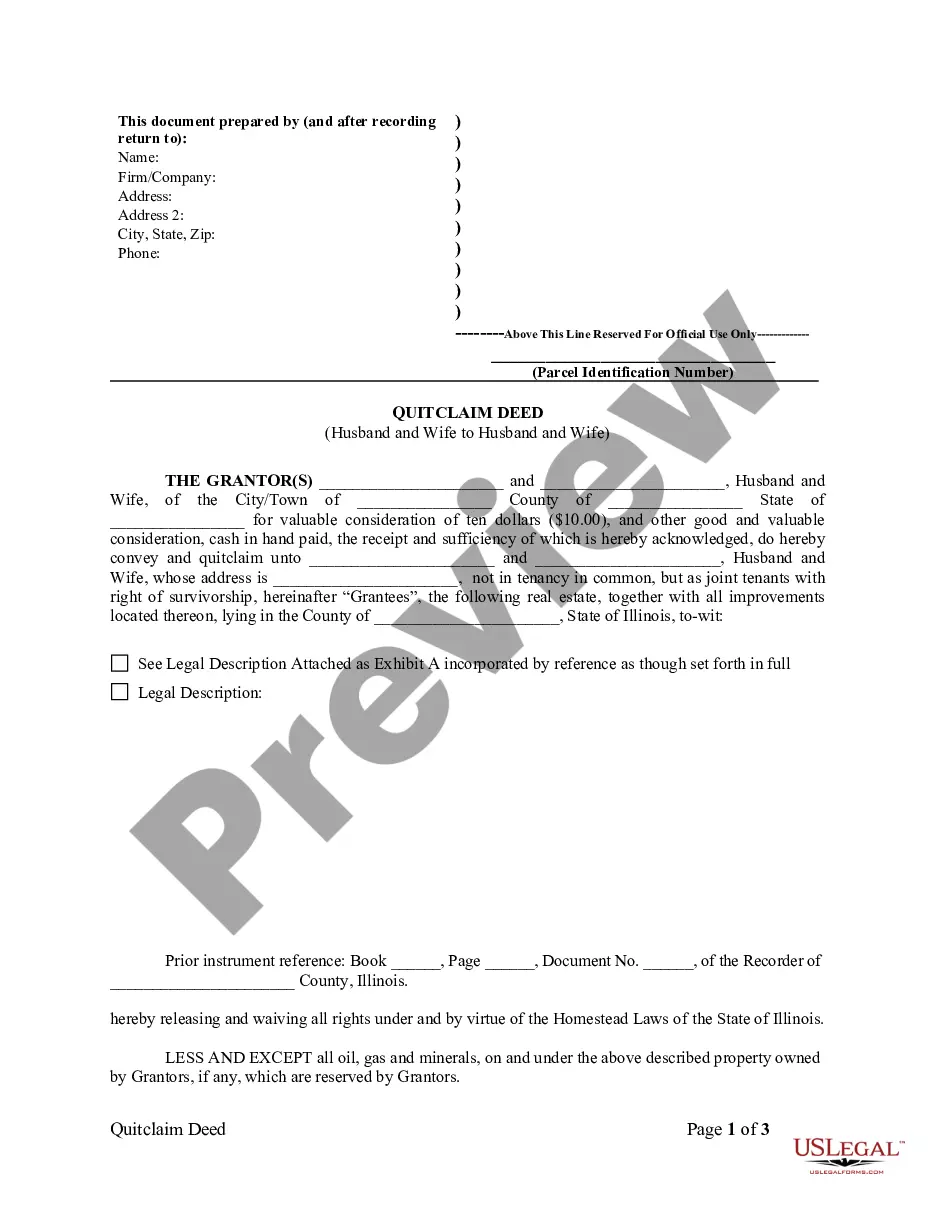

Description

How to fill out Cook Illinois Farm Lease Or Rental - General?

Creating forms, like Cook Farm Lease or Rental - General, to manage your legal matters is a tough and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for various cases and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Cook Farm Lease or Rental - General form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Cook Farm Lease or Rental - General:

- Make sure that your template is specific to your state/county since the regulations for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Cook Farm Lease or Rental - General isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start utilizing our service and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

The largest expenditures for crop farms are rent at $24.1 billion (13.2 percent of total), labor at $24.5 billon (13.5 percent), and farm services at $24.8 billion (13.6 percent). Combined crop inputs (chemicals, fertilizers, and seeds) are $53.2 billion, accounting for 29.2 percent of crop farms total expenses.

Variable costs are relatively straightforward and include costs such as seed, fertilizers and chemicals. The cost of these fluctuate depending on market prices, but generally speaking, they will eventually moderate and only account for a portion of farmers' costs.

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other require- ments such as business licenses and fees. Check with your state and local governments for more information.

The IRS stipulates that you can typically claim three consecutive years of farm losses.

Inputs are things put into the production process such as land, labour, implements, seed, mechanization (tractors) fertilizer, pesticides.

In agriculture, these ordinary and necessary expenses include car and truck expenses, fertilizer, seed, rent, insurance, fuel, and other costs of operating a farm. Schedule F itemizes many of these expenses in Part II. Those properly deductible expenses not separately listed on the Form are reported on line 32.

According to the IRS, a farmer needs to show a profit 3 out of 5 years, even if the profits are not large. Always showing a loss on your Schedule F, can alert the IRS that the operation may be a hobby and not a for-profit business.

Known as the hobby loss rule, the IRS states: An activity is presumed for profit if it makes a profit in at least three of the last five tax years, including the current year (or at least two of the last seven years for activities that consist primarily of breeding, showing, training or racing horses).

The balance sheet is a report of the farm business's financial position at a given moment in time. It lists assets, liabilities, and net worth (owner's equity), and represents a snapshot of the farm business as of a certain date.

These people must report this income on their tax return. A hobby is any activity that a person pursues because they enjoy it and with no intention of making a profit. This differs from those that operate a business with the intention of making a profit.