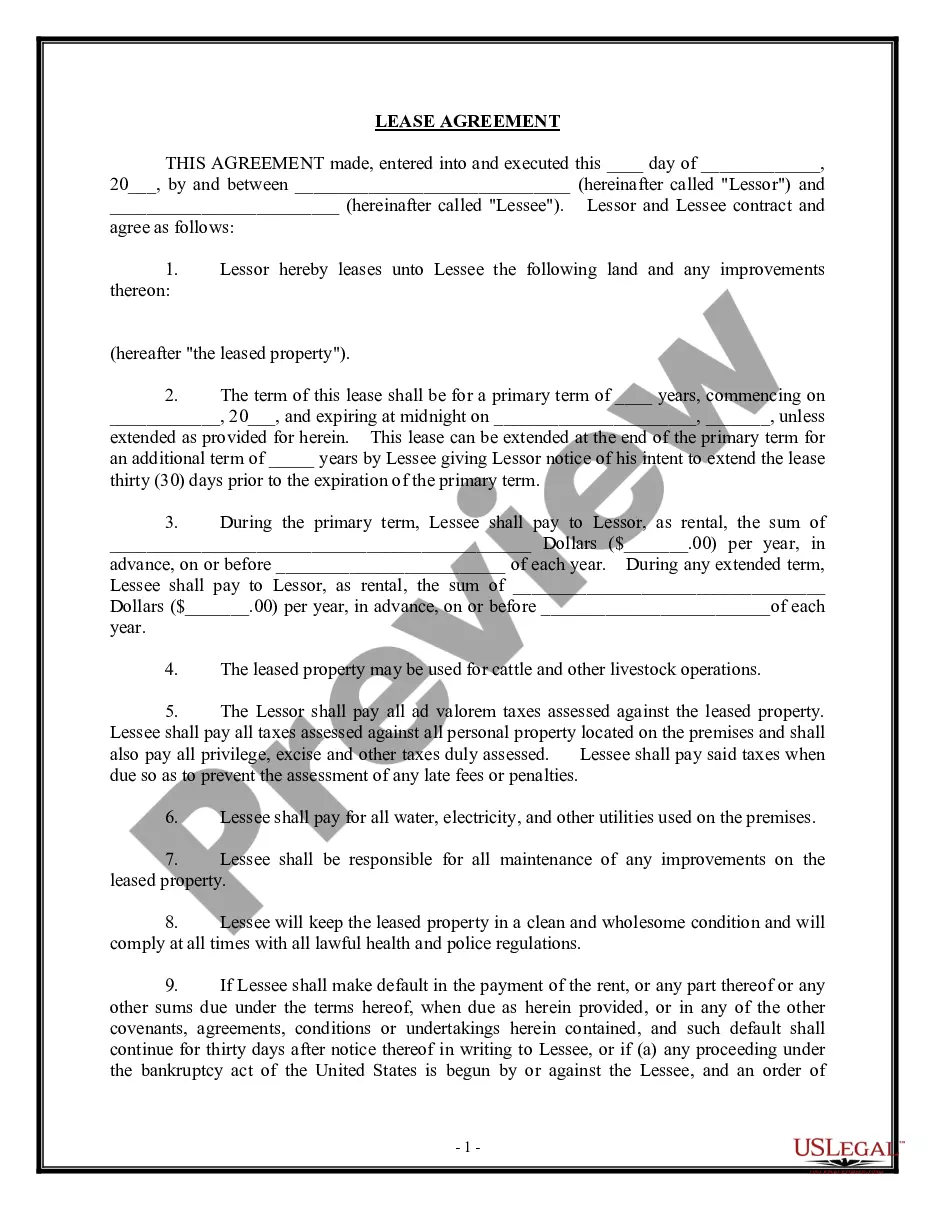

Harris Texas Farm Lease or Rental — General: Exploring Farming Opportunities in Harris County If you are an aspiring farmer or landowner looking for a viable business opportunity in Harris County, Texas, the Harris Texas Farm Lease or Rental — General is the perfect solution for you. This detailed description will provide valuable information about what this type of lease entails and the various types available to suit different needs. What is a Harris Texas Farm Lease or Rental — General? A Harris Texas Farm Lease or Rental — General refers to an agreement between the landowner (lessor) and an interested party (lessee) who wishes to lease or rent farming land in Harris County, Texas. The lease or rental terms are designed to allocate the land for agricultural purposes while establishing the rights, responsibilities, and duration of use for both parties involved. Types of Harris Texas Farm Lease or Rental — General: 1. Cash Lease: In a cash lease agreement, the lessee pays a fixed amount of money, usually annually or on a per-acre basis, to the lessor for the use of the farmland. The lessee assumes all production and price risks while maintaining complete control over farming decisions and marketing. 2. Sharecropping Lease: Under a sharecropping lease, the landowner and lessee agree to share the agricultural production and costs in a predetermined ratio. The lessee provides labor and machinery, while the landowner contributes the land and may also provide resources like fertilizers and seeds. 3. Flexible Cash Lease: A flexible cash lease combines elements of both a cash lease and a sharecropping lease. The agreement is structured to vary the rental cost based on specific production results or market conditions. This type of lease allows for a fair distribution of risks and rewards between the landowner and lessee. 4. Grazing Lease: A grazing lease specifically focuses on the use of farmland for livestock grazing purposes. This type of lease is commonly used for raising cattle, sheep, or horses. The agreement outlines the terms, such as the stocking rate, the duration of grazing, and any necessary provisions for fence maintenance. 5. Renewable Lease: A renewable lease provides the option for the lessee or landowner to extend the lease term after the initial agreement expires. This allows for continuity in farming operations and provides security for long-term investments. Key Considerations for a Harris Texas Farm Lease or Rental — General: When entering into a Harris Texas Farm Lease or Rental — General, both the landowner and lessee should consider the following factors: 1. Lease Terms: Clearly define the duration of the lease, payment structure, responsibilities for property maintenance, and provisions for early termination or renewal. 2. Land Use Restrictions: Determine any limitations on the use of the land, such as grazing restrictions, conservation practices, or regulations related to pesticide and herbicide usage. 3. Environmental Stewardship: Consider incorporating sustainable farming practices, such as soil conservation, water management, and wildlife habitat preservation, to ensure long-term agricultural productivity and environmental well-being. By understanding the various types of Harris Texas Farm Lease or Rental — General and considering the key considerations above, prospective lessees and landowners can enter into a mutually beneficial agreement that supports sustainable farming practices, economic growth, and the preservation of agricultural heritage in Harris County.

Harris Texas Farm Lease or Rental - General

Description

How to fill out Harris Texas Farm Lease Or Rental - General?

If you need to get a trustworthy legal form provider to find the Harris Farm Lease or Rental - General, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support make it easy to find and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to search or browse Harris Farm Lease or Rental - General, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Harris Farm Lease or Rental - General template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Harris Farm Lease or Rental - General - all from the convenience of your home.

Join US Legal Forms now!