The Cuyahoga Ohio Complex Guaranty Agreement to Lender is a legal document that outlines the terms and conditions of a guarantee provided by a borrower to a lender in the Cuyahoga County, Ohio region. This agreement serves as a collateral for the lender, providing them with additional security in case the borrower defaults on the loan or fails to fulfill their financial obligations. This guaranty agreement is typically used in complex financial transactions where the borrower is acquiring or refinancing a commercial property, such as an office building, shopping center, or industrial facility. The presence of multiple tenants, complex lease agreements, and significant financial investments necessitate a guaranty agreement that covers various aspects of the transaction. Key elements of the Cuyahoga Ohio Complex Guaranty Agreement include: 1. Identification of Parties: The agreement identifies the borrower, lender, and any other relevant parties involved in the transaction, such as guarantors or co-signers. 2. Description of the Loan: This section outlines the specifics of the loan, including the loan amount, interest rate, repayment terms, and any other relevant details. 3. Scope of Guaranty: The agreement clearly defines the scope of the guarantor's obligation, stating that they will be responsible for the borrower's debt if they default on the loan. 4. Personal Guarantee: The guarantor agrees to be personally liable for the debt, which means that their personal assets can be used to repay the loan if the borrower is unable to do so. 5. Loan Security: The agreement may also include provisions related to the collateral provided by the borrower to secure the loan, such as the property or other valuable assets. Different types of Cuyahoga Ohio Complex Guaranty Agreements to Lender may include: 1. Full Recourse Guaranty: In this type of guaranty, the guarantor is responsible for repaying the full amount of the loan if the borrower defaults. The lender can pursue the guarantor's personal assets to recover the outstanding debt. 2. Limited Recourse Guaranty: In a limited recourse guaranty, the guarantor's liability is limited to a specific portion of the loan amount or certain predetermined circumstances. This type of guaranty provides some protection to the guarantor, as they may only be responsible for a portion of the debt. 3. Completion Guaranty: This type of guaranty is often used in construction projects where the borrower guarantees that the project will be completed as per the agreed-upon plans and specifications. If the borrower fails to meet these obligations, the guarantor may be required to fund the completion of the project. In conclusion, the Cuyahoga Ohio Complex Guaranty Agreement to Lender is a legally binding contract that protects the interests of the lender in complex financial transactions within Cuyahoga County, Ohio. The agreement outlines the obligations of the guarantor and provides additional security to the lender in case of default. Different types of guaranty agreements, such as full recourse, limited recourse, or completion guaranties, can be tailored to meet the specific needs of the parties involved in the transaction.

Cuyahoga Ohio Complex Guaranty Agreement to Lender

Description

How to fill out Cuyahoga Ohio Complex Guaranty Agreement To Lender?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life situation, locating a Cuyahoga Complex Guaranty Agreement to Lender meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Cuyahoga Complex Guaranty Agreement to Lender, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Cuyahoga Complex Guaranty Agreement to Lender:

- Examine the content of the page you’re on.

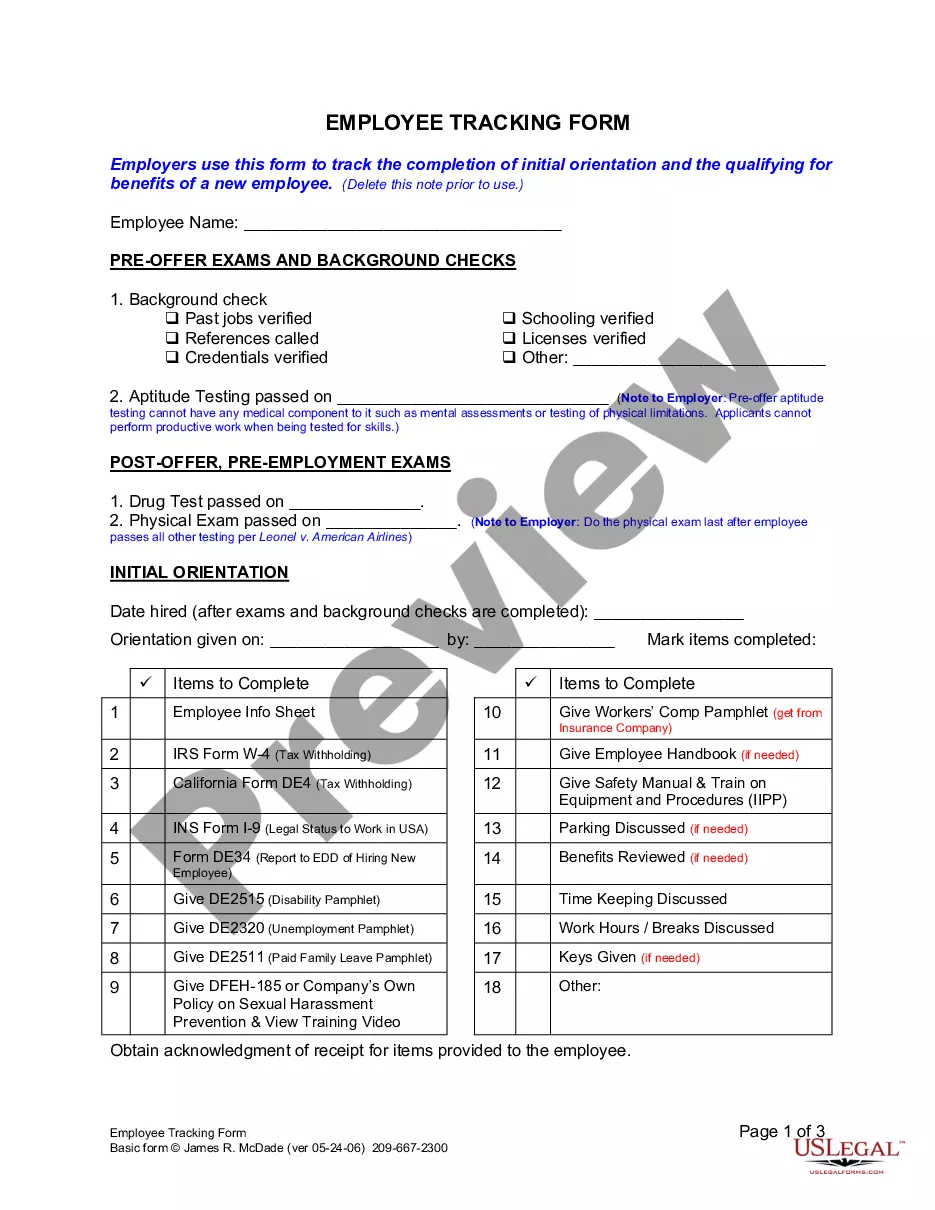

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cuyahoga Complex Guaranty Agreement to Lender.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

The security portion of the agreement determines an asset or assets that will be offered up as collateral to the lender to secure the loan. Guaranty and security agreements are used to offer additional incentives and protection to lenders for a loan.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property. Once all loan repayments have been made, the lien is removed. However, the buyer doesn't own the property till all loan payments have been made.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A person who acts as a guarantor under a GUARANTEE. GUARANTY, contracts. A promise made upon a good consideration, to answer for the payment of some debt, or the performance of some duty, in case of the failure of another person, who is, in the first instance, liable to such payment or performance.

Each Guarantor and the Borrower hereby agrees that all of its obligations and liabilities under the Credit Agreement and each other Loan Document to which it is a party remain in full force and effect on a continuous basis after giving effect to this Amendment.

Guaranty and Security Agreement means that certain Amended and Restated Guaranty and Security Agreement, dated as of the Closing Date, made by the Borrower and the Guarantors in favor of the Administrative Agent, for the benefit of the Secured Parties.