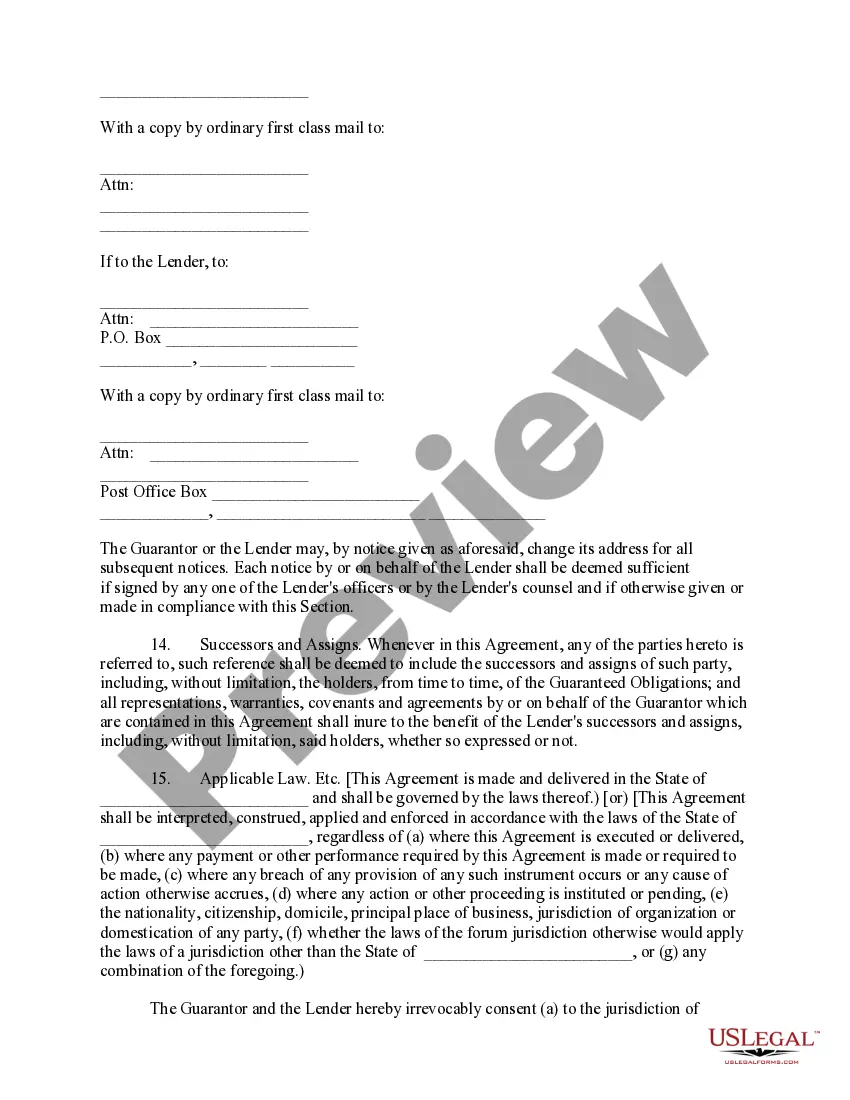

A Philadelphia Pennsylvania Complex Guaranty Agreement to Lender is a legal contract that establishes a binding relationship between a borrower, a lender, and a guarantor in a financial transaction involving complex terms and conditions. This agreement ensures the lender's protection by adding a layer of security provided by the guarantor in case the borrower fails to fulfill their loan obligations. In these complex agreements, various types may exist based on the specific terms and conditions outlined therein. Some common types of Philadelphia Pennsylvania Complex Guaranty Agreements to Lender include: 1. Full Guaranty Agreement: This type of agreement involves the guarantor taking full responsibility for the borrower's obligations and repayment of the loan. In the event of borrower default, the lender can pursue the guarantor for the full amount owed. 2. Limited Guaranty Agreement: In contrast to a full guaranty, a limited guaranty agreement restricts the guarantor's liability to a specific portion or duration of the loan. This type of agreement protects the guarantor from being held accountable for the entirety of the loan if the borrower defaults. 3. Continuing Guaranty Agreement: Under this agreement, the guarantor's obligations extend throughout the duration of the loan, including any renewals, extensions, or modifications made to the original terms. It provides the lender with an additional layer of security even if there are changes to the initial loan structure. 4. Conditional Guaranty Agreement: This type of agreement requires the lender to fulfill certain conditions, such as notifying the guarantor about the borrower's default before pursuing them for repayment. It ensures that the lender follows a specific protocol when attempting to hold the guarantor liable for any outstanding debt. Philadelphia, Pennsylvania, being a major commercial and financial hub, often witnesses complex financial transactions with significant sums involved. As a result, a Philadelphia Pennsylvania Complex Guaranty Agreement to Lender becomes crucial in safeguarding the lender's interests, enhancing confidence, and minimizing risks associated with lending practices. These agreements typically outline the roles and responsibilities of the borrower, lender, and guarantor, including specifics regarding loan repayment, interest rates, loan maturity dates, and any additional fees or penalties. By creating a legal obligation for the guarantor to step in and fulfill the borrower's obligations upon default, these agreements provide added assurance to the lender and can facilitate smoother financial transactions. In conclusion, a Philadelphia Pennsylvania Complex Guaranty Agreement to Lender is a legally binding document that establishes the roles and responsibilities of a borrower, lender, and guarantor in complex financial transactions. The different types of such agreements, including full guaranty, limited guaranty, continuing guaranty, and conditional guaranty, cater to specific needs and risk tolerances of the parties involved. These agreements play an essential role in ensuring the lender's protection and fostering trust in financial dealings within Philadelphia, Pennsylvania.

Philadelphia Pennsylvania Complex Guaranty Agreement to Lender

Description

How to fill out Philadelphia Pennsylvania Complex Guaranty Agreement To Lender?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Philadelphia Complex Guaranty Agreement to Lender, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the recent version of the Philadelphia Complex Guaranty Agreement to Lender, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Philadelphia Complex Guaranty Agreement to Lender:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Philadelphia Complex Guaranty Agreement to Lender and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!