Collin Texas General Partnership for Business is a legally recognized business structure where two or more individuals come together to operate a business for profit. This type of partnership is governed by the laws and regulations of the state of Texas, specifically in Collin County. A general partnership is one of the most common business structures, offering certain advantages and disadvantages to its members. The partners involved in a general partnership share equal rights and responsibilities, contributing capital, expertise, and labor to the business. This business structure allows partners to combine resources and skills, leading to shared decision-making and the potential for increased profitability. In Collin County, Texas, the general partnership for business offers various advantages. Firstly, partners can pool financial resources to establish and grow their enterprises. With more funds available, they can invest in equipment, technology, and marketing initiatives to enhance their competitiveness in the local market. Moreover, general partnerships provide flexibility in terms of management structure, allowing partners to tailor operational decisions and strategies as per their specific needs. There are several types of general partnerships available for businesses in Collin, Texas. These can include: 1. Standard General Partnership: This is the most basic form of a partnership where all partners have equal rights and share profits, losses, and liabilities equally. 2. Limited Partnership (LP): In an LP, there are two types of partners — general partners and limited partners. General partners have unlimited liability and actively participate in managing the business, while limited partners have limited liability but generally do not participate in day-to-day operations. 3. Limited Liability Partnership (LLP): An LLP is a type of partnership that combines features of both general partnerships and limited liability companies (LCS). It provides partners with limited personal liability for certain business debts while maintaining the flexibility and tax benefits of a partnership. 4. Professional Partnership: This type of partnership is specifically designed for professionals such as lawyers, doctors, or accountants who wish to operate their practices collectively. It allows professionals to share resources, operate as a partnership, and limit personal liability. In summary, Collin Texas General Partnership for Business is a popular business structure where partners come together to establish and operate a business in Collin County, Texas. It offers shared decision-making, shared profits, and shared liabilities among partners. Different types of general partnerships, including standard partnerships, limited partnerships, limited liability partnerships, and professional partnerships, provide flexibility and varying levels of personal liability protection for the partners involved.

Collin Texas General Partnership for Business

Description

How to fill out Collin Texas General Partnership For Business?

Preparing documents for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Collin General Partnership for Business without expert help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Collin General Partnership for Business on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Collin General Partnership for Business:

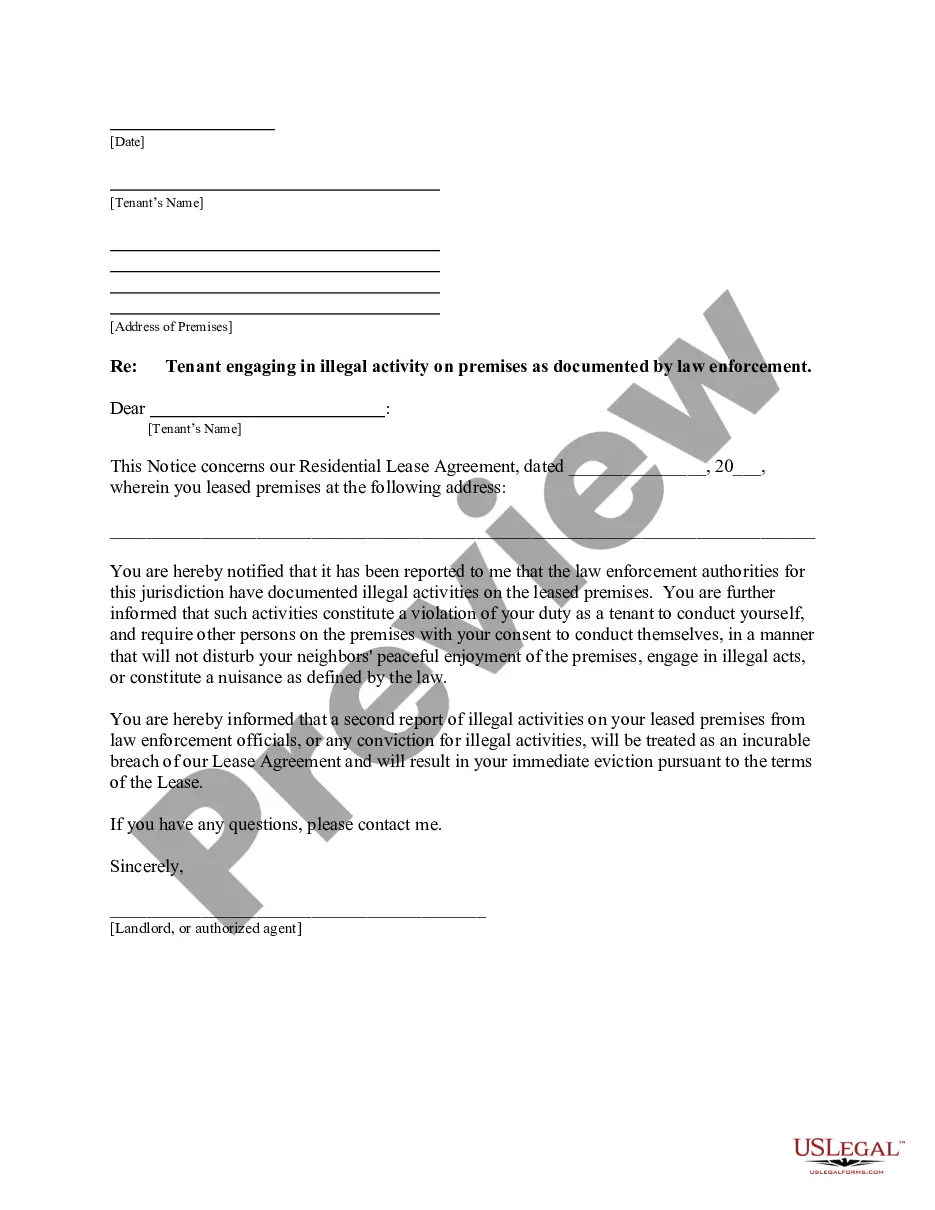

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a few clicks!