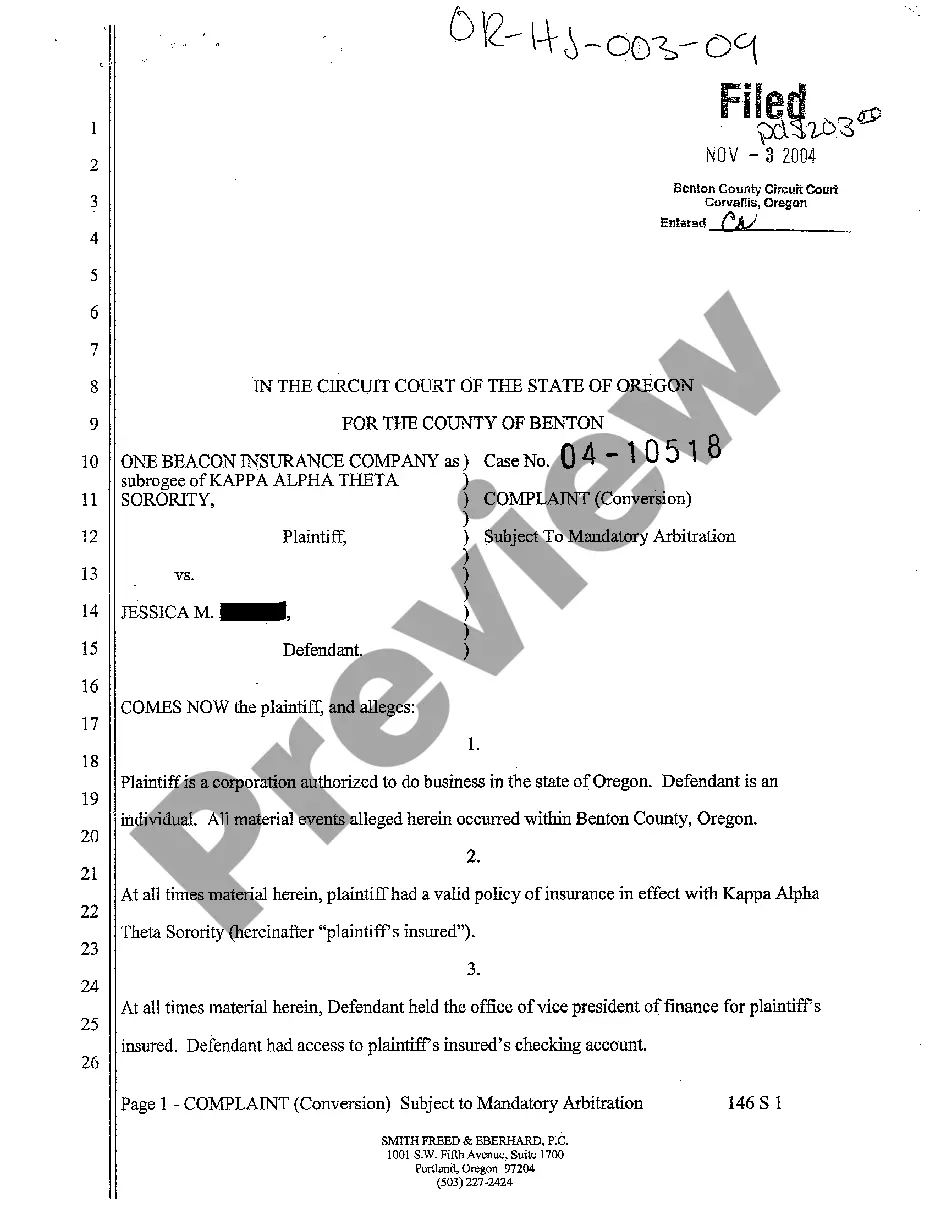

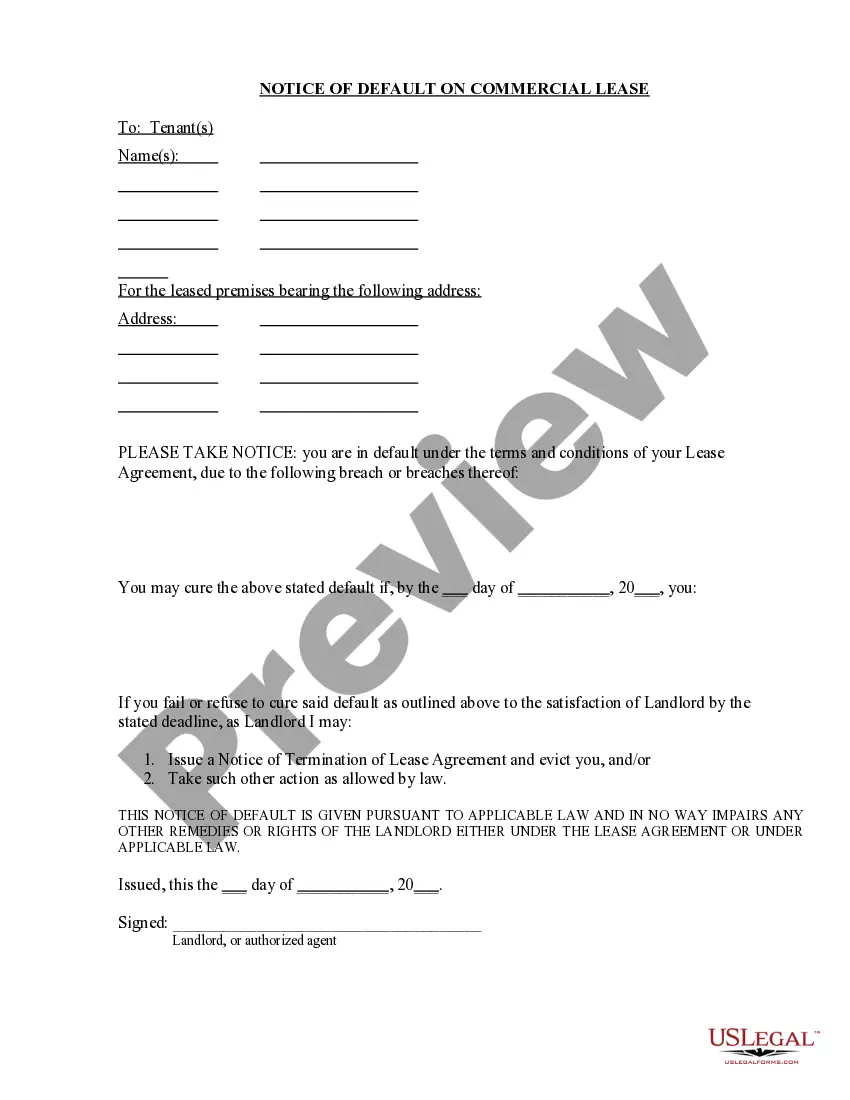

Nassau New York Form Letters — Notice of Default: A Comprehensive Overview In Nassau County, New York, when individuals or businesses fail to fulfill their financial obligations, creditors may issue a Notice of Default to notify them of their account's delinquency. These formal documents serve as a crucial step in the debt collection process and are designed to inform the debtor of their current standing and the potential consequences of non-payment. Nassau New York Form Letters — Notice of Default are customizable templates that creditors utilize to streamline and standardize communication with debtors. To address the diverse situations that may arise, there are several types of Nassau New York Form Letters — Notice of Default. Familiarizing oneself with these different variations can provide a better understanding of the nuances involved in debt collection. Some crucial types include: 1. Notice of Default on Loan: This type of form letter is often sent by lenders or financial institutions to borrowers who have defaulted on their loans. It outlines the specific terms and conditions violated, the amount owed, and the actions required to rectify the default. 2. Notice of Default on Mortgage: When homeowners encounter significant difficulties in meeting their mortgage obligations, this form letter is sent by the lender to inform them of the default. The document clarifies the outstanding payments, any applicable fees, and potential consequences leading to foreclosure if necessary steps are not taken to settle the debt. 3. Notice of Default for Non-Payment of Rent: Landlords often utilize this form letter when tenants fail to pay their rent as agreed. The notice defines the unpaid amount, provides a timeframe for rectification, and may include details regarding potential eviction if non-payment persists. 4. Notice of Default on Credit Card Account: Credit card companies employ this form letter to notify cardholders of non-payment or default on their accounts. It typically mentions the outstanding balance, penalties, and potential repercussions, such as increased interest rates or credit score damage. 5. Notice of Default for Unpaid Invoices: Businesses and individuals may send this notice to their clients or customers who have outstanding invoices. It states the amount owed, the terms of payment, and the consequences of continued non-payment, such as the initiation of legal action. Nassau New York Form Letters — Notice of Default are essential in maintaining transparency and ensuring fair communication between creditors and debtors. These letters are designed to protect the rights and interests of all parties involved while providing an opportunity for resolution. As each situation can be unique, it is crucial to consult with legal professionals to ensure compliance with local laws and regulations when sending these notices.

Nassau New York Form Letters - Notice of Default

Description

How to fill out Nassau New York Form Letters - Notice Of Default?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Nassau Form Letters - Notice of Default, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the latest version of the Nassau Form Letters - Notice of Default, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Nassau Form Letters - Notice of Default:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Nassau Form Letters - Notice of Default and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!