The King Washington Stock Purchase Letter of Intent is a legally binding document that outlines the terms and conditions of a stock purchase agreement between parties involved in a specific transaction. This agreement serves as a preliminary step towards the final acquisition or sale of stocks, establishing the intentions of both the buyer and the seller. Key terms and keywords related to the King Washington Stock Purchase — Letter of Intent include: 1. Stock purchase: This refers to the act of buying or selling stocks or shares of a company, typically involving a specific quantity and price. 2. Letter of Intent (LOI): A document expressing the intention of parties to proceed with a specific transaction, which establishes the framework for negotiations and due diligence. 3. Acquisition: The act of one company purchasing another company, often involving the transfer of stocks or shares as a form of payment. 4. Preliminary agreement: The LOI serves as an initial agreement before the final acquisition or sale agreement is reached, outlining the primary terms and conditions for the transaction. 5. Legal document: The LOI is a legally binding document, offering protection and assurance to both the buyer and the seller. 6. Terms and conditions: The LOI details the conditions under which the stock purchase will take place, including price, quantity, payment terms, and any contingencies. 7. Due diligence: The process of conducting thorough investigations and evaluations of a company's financial, legal, and operational aspects before completing the stock purchase. 8. Binding agreement: A letter of Intent may be binding, indicating that both parties are committed to proceeding with the transaction and will be held accountable. 9. Exclusive negotiating rights: In some cases, the LOI may grant exclusive rights to the buyer for a specific period, allowing them to negotiate with the seller without interference from other potential buyers. 10. Multiple types of LOI: Depending on the specifics of the transaction, there can be various types of LOIs, such as those focused on asset purchases, stock acquisitions, mergers, or joint ventures. In summary, a King Washington Stock Purchase Letter of Intent is a significant step in the process of acquiring or selling stocks. It establishes the intentions, terms, and conditions for the transaction, guiding the subsequent negotiations and due diligence.

King Washington Stock Purchase - Letter of Intent

Description

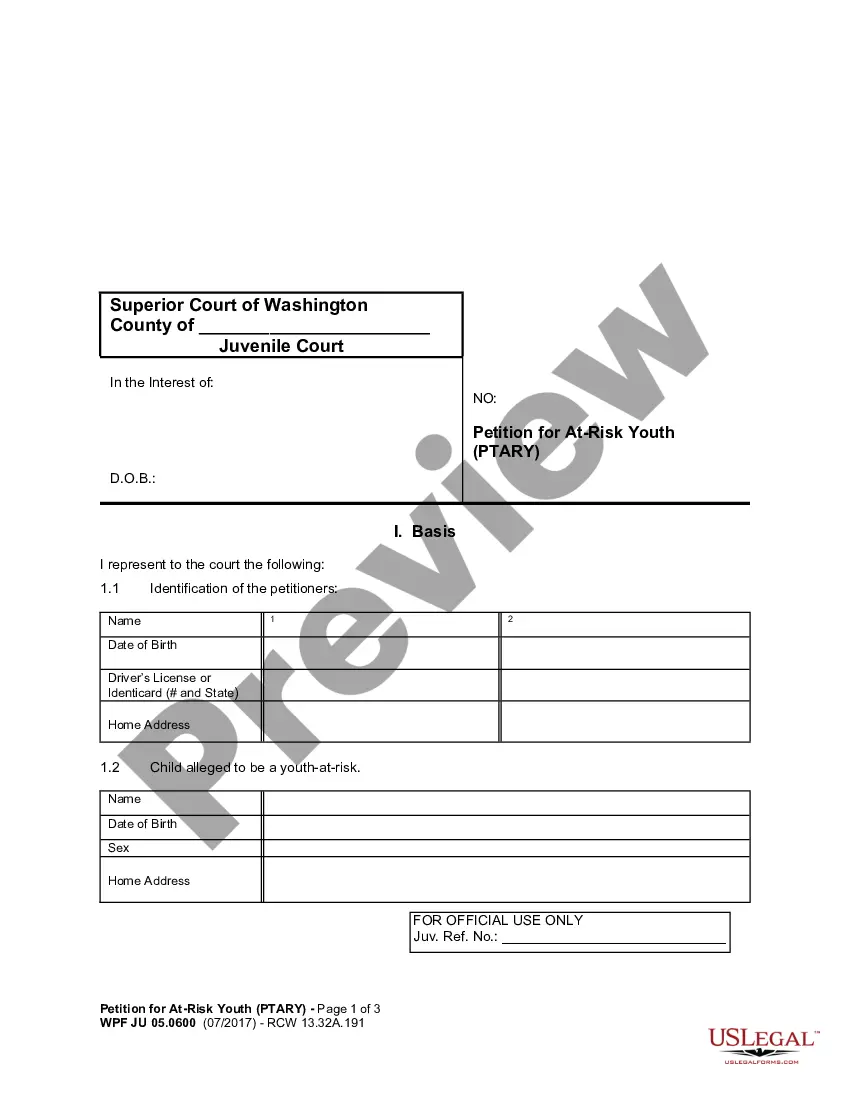

How to fill out King Washington Stock Purchase - Letter Of Intent?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the King Stock Purchase - Letter of Intent, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the King Stock Purchase - Letter of Intent from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the King Stock Purchase - Letter of Intent:

- Analyze the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Sample Letter of Intent to Purchase Dear Sir/Madam, We take the opportunity to declare our intention to purchase some goods from your company. Our company is duly organized and exists under the laws of the State of Texas, based on its Articles of Incorporation dated April 1, 2021.

A letter of intent is generally not binding since it's basically a description of the deal process. It is, in effect, an agreement to agree. Thus, either party can cancel the letter at any time.

An LOI stands for Letter of Intent. In commercial real estate, a Letter of Intent is a preliminary agreement that is negotiated between a tenant and landlord or buyer and seller. The LOI or Letter of Intent states the primary economics and deal points with proposed terms.

Letter of Intent for Business An intent to purchase business agreement isn't legally binding and is simply a notice to begin negotiations to purchase a business. It is a way to put into writing the tentative agreement that was most likely made verbally between the two parties.

Components of a Letter of Intent Introduction. The introduction of an LOI will include a statement of the purpose of the document.Identification of Parties.Transaction and Timing.Contingencies.Due Diligence.Covenants and Other Binding Agreements.

3. The letter of intent should include both a purchase price and an explanation of the assumptions that the purchase price is based upon. During the due diligence process, it may turn out that many of the early assumptions used in calculating the purchase price will turn out not to be true.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Once the LOI is signed, the next steps are to negotiate the purchase agreement and perform due diligence. These are separate processes, but they usually occur in parallel and take about 90 days to complete.

The purchase agreement usually is preceded in the process by a letter of intent (referred to in this article as the LOI). While certain terms in the LOI are legally binding, the LOI is not intended to bind the parties to do the sale itself. The LOI instead expresses the parties' intent to pursue the sale.

How to write a letter of intent for business Write the introduction.Describe the transaction and timeframes.List contingencies.Go through due diligence.Include covenants and other binding agreements.State that the agreement is nonbinding.Include a closing date.