Santa Clara, California Model Stock Purchase and Sales Agreement refers to a legally binding document used in Santa Clara County, California, that outlines the terms and conditions of buying and selling stock in a company. This agreement is designed to protect the interests of both the buyer and the seller and ensure a smooth transaction. Keywords: Santa Clara, California, model stock purchase and sales agreement, legally binding, terms and conditions, buying and selling stock, company, protect interests, smooth transaction. There are various types of Santa Clara, California Model Stock Purchase and Sales Agreements, each tailored to specific situations and requirements. Some common types include: 1. Standard Model Stock Purchase and Sales Agreement: This type of agreement is commonly used for general stock transactions, where a buyer purchases shares from a seller. It typically includes clauses related to the purchase price, payment terms, representations and warranties, indemnification, conditions precedent, and dispute resolution. 2. Asset Purchase and Sales Agreement: This variation of the stock purchase agreement is used when the buyer wants to acquire specific assets of a company instead of purchasing shares. It may include provisions for the transfer of assets, liabilities, intellectual property rights, and any relevant ongoing contracts. 3. Shareholder Agreement: This type of agreement is used when multiple shareholders own shares in a company and want to regulate their relationship and obligations. It may cover topics such as voting rights, shareholders' roles and responsibilities, dividend distribution, dispute resolution, and governance. 4. Stock Option Purchase Agreement: This agreement is specific to stock options, which give the holder the right to purchase shares at a predetermined price. It outlines the terms and conditions of exercising the stock options, including exercise period, strike price, vesting schedule, and any applicable tax implications. 5. Merger or Acquisition Agreement: This agreement is used when one company acquires another or when two companies merge to create a new entity. It covers the terms of the transaction, including purchase price, payment details, due diligence, representations and warranties, and post-closing obligations. In conclusion, Santa Clara, California Model Stock Purchase and Sales Agreement is a crucial legal document that facilitates the buying and selling of stock in Santa Clara County. Different types of agreements exist to cater to specific circumstances and requirements, ensuring a fair and transparent transaction process.

Santa Clara California Model Stock Purchase and Sales Agreement

Description

How to fill out Santa Clara California Model Stock Purchase And Sales Agreement?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life situation, locating a Santa Clara Model Stock Purchase and Sales Agreement meeting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. In addition to the Santa Clara Model Stock Purchase and Sales Agreement, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Santa Clara Model Stock Purchase and Sales Agreement:

- Examine the content of the page you’re on.

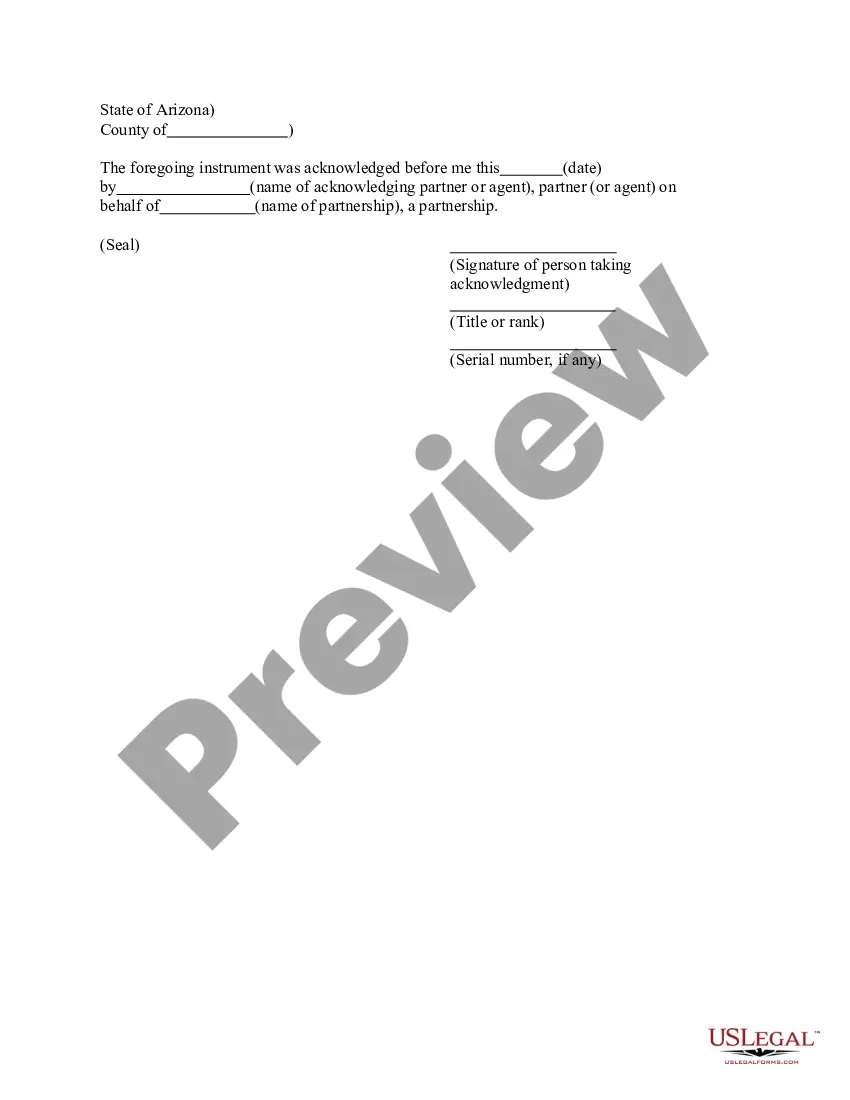

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Santa Clara Model Stock Purchase and Sales Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Every residential purchase agreement in California needs to include: Seller and buyer personal info. Address of the property in question. Condition of the property. Details of the offer. Price of the property. Security deposit information. Date of signing the contract. Signatures of both parties.

A Sale and Purchase Agreement (SPA) is a legally binding contract outlining the agreed upon conditions of the buyer and seller of a property (e.g., a corporation). It is the main legal document in any sale process.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

A California residential purchase and sale agreement is a contract between a buyer that agrees to purchase real estate from a seller for an agreed-upon sales price. All terms and contingencies related to the sale must be included in the same agreement.

5 easy steps to file share purchase agreement Review of the share purchase agreement by both the parties. Signature by both the parties.Copies should be made for a purchaser, seller and the company. Giving the certificate after the payment. It can register if you meet certain criteria.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

How To Fill Out The New 2021 California Residential PurchaseYouTube Start of suggested clip End of suggested clip Address city county zip assessor's parcel number which can be found on the mls listing on the tax.MoreAddress city county zip assessor's parcel number which can be found on the mls listing on the tax. Bill on a title company's property profile or realist property profile.

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.

A purchase and sale agreement, also known as a purchase and sale contract, P&S agreement, or PSA, is a legally-binding document that establishes the terms and conditions related to a real estate transaction. It defines what requirements the buyer must meet as well as purchase price, limitations, and contingencies.