Dallas Commercial Lease Agreement for Office Space is a legally binding contract between a landlord and a tenant, outlining the terms and conditions of renting an office space in Dallas, Texas. This agreement is essential for both parties to protect their rights and clearly define their responsibilities. Keywords: Dallas, Texas, commercial lease agreement, office space In Dallas, there are different types of commercial lease agreements for office space, including: 1. Full-Service Lease Agreement: This type of lease agreement is also known as a gross lease, where the tenant pays a fixed monthly rent, and the landlord covers all operating expenses, including utilities, maintenance, insurance, and property taxes. 2. Modified Gross Lease Agreement: In this type of lease, the tenant pays a base rent, while the operating expenses are split between the landlord and tenant. The specific terms regarding the allocation of operating expenses should be clearly outlined in the agreement. 3. Triple Net Lease Agreement: A triple net lease, also called an NNN lease, is a lease where the tenant is responsible for paying the base rent along with all the operating expenses, including property taxes, insurance, and maintenance costs. 4. Percentage Lease Agreement: This lease agreement is often used for retail office spaces in Dallas. In this arrangement, the tenant pays a base rent plus a percentage of their gross sales. This type of lease is common in shopping centers and malls, where the success of the tenant's business directly impacts the rent payment. Within a Dallas Commercial Lease Agreement for Office Space, the following key elements are typically included: 1. Parties Involved: The lease agreement should clearly identify the landlord or property owner and the tenant. 2. Premises Description: A detailed description of the office space being leased, including the address, square footage, and any specified use restrictions. 3. Lease Term: The specific duration of the lease, including the start and end dates. This section may also include options for renewal or termination. 4. Rent and Payment Terms: Clearly outlining the base rent amount, payment due dates, any escalations, and acceptable payment methods. 5. Security Deposit: The amount of the security deposit required and the conditions under which it will be returned. 6. Maintenance and Repairs: Defining each party's responsibility for maintenance and repairs, including who will be responsible for specific expenses, such as HVAC or structural repairs. 7. Insurance and Indemnification: Outlining the insurance requirements for both parties and who is responsible for maintaining the coverage. Additionally, addressing liability for damages or injuries to third parties. 8. Termination and Default: Establishing the conditions under which either party can terminate the lease agreement and the consequences of default, such as eviction or legal action. 9. Modifications and Improvements: Addressing the procedures for making alterations or improvements to the leased space and who will be responsible for associated costs. 10. Dispute Resolution: Determining the method of resolving any disputes that may arise during the term of the lease, such as mediation or arbitration. It is important for both parties to thoroughly review and negotiate the terms of a Dallas Commercial Lease Agreement for Office Space before signing to ensure that all necessary provisions and protections are included.

Dallas Texas Commercial Lease Agreement for Office Space

Description

How to fill out Dallas Texas Commercial Lease Agreement For Office Space?

How much time does it typically take you to create a legal document? Because every state has its laws and regulations for every life scenario, locating a Dallas Commercial Lease Agreement for Office Space meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Aside from the Dallas Commercial Lease Agreement for Office Space, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Dallas Commercial Lease Agreement for Office Space:

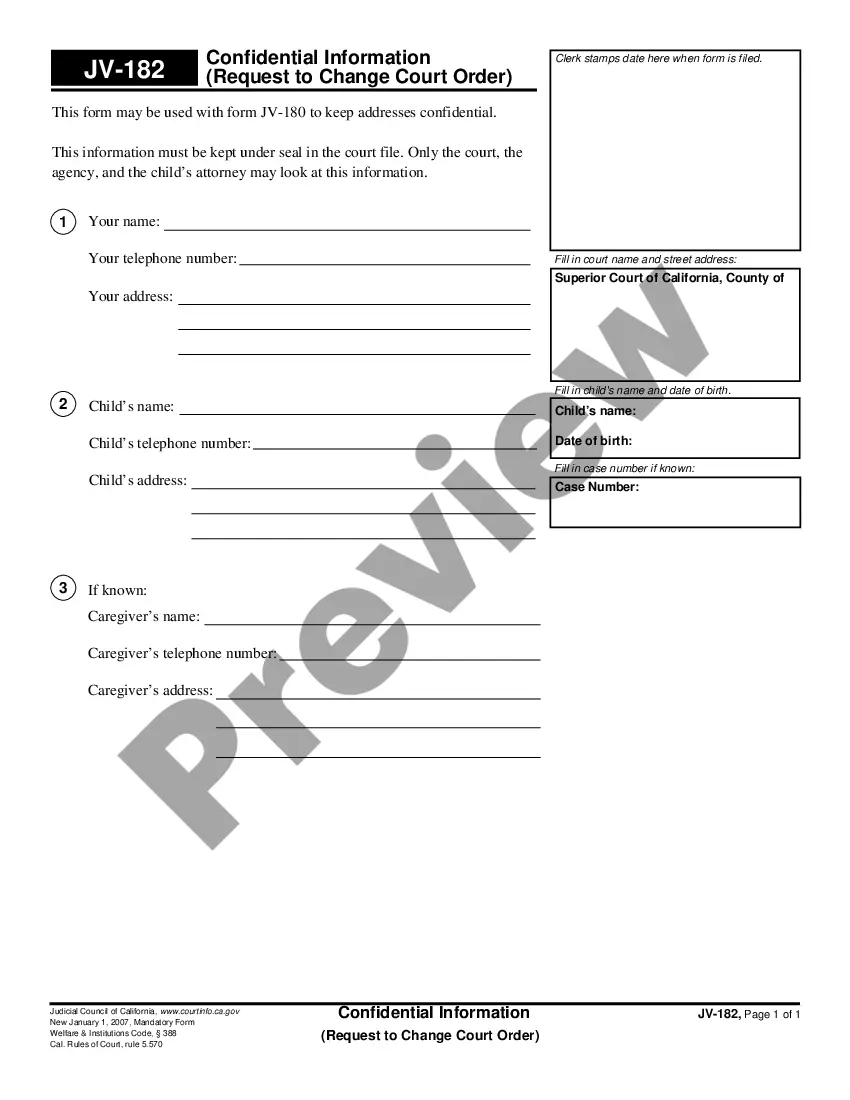

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Dallas Commercial Lease Agreement for Office Space.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!