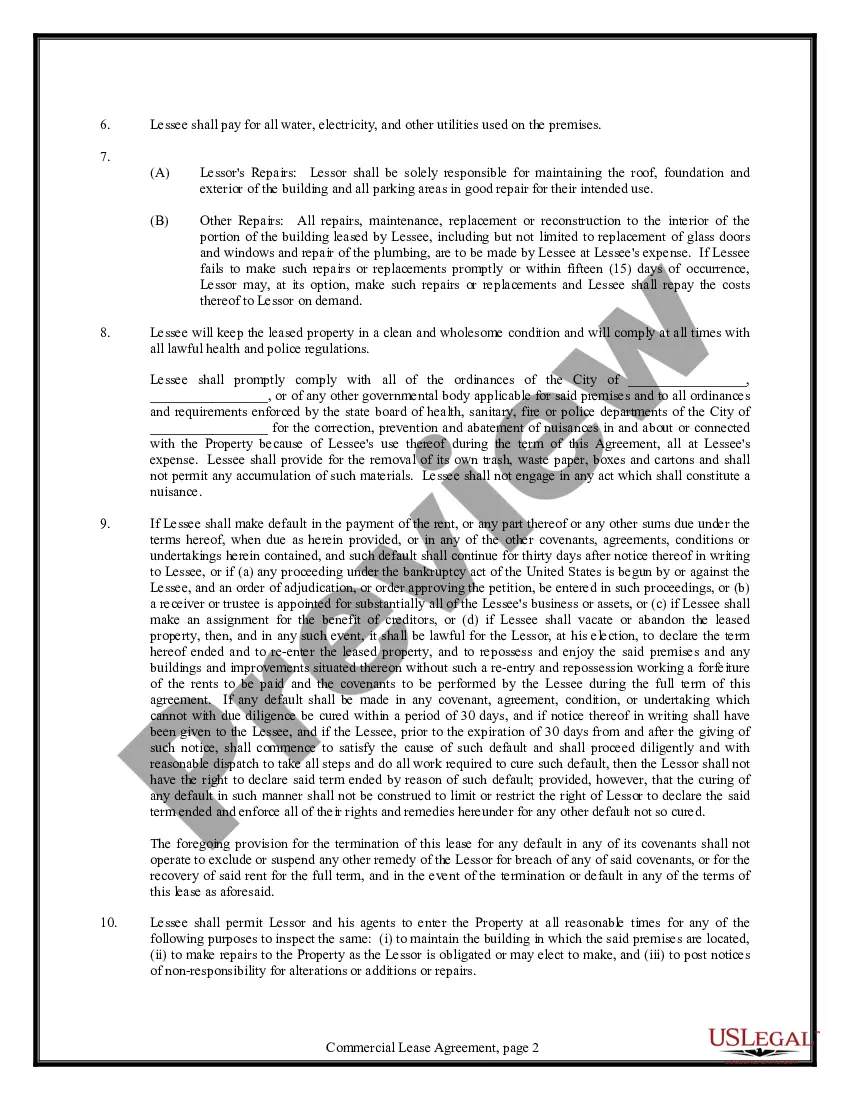

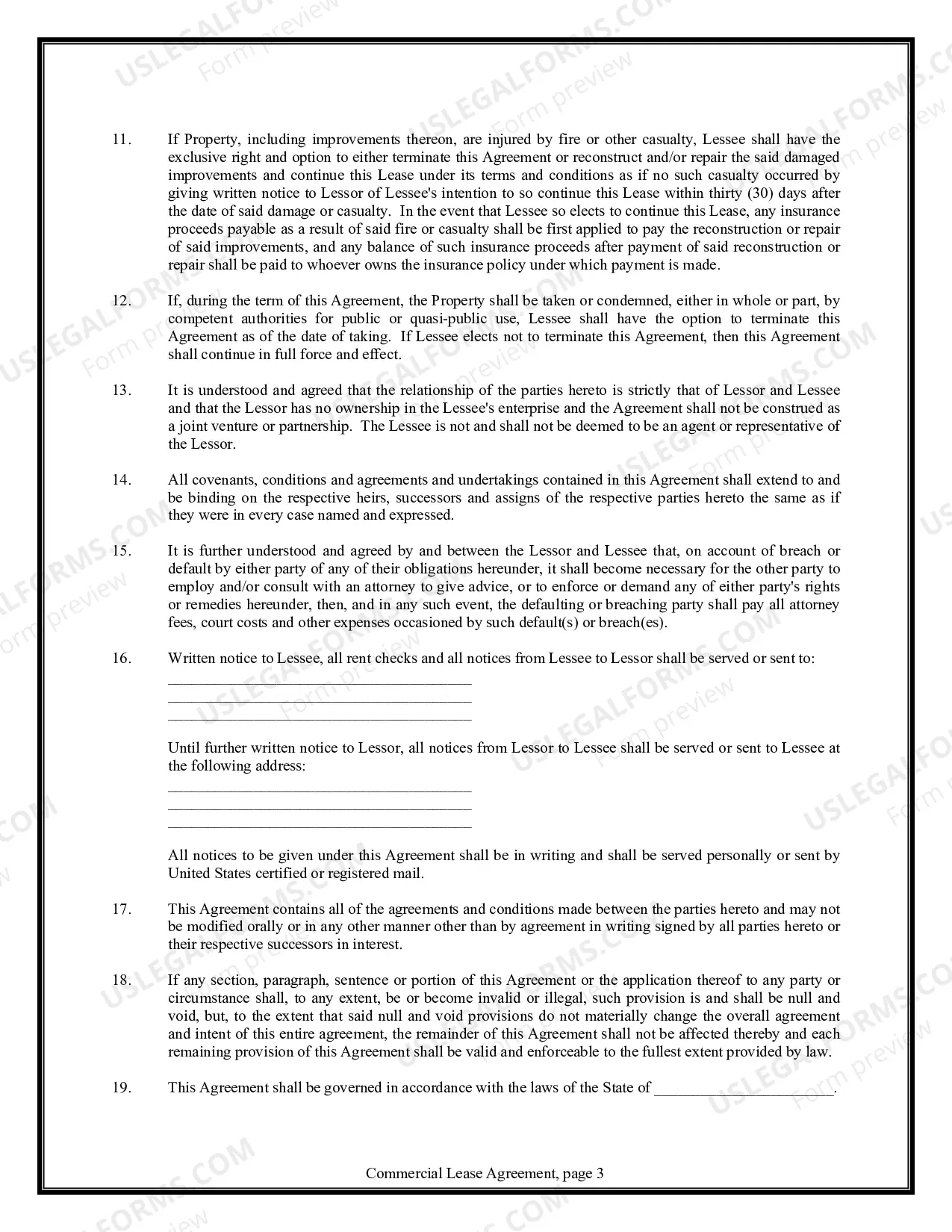

Allegheny Pennsylvania Commercial Lease Agreement for Restaurant is a legally binding contract between a property owner and a restaurant tenant in Allegheny County, Pennsylvania. This agreement outlines the terms and conditions that both parties must adhere to during the lease period. The primary purpose of this lease agreement is to specify the rental terms, obligations, and rights of both the landlord and the tenant regarding the use of the commercial space for restaurant operations in Allegheny Pennsylvania. Keywords: 1. Allegheny Pennsylvania: Refers to the specific county within the state of Pennsylvania where the lease agreement is binding. 2. Commercial Lease Agreement: A legal document that establishes the terms and conditions for renting a commercial property and outlines the rights and responsibilities of both the landlord and tenant. 3. Restaurant: A business establishment that prepares and serves food and beverages to customers. In this context, the agreement pertains specifically to leasing a property for restaurant operations. 4. Property Owner/Landlord: The individual or entity that owns the commercial space and grants the tenant the right to use it for restaurant purposes. 5. Tenant: The individual or business entity that will be leasing the commercial space from the landlord for operating a restaurant. 6. Rental Terms: The provisions that define the amount of rent to be paid, payment schedule, lease duration, and any additional costs or fees, as agreed upon by both parties. 7. Obligations: The responsibilities and duties that both the landlord and tenant must fulfill throughout the lease period, such as property maintenance, utility payments, compliance with health and safety regulations, etc. 8. Rights: The privileges and entitlements that the landlord and tenant possess, including access to the premises, renewal options, signage rights, and any exclusive use clauses. 9. Lease Period: The specified duration for which the lease agreement is valid, typically expressed in months or years. 10. Commercial Space: The physical premises being leased to the tenant, which includes the restaurant area, kitchen, storage facilities, restrooms, and any other specified areas related to restaurant operations. Different types of Allegheny Pennsylvania Commercial Lease Agreement for Restaurant may include: 1. Triple Net Lease: In this type of lease, the tenant is responsible for not only paying rent but also covering additional costs such as property taxes, insurance, and maintenance expenses. 2. Full-Service Lease: This lease type implies that the landlord is responsible for providing all services, including maintenance, utility payments, and property management, while the tenant pays a higher rent to cover these costs. 3. Percentage Lease: In this arrangement, the tenant pays a base rent plus a percentage of their restaurant's revenue, typically applied in addition to the fixed rent. 4. Gross Lease: A lease where the tenant pays a flat rent amount, and the landlord covers all expenses related to property taxes, insurance, and maintenance. 5. Build-to-Suit Lease: This type of lease involves the landlord constructing a customized commercial space according to the specific needs and requirements of the tenant. The tenant may have input into the design and layout of the restaurant space. 6. Short-term Lease: A lease agreement with a relatively short duration, typically less than one year, providing flexibility to tenants who might require temporary restaurant space or are planning to test a new concept before committing to a long-term lease. These are just a few examples of the different types of Allegheny Pennsylvania Commercial Lease Agreements available for restaurant operations, each with its own unique terms, conditions, and considerations.

Allegheny Pennsylvania Commercial Lease Agreement for Restaurant

Description

How to fill out Allegheny Pennsylvania Commercial Lease Agreement For Restaurant?

If you need to find a trustworthy legal document provider to get the Allegheny Commercial Lease Agreement for Restaurant, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to get and execute different documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Allegheny Commercial Lease Agreement for Restaurant, either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Allegheny Commercial Lease Agreement for Restaurant template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less expensive and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate agreement, or execute the Allegheny Commercial Lease Agreement for Restaurant - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

A commercial lease is a form of legally binding contract made between a business tenant - your company - and a landlord. The lease gives you the right to use the property for business or commercial activity for a set period of time. In return for this, you will pay money to the landlord.

Writing a California Commercial Lease Agreement Introduction: State the date of the lease and legal names of involved parties. Description of Premises: Indicate the type of commercial space, square footage and address of the premises. Use of Premises. Lease Term: State the start and end date of the lease.

The letter of intent should include the following six things: A Statement Declaring Your Interest in Leasing the Space.A Description of Your Company.An Outline of On-Site Employees, Equipment, and Machinery.Your Business Hours.An Overview of Your Current Space.Contact Details.

The Consumer Protection Act (CPA) does NOT apply to all lease agreements (or rental agreements). This is really important to know because the Consumer Protection Act has a big influence on the lease and changes the legal position between the landlord and tenant significantly.

Seeking advice from a commercial property solicitor is not required, but it is strongly recommended if you are looking to enter into a commercial lease. The solicitor will review the lease and ensure the tenant is protected and they are aware of all conditions in the lease.

No, a commercial lease does not need to be notarized in Pennsylvania to be a legally valid document; however, one or both parties may request to have the commercial lease notarized if they so desire. The information for this answer was found on our Pennsylvania Commercial Lease Agreement answers.

What are the important lease terms included in a commercial lease agreement? Duration of the lease.Base rent and monthly rent.Security deposit.Rent increases.Details of the commercial property.Signage for the leased commercial space.Usage of common areas and utility bills.Repairs and improvements to the property.

Commercial Lease Type Chart Type of Commercial LeaseTenant PaysFull Service/Gross LeaseRent + utilitiesNet LeaseRent, utilities + some building operating expensesTriple Net Lease (NNN)Rent, utilities + proportionate share of building operating expenses (e.g. maintenance fees, insurance, property taxes)5 more rows ?

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

A lease is a contract outlining the terms under which one party agrees to rent an assetin this case, propertyowned by another party. It guarantees the lessee, also known as the tenant, use of the property and guarantees the lessor (the property owner or landlord) regular payments for a specified period in exchange.