A Maricopa, Arizona Commercial Lease Agreement for Warehouse is a legal contract that outlines the terms and conditions under which a property owner (the landlord) agrees to lease a warehouse space to a tenant for commercial purposes. This agreement protects the rights and responsibilities of both parties and serves as a binding document for the duration of the lease. The Maricopa, Arizona Commercial Lease Agreement for Warehouse includes key details such as the names and addresses of the landlord and tenant, the lease term (start and end dates), the rental amount, and any provisions regarding rent increases over time. It also outlines the permitted use of the warehouse space and may specify any restrictions or limitations on the activities that can be conducted within the premises. Another critical element that this agreement covers is the maintenance and repair obligations. It specifies whether the landlord or tenant will be responsible for certain repairs, such as structural maintenance or HVAC system repairs. Additionally, it may outline the process for requesting and approving modifications or improvements to the warehouse space. Furthermore, the contract typically addresses insurance requirements, stating which party is responsible for obtaining and maintaining property and liability insurance coverage. It may also include provisions regarding subleasing or assignment of the lease, as well as the consequences for breach or default of the agreement. In Maricopa, Arizona, there may be different types of Commercial Lease Agreements for Warehouse, depending on specific circumstances and needs. Some common variations include: 1. Gross Lease: A lease where the tenant pays a fixed rental amount, and the landlord covers the operating expenses such as taxes, insurance, and maintenance. 2. Net Lease: This type of lease requires the tenant to pay a base rent plus a share of additional expenses, such as property taxes, insurance, and maintenance costs. 3. Triple Net Lease: In a triple net lease, the tenant is responsible for the base rent along with all expenses associated with the property, including taxes, insurance, and maintenance. 4. Modified Gross Lease: This lease type combines elements of gross and net leases, where both the landlord and tenant share some operating costs. It is crucial for both landlords and tenants in Maricopa, Arizona to carefully review and understand the terms of the Commercial Lease Agreement for Warehouse before signing to ensure their rights and obligations are fully protected within the boundaries of the law. Seeking legal counsel or assistance is advisable to navigate any complexities that may arise during the negotiation and drafting process.

Maricopa Arizona Commercial Lease Agreement for Warehouse

Description

How to fill out Maricopa Arizona Commercial Lease Agreement For Warehouse?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa Commercial Lease Agreement for Warehouse, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Consequently, if you need the latest version of the Maricopa Commercial Lease Agreement for Warehouse, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Commercial Lease Agreement for Warehouse:

- Glance through the page and verify there is a sample for your area.

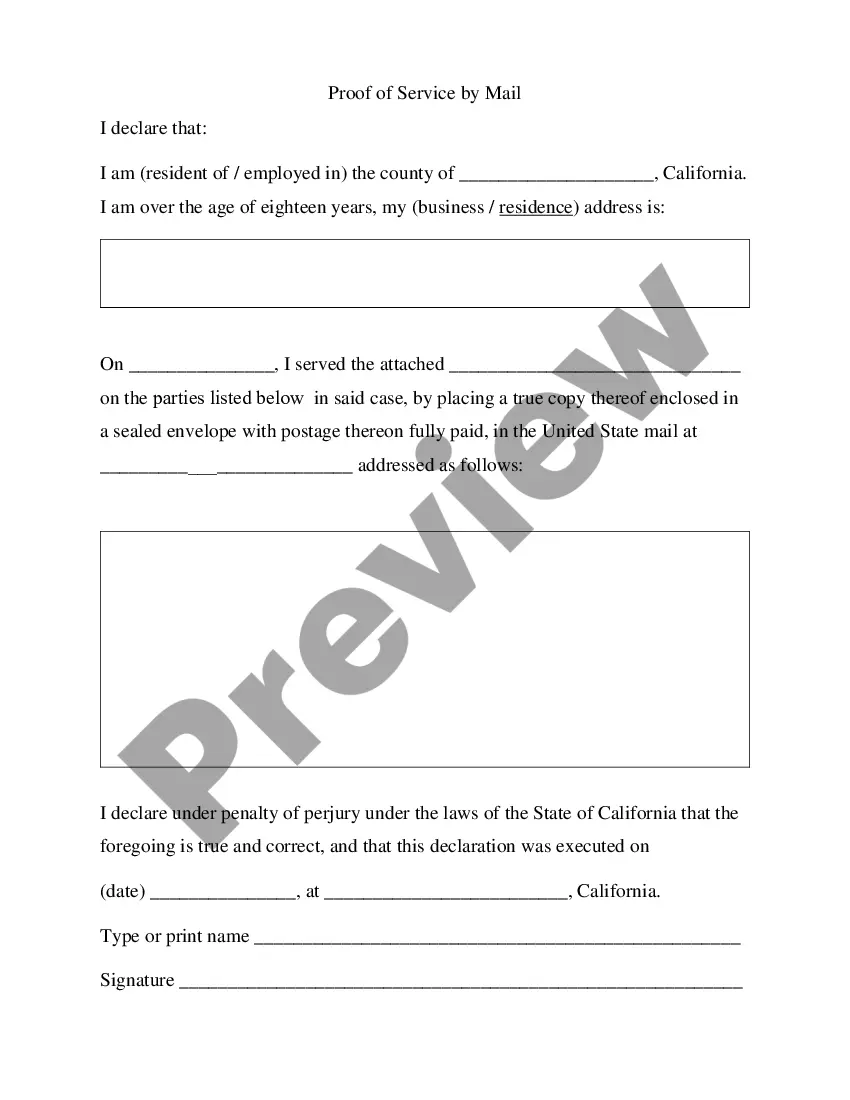

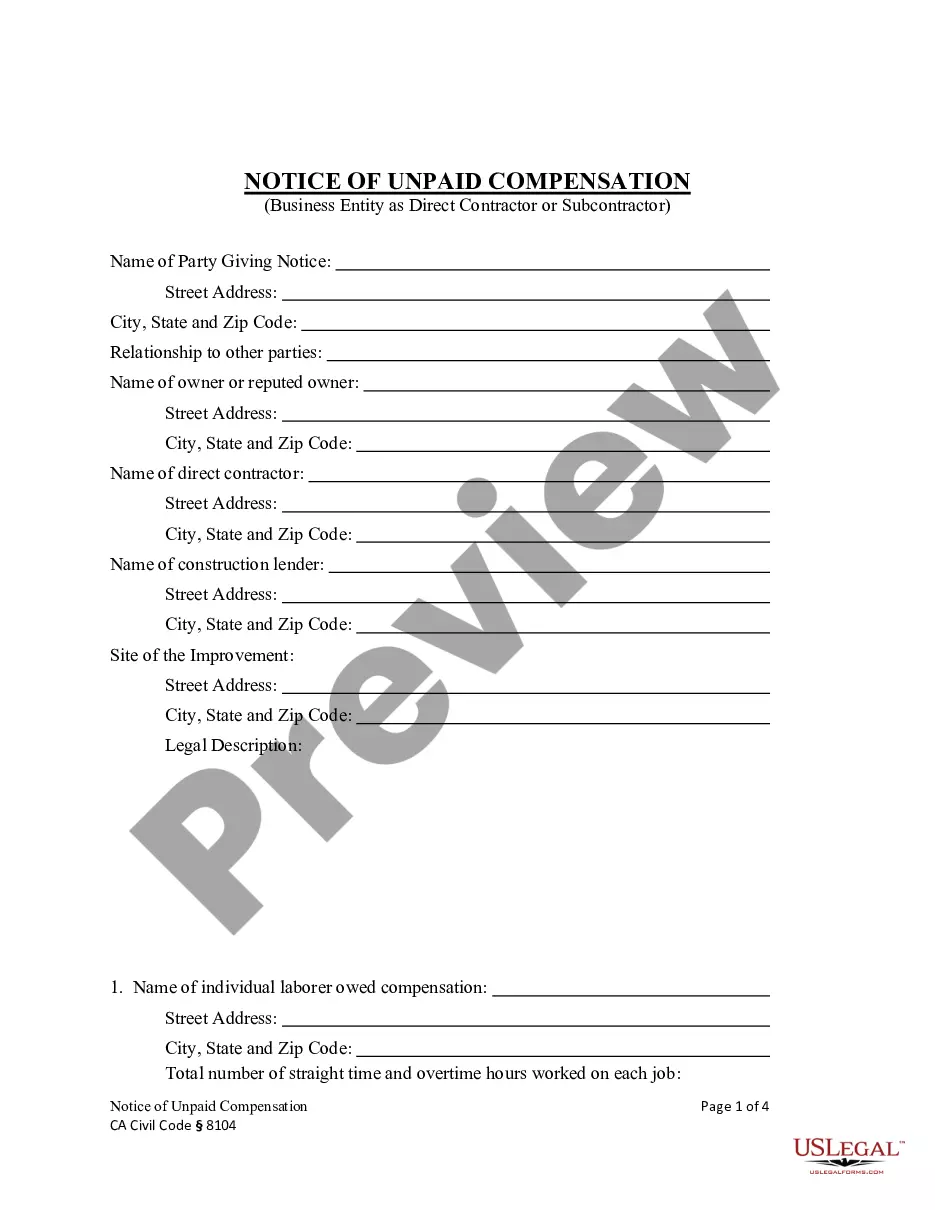

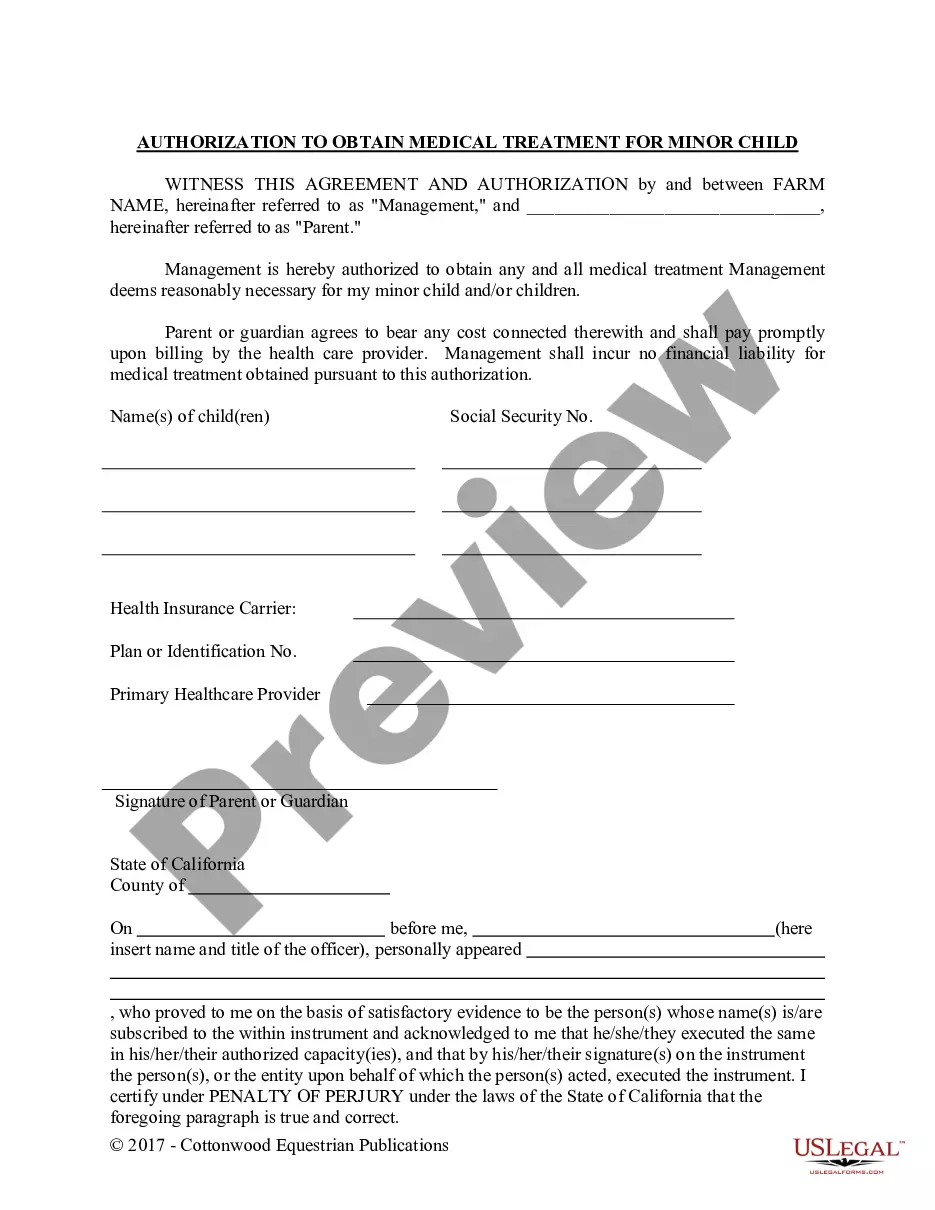

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Maricopa Commercial Lease Agreement for Warehouse and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!