Maricopa Arizona Commercial Lease Agreement for Tenant is a legally binding document that outlines the terms and conditions between a landlord and a tenant regarding the leasing of commercial property in Maricopa, Arizona. This agreement serves as a comprehensive guide to ensure a smooth and mutually beneficial relationship between the parties involved. The Maricopa Arizona Commercial Lease Agreement for Tenant encompasses various essential clauses that address key aspects of the leasing arrangement. It typically includes provisions for rent payment, lease duration, maintenance and repairs, utilities, insurance, permitted use of the property, security deposit, termination procedures, and dispute resolution mechanisms. There may be different types of Maricopa Arizona Commercial Lease Agreements for Tenants, each catering to specific commercial property requirements. Some common variations include: 1. Gross Lease Agreement: This type of agreement specifies a fixed rent amount, which includes most operating expenses such as property taxes, insurance, and maintenance fees. The landlord bears the responsibility of these expenses. 2. Net Lease Agreement: In this agreement, the tenant is responsible for paying a portion, or sometimes all, of the property expenses in addition to the base rent. These expenses typically include property taxes, insurance, maintenance, and utilities. There are different variations of net leases, including single-net leases, double-net leases, and triple-net leases, depending on the extent of expenses passed onto the tenant. 3. Percentage Lease Agreement: Commonly used for retail spaces, this type of lease requires the tenant to pay a base rent amount plus a percentage of their monthly sales. It is often used when the tenant's business revenue is directly dependent on location and foot traffic. 4. Sublease Agreement: This agreement allows a tenant who is already leasing commercial space to sublease a portion or the entire space to another party. The subtenant becomes responsible for adhering to the terms of the original lease agreement between the primary tenant and the landlord. It is crucial for both landlords and tenants in Maricopa, Arizona, to thoroughly understand the terms and conditions outlined in the Commercial Lease Agreement. Seeking legal advice is strongly recommended ensuring compliance with local regulations and to protect the rights and interests of both parties involved.

Maricopa Arizona Commercial Lease Agreement for Tenant

Description

How to fill out Maricopa Arizona Commercial Lease Agreement For Tenant?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Maricopa Commercial Lease Agreement for Tenant, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any tasks related to document execution straightforward.

Here's how to find and download Maricopa Commercial Lease Agreement for Tenant.

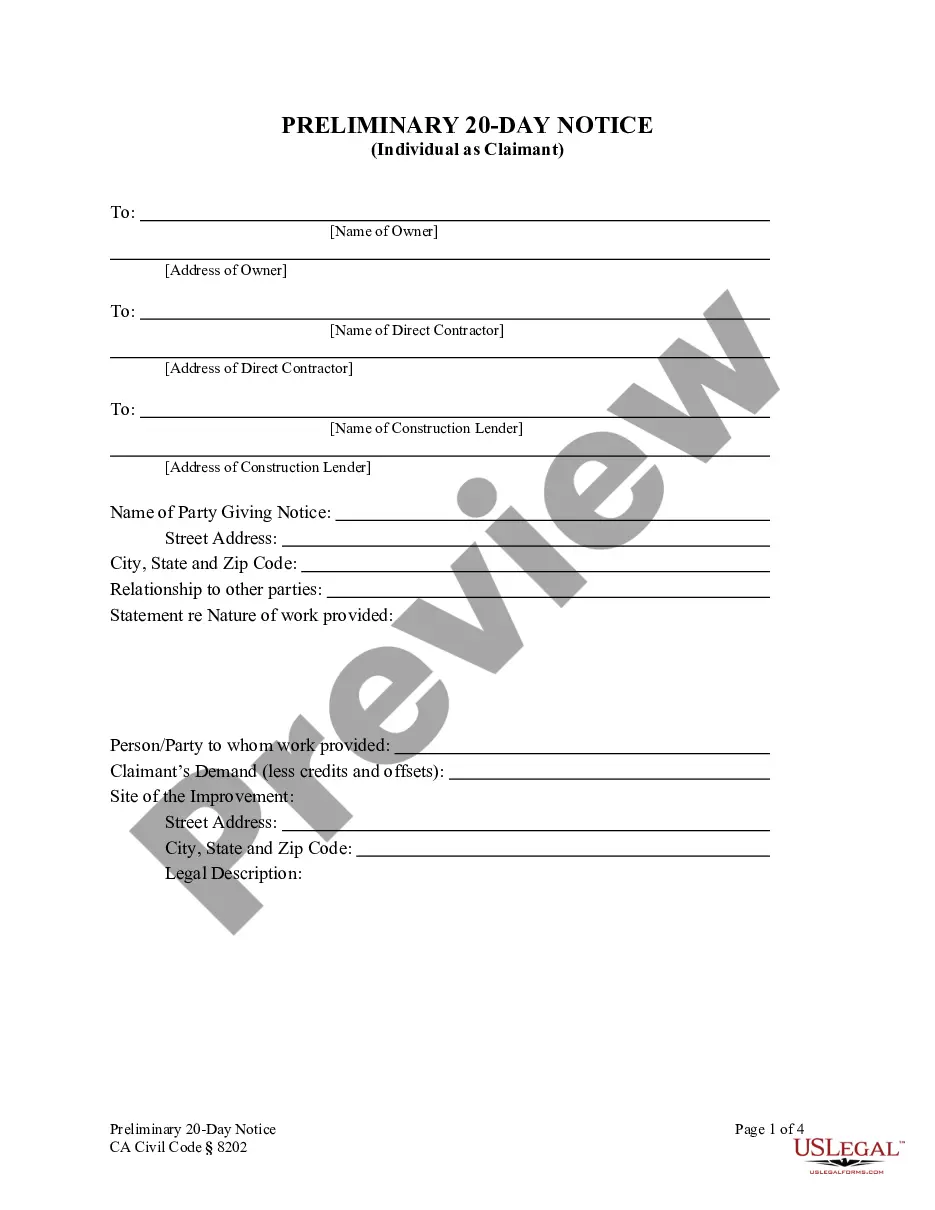

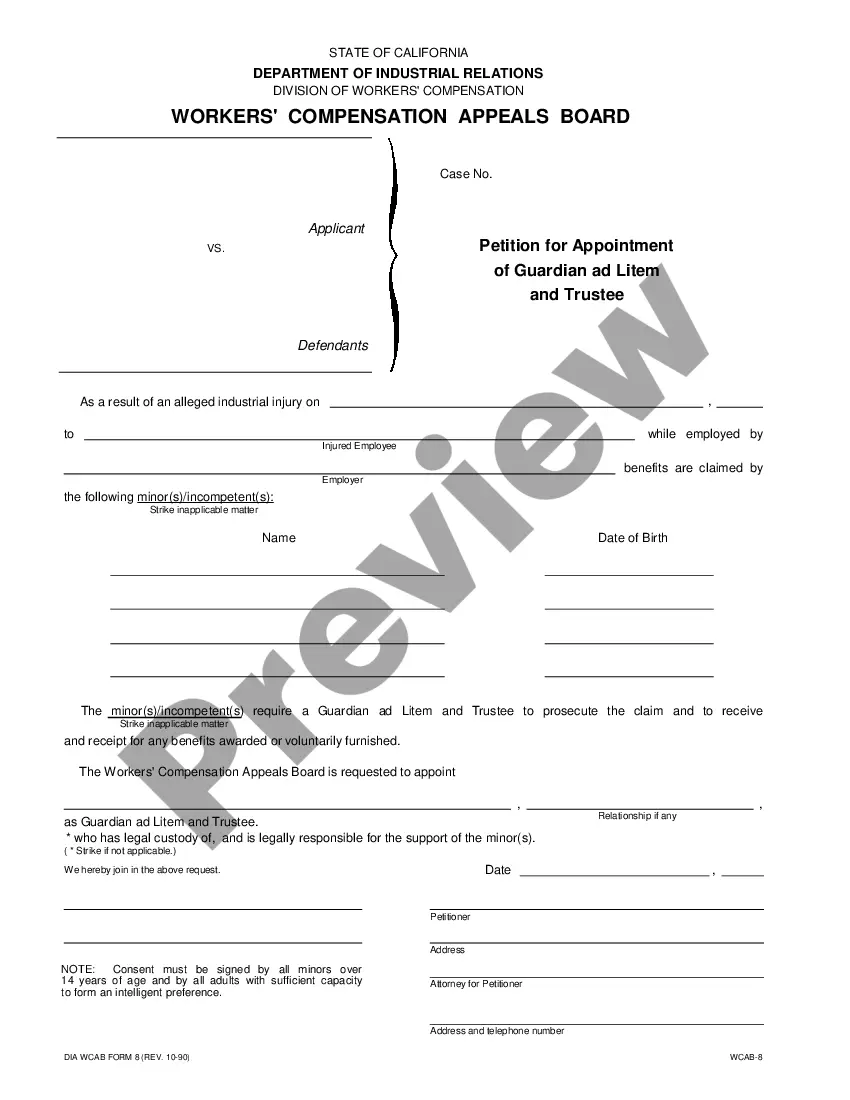

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the related document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and buy Maricopa Commercial Lease Agreement for Tenant.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Maricopa Commercial Lease Agreement for Tenant, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you need to deal with an exceptionally complicated situation, we advise getting an attorney to check your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!