A Travis Texas Commercial Lease Agreement for Tenant is a legally binding contract that outlines the terms and conditions under which a commercial property is rented by a tenant in Travis County, Texas. This agreement serves as a comprehensive document that establishes the rights and obligations of both the landlord and the tenant. In a Travis Texas Commercial Lease Agreement for Tenant, key details include the names and contact information of both parties, the description of the leased property, the lease term (duration of the agreement) and any renewal options, the monthly rent amount, the security deposit, and the payment terms. It also specifies the permitted uses of the commercial space, such as retail, office, or industrial purposes, and any restrictions on activities. Additionally, the agreement will cover maintenance responsibilities, repair and improvement clauses, insurance requirements, and any applicable utility provisions. It may further address issues such as subleasing, alterations to the premises, and dispute resolution procedures. The lease agreement will define the rights and obligations of the landlord regarding property access, inspection rights, and potential consequences for non-payment or breach of the terms. There are different types of Travis Texas Commercial Lease Agreements for Tenant depending on the specific needs and circumstances of the parties involved. Some common variations include: 1. Full-service lease agreement: This type of lease typically includes additional charges for maintenance, utilities, and property taxes, which are paid by the tenant in addition to the base rent. 2. Net lease agreement: In this type of lease, the tenant is responsible for paying a portion or all of the property expenses, such as property taxes, insurance, and maintenance costs, in addition to the base rent. 3. Triple net lease agreement: Here, the tenant is responsible for paying all property expenses, including property taxes, insurance, maintenance, and utilities, on top of the base rent. 4. Percentage lease agreement: This type of lease is commonly used for retail businesses. In addition to a base rent, the tenant pays a percentage of their gross sales as rent, providing the landlord with a share of the tenant's revenue. 5. Short-term lease agreement: This type of lease is typically used for temporary or seasonal commercial rentals. It covers a shorter duration, such as a month-to-month or a fixed-term lease that lasts less than a year. It is essential for both landlords and tenants to seek legal advice when drafting or signing a Travis Texas Commercial Lease Agreement to ensure that all relevant local laws and regulations are followed, and that both parties are adequately protected.

Travis Texas Commercial Lease Agreement for Tenant

Description

How to fill out Travis Texas Commercial Lease Agreement For Tenant?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Travis Commercial Lease Agreement for Tenant without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Travis Commercial Lease Agreement for Tenant on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Travis Commercial Lease Agreement for Tenant:

- Look through the page you've opened and check if it has the document you need.

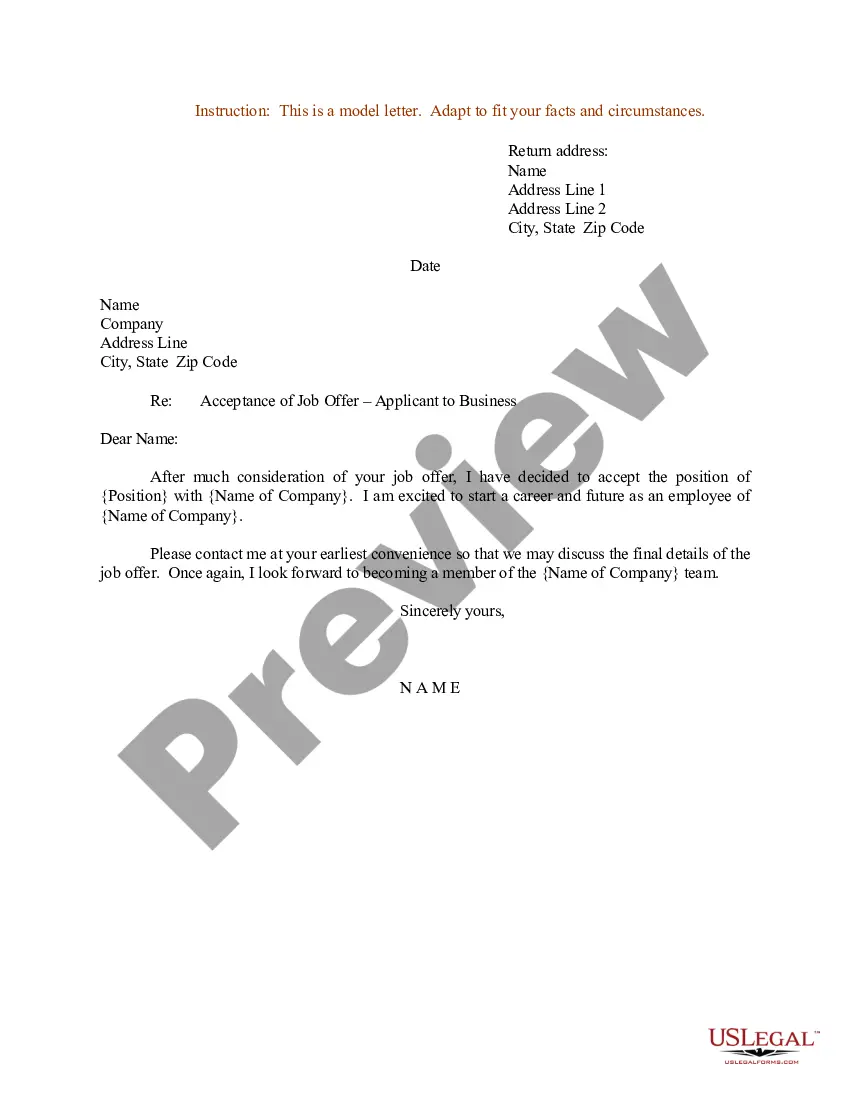

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!