Miami-Dade Florida Tenant References Checklist to Check Tenant References

Description

Form popularity

FAQ

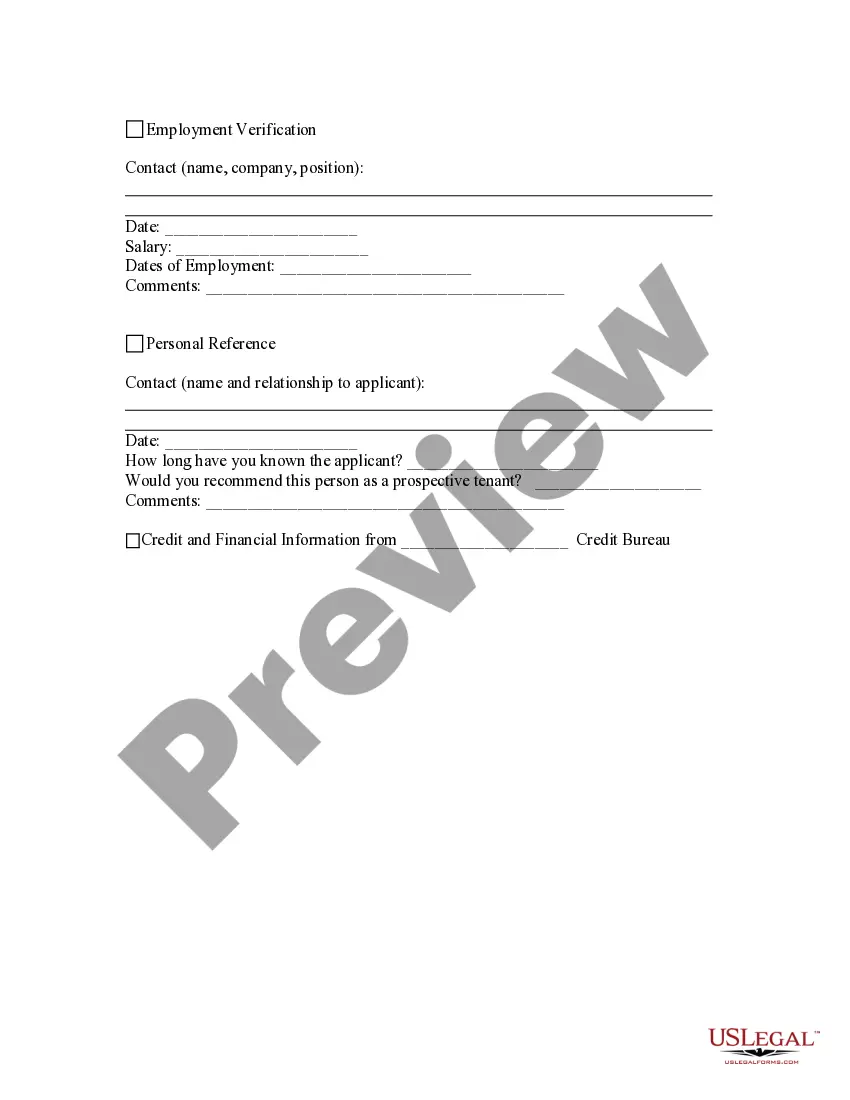

When selecting rental applicants, owners and managers have the right to undertake a non-biased screening process that is equally applied to everyone. For example, it is reasonable for landlords to require that all applicants submit to a credit check, income verification and criminal background screening.

How many referees are necessary? According to experts in the field of property and rentals, having two personal references for your rental application is recommended. It is also recommended to receive these two personal references from the two most recent property managers that you have lived under.

Did the tenant abide by the rules of the lease and any move-out rules? Did the tenant take care of your home and yard? Were there any complaints made against the tenant? How much work did you have to do to get it ready for the next tenant?

Landlords also consider factors like income, relevant criminal convictions, and past evictions.

Reference checks You'II be asked to give references to show you can afford the property, and will be a good tenant. You'll usually have to give a reference from: your current landlord and previous landlords if you're renting from a letting agent. your employer - to show you have a job and it will continue.

Landlords can select the most qualified applicant based on credit, income, references, and other business reasons.

The Housing Advocacy hotline, 786-469-4545, is available Monday through Friday from 8 a.m to 5 p.m., and closed on weekends and County holidays. Register to submit inquiries and complaints online. The Notice of Tenant Rights is now available under the resources for Landlords.

Questions to Ask a Potential Tenant During a Showing Why do you want to move? How long have you lived at your current address? When would you want to move in? Are you able to pay the security deposit in advance? How many people would be occupying the house? Is there anything that may hinder your ability to pay rent?

Landlords request reference letters in order to get to know more about prospective tenants who are interested in renting their unit, as well as verifying whether or not they would be able to make rent payments.

The Fair Housing Act makes it illegal to harass persons because of race, color, religion, sex (including gender identity and sexual orientation), disability, familial status, or national origin.