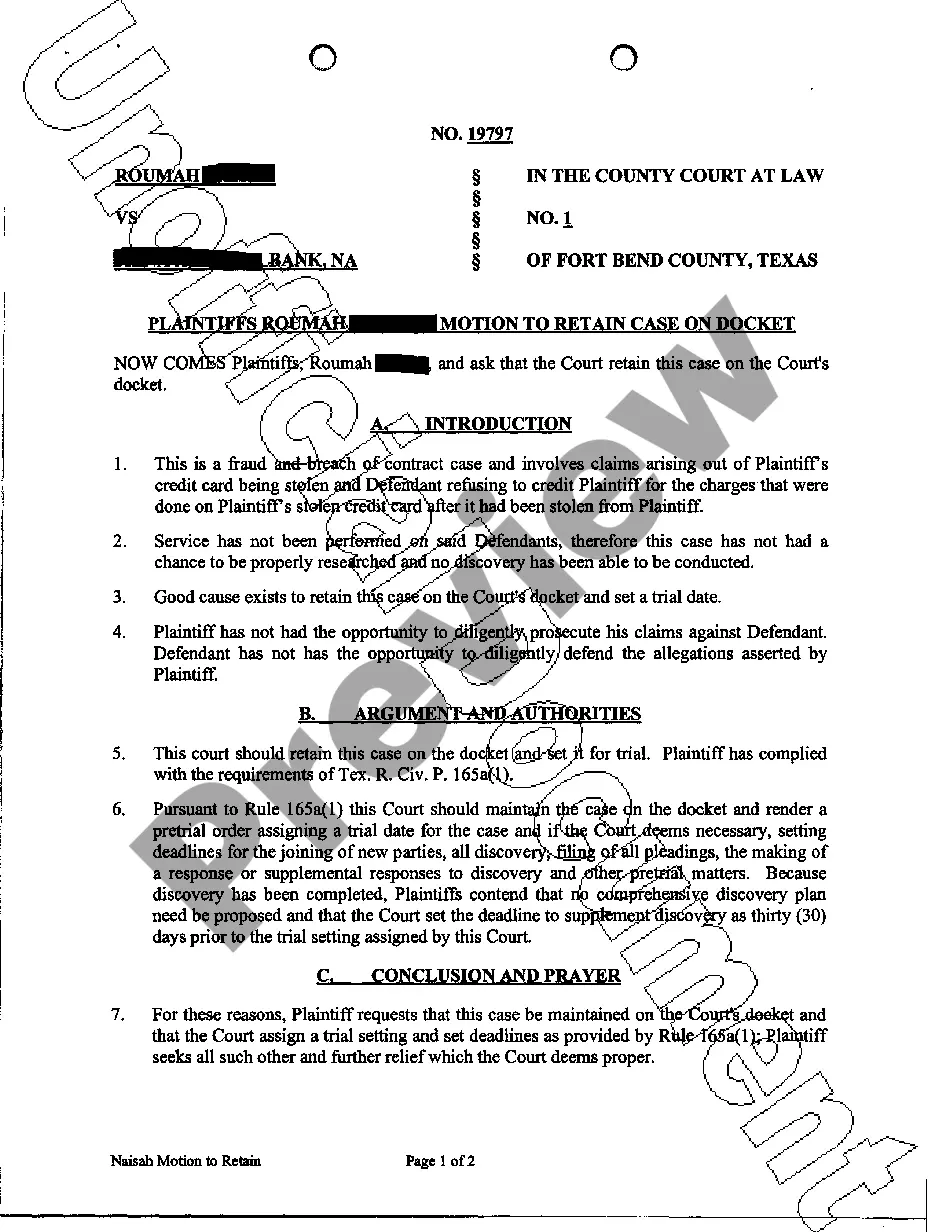

Fairfax, Virginia Demand for Payment of Account by Business to Debtor is a legal document used by businesses in Fairfax, Virginia to formally request payment from a debtor who has an outstanding account. This demand for payment, also known as a demand letter, serves as a formal notice of the debt owed and seeks to prompt the debtor to fulfill their financial obligations. In Fairfax, Virginia, businesses have the right to send a demand for payment to debtors who have failed to make payments on time or have not responded to previous requests for payment. This document is an essential step before pursuing legal action, such as filing a lawsuit, to recover the amount owed. The Demand for Payment of Account by Business to Debtor typically includes the following information: 1. Contact Information: The demand letter starts with the business's contact information, including name, address, phone number, and email address. This allows the debtor to reach out and discuss payment arrangements or address any disputes. 2. Debtor's Information: The debtor's name, address, and contact details are provided, ensuring that the demand letter is delivered to the correct recipient. 3. Account Details: The demand letter includes a thorough description of the account, including the outstanding balance, the date the debt originated, and any relevant invoice or agreement numbers. 4. Payment Due Date: The letter specifies a payment due date, by which the debtor must settle the outstanding amount. This date is typically reasonable, allowing the debtor enough time to arrange payments. 5. Consequences of Non-payment: The demand for payment outlines the consequences of non-payment. This may include additional fees, interest charges, or pursuing legal action to recover the debt. 6. Payment Options: The letter may provide various payment options, such as payment by check, online transfer, or credit card, and provide instructions on how to make payment. 7. Dispute Resolution: The demand letter may include information on how to dispute the debt if the debtor believes there is an error or disagreement regarding the amount owed. Different types of Fairfax Virginia Demand for Payment of Account by Business to Debtor can include variations in wording or formatting, but the core purpose remains the same: to formally request payment and encourage the debtor to fulfill their financial obligations. It is important to ensure that the demand letter complies with relevant laws and regulations in Fairfax, Virginia, to increase the chances of successful debt recovery.

Fairfax Virginia Demand for Payment of Account by Business to Debtor

Description

How to fill out Fairfax Virginia Demand For Payment Of Account By Business To Debtor?

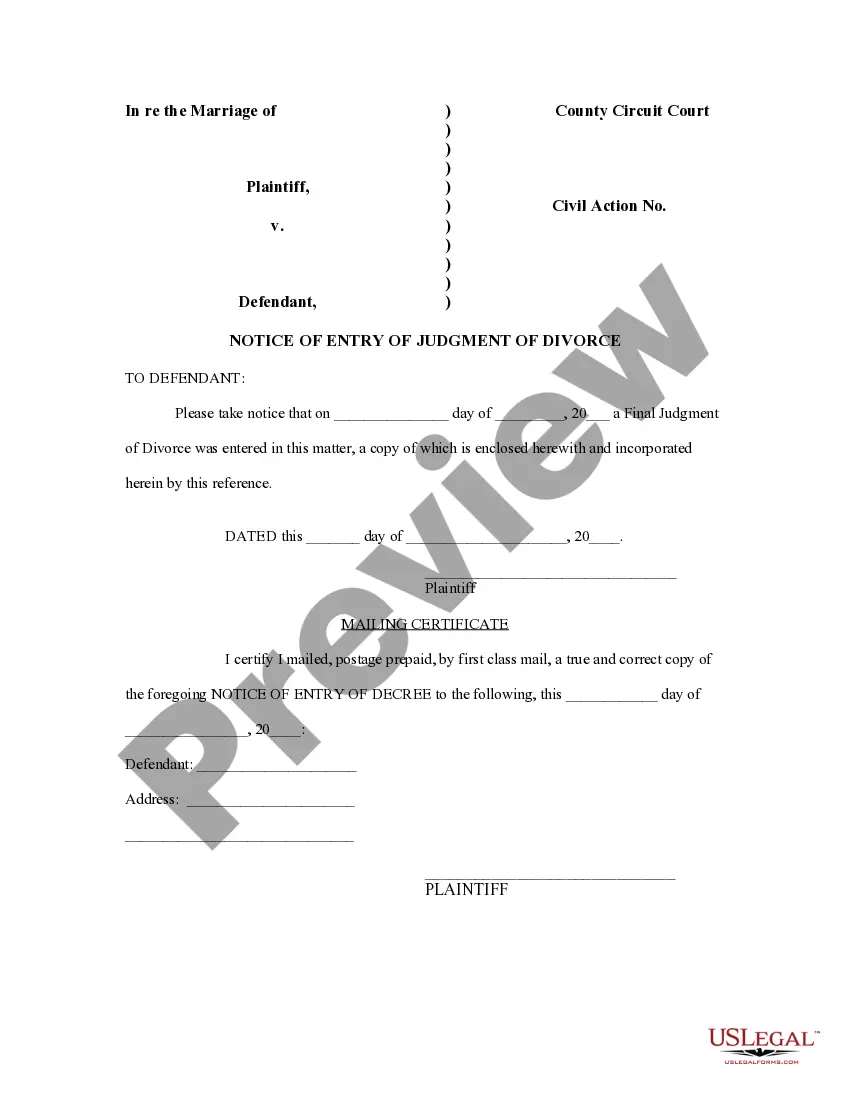

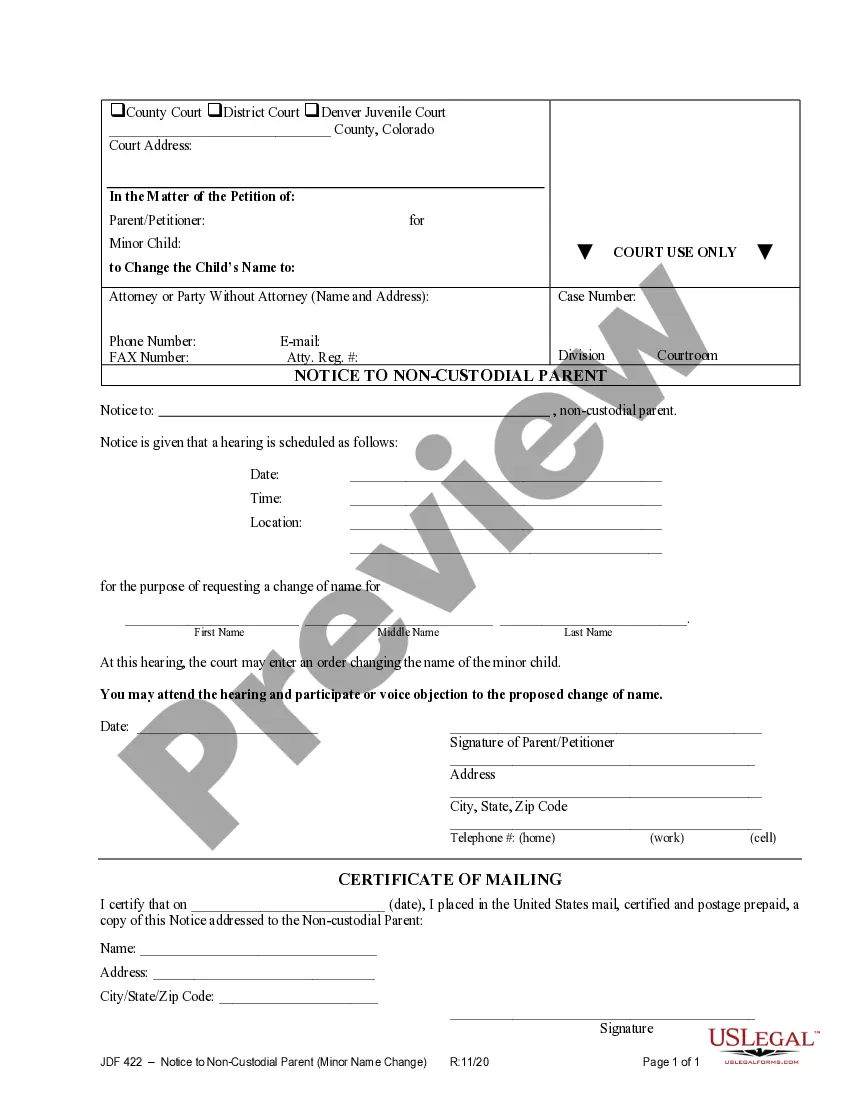

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Fairfax Demand for Payment of Account by Business to Debtor, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the recent version of the Fairfax Demand for Payment of Account by Business to Debtor, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Demand for Payment of Account by Business to Debtor:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Fairfax Demand for Payment of Account by Business to Debtor and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

If someone owes you money and they refuse to pay you at the agreed time, you may take the matter to the Small Claims Court. If someone has bought goods such as furniture from you and they have failed to pay for it, you can take the matter to the Small Claims Court.

A Summons to Answer Interrogatories is a post-judgment series of written questions drawn up for the purpose of ascertaining the personal estate of a judgment debtor, and to ascertain any real estate, in or out of this Commonwealth, to which the debtor named in a judgment and fieri facias is entitled.

The Writ of Fieri Facias is good for ninety (90) days from the date of issuance. This means the Sheriff has ninety (90) days in which to execute the process.

The creditor can seize and sell debtors personal property (like a motor vehicle, jewelry, appliances, equipment, furniture, clothing, etc.) to collect on the judgment.

The small claims court is a special division of the general district court. The small claims court has jurisdiction (the authority to hear and decide a particular type of case) over civil cases in which the plaintiff is seeking a money judgment up to $5,000 or recovery of personal property valued up to $5,000.

The small claims court is a special division of the general district court. The small claims court has jurisdiction (the authority to hear and decide a particular type of case) over civil cases in which the plaintiff is seeking a money judgment up to $5,000 or recovery of personal property valued up to $5,000.

To file this lawsuit, you must go to the General District Court Clerk's office. Ask for the proper court form. To sue for money, fill out a "Warrant in Debt." Even though this court form is called a "warrant," it is not used in a criminal case. It is used in a civil (non-criminal) case.

Writ of Fieri Facias (Fi Fa) VA Code §8.01-474. This writ is designed to help a plaintiff obtain sufficient money out of the assets held by the defendant to pay a money judgment in favor of the plaintiff and against the defendant at the option of the plaintiff.

Fieri facias (abbreviated fi. fa.) is a Latin phrase that refers to a writ of execution which directs a state specified officer, usually a sheriff, to take control of a piece of property and sell it in order to satisfy the owner's debt or tax obligations.

Filing Deadline in Virginia District Court, Small Claims Division. You have a limited amount of time to bring a lawsuit, regardless of the Virginia court in which you file. The statute of limitations for injury cases is two years, and five years for property damage matters.