Lima, Arizona Demand for Payment of Account by Business to Debtor is a legal document utilized by businesses to assert their rights and demand payment from a debtor who owes them money. This document is often essential in initiating the collection process and can be customized based on the specific details of the debt and the debtor's information. Keywords: Lima, Arizona, demand for payment, account, business, debtor, legal document, collection process, debt, customized. Types of Lima, Arizona Demand for Payment of Account by Business to Debtor: 1. Lima, Arizona Final Demand for Payment: This type of demand letter is typically sent as a last resort before legal action is pursued. It emphasizes the urgency for the debtor to settle the outstanding account and usually includes a warning about potential legal consequences if payment is not received within a specified time frame. 2. Lima, Arizona Second Notice Demand for Payment: This letter is sent when the initial payment request has been ignored or overlooked by the debtor. It serves as a reminder to the debtor about the unpaid account and reiterates the expectation of prompt payment. 3. Lima, Arizona Installment Demand for Payment: When a debtor has agreed to a repayment plan, this type of demand letter is used to ensure compliance with the agreed-upon installment terms. It outlines the remaining balance, due dates, and consequences for non-compliance, such as acceleration of the remaining balance. 4. Lima, Arizona Pre-meal Demand for Payment: This demand letter is an intermediate step before initiating any legal proceedings. It emphasizes the seriousness of the matter and typically includes a deadline for payment, after which legal action will be pursued. 5. Lima, Arizona Invoice Demand for Payment: This type of demand letter is commonly utilized when a customer or client fails to pay the invoice for goods or services rendered. It specifies the invoice amount, due date, and requests immediate payment to avoid any further collection efforts. Note: It is crucial to consult an attorney or legal professional when drafting and sending a Lima, Arizona Demand for Payment of Account by Business to Debtor to ensure compliance with local laws and regulations.

Pima Arizona Demand for Payment of Account by Business to Debtor

Description

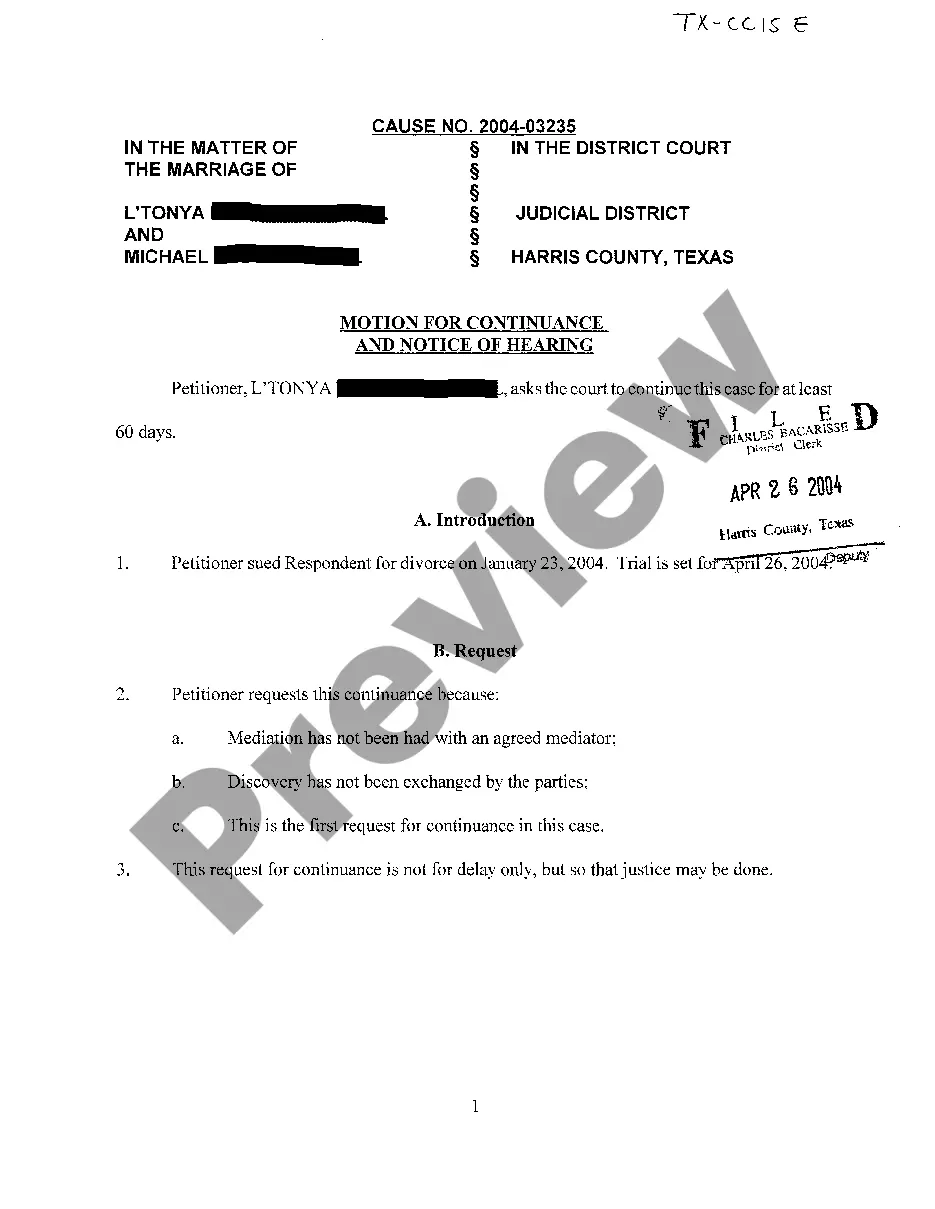

How to fill out Pima Arizona Demand For Payment Of Account By Business To Debtor?

Draftwing paperwork, like Pima Demand for Payment of Account by Business to Debtor, to manage your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for a variety of cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Pima Demand for Payment of Account by Business to Debtor template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before getting Pima Demand for Payment of Account by Business to Debtor:

- Make sure that your document is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Pima Demand for Payment of Account by Business to Debtor isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our website and get the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

The statute of limitations on written contracts, which includes most debt, is six years....Understanding Arizona's statute of limitations. Arizona Statute of Limitations on DebtMortgage debt6 yearsCredit card3 yearsAuto loan debt4 yearsState tax debt10 years1 more row ?

Judgment creditors can only seize property that isn't protected by an exemption. This includes real property and personal property.

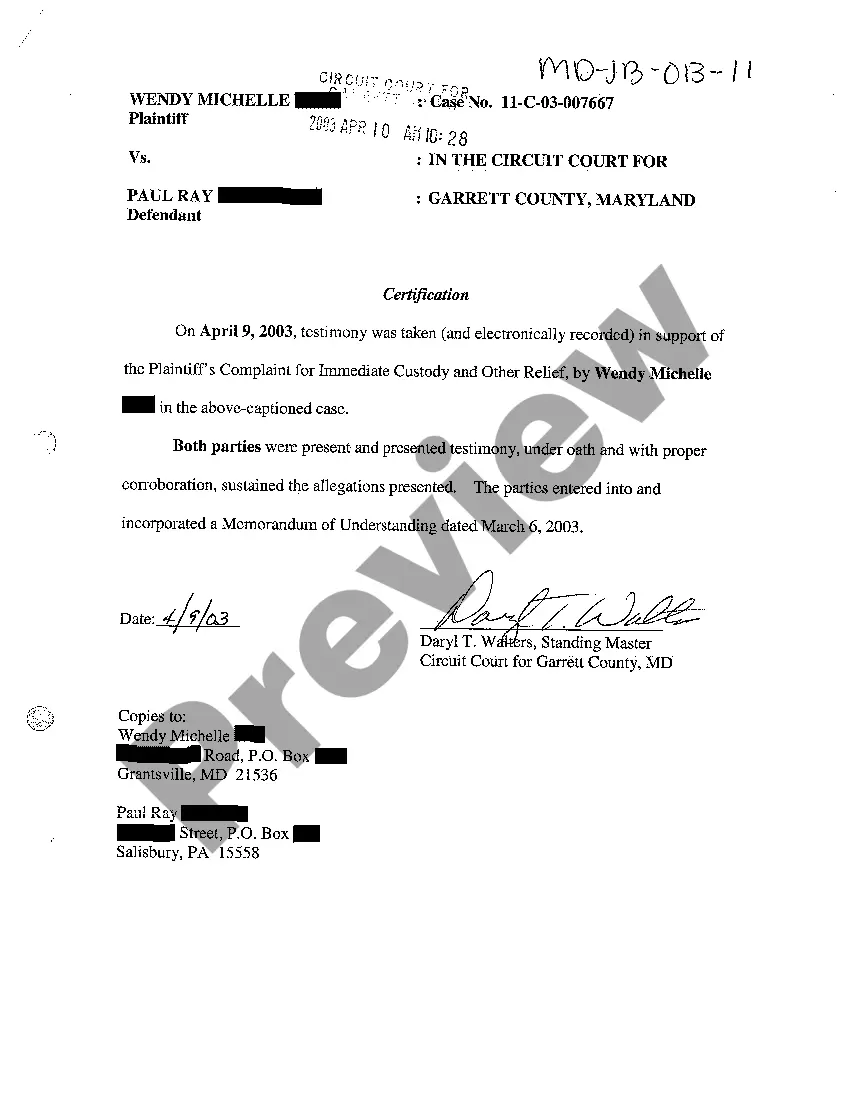

The winner of the case may collect by first sending a letter stating what is owed and trying to collect from the other party . If the other party refuses to pay there are of other tools that a person can use to collect such as: garnishment , executions on property , debtor's examinations, and recording judgments.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

Arizona Extends Judgment Validity and Renewal Deadline from Five to Ten Years. Current Arizona law (A.R.S. §§ 12-1551, 12-1611 and 12-1612) allows a judgment to be enforced by writ of execution or renewed within five years of its date of entry.

Process for Recording the Judgment Request a Transcript of Judgment from the Justice Court and pay the filing fee. File the Transcript of Judgment with the Superior Court clerk. Additional filing fee may apply. Contact the Clerk of the Superior Court at 724-3200 for filing fee information.

The statute of limitations is the time the company suing has to file the lawsuit from the date of that breach. Written contracts: 6 years, runs from date creditor could have sued account. Oral debts, stated or opens accounts: 3 years.

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

You can try and get your money (called 'enforcing your judgment') by asking the court for: a warrant of control. an attachment of earnings order. a third-party debt order. a charging order.

More info

Property Name: BROKER. Address: P.O. BOX 74583. Lot Description: SOUTH YAMAHA BAY. County:Lima. Lot size:18 acres. The transaction was registered with the Department of Treasury Service, and you are being notified of the transaction. This is my first property sale as a farmer, and it was quite a learning experience. It takes some experience to learn the system and the way it works. The property is on 6-A of Gila County. Address:C/OALISA, BARTLETT GILES, CALIFORNIA. Lot Size:10 Acres. The property is on Gila County land, and I live there on a 40-acre ranch with a lot of size of 5.5 acres. I have a water frontage of 45.43 feet. There are no utilities services, which includes electricity, telephone, gas, gas heat, water pumps and septic. The market value of the property is 7,995, and is being offered for 4,500 less than the list price of 5,000. It includes a water system and irrigation system.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.