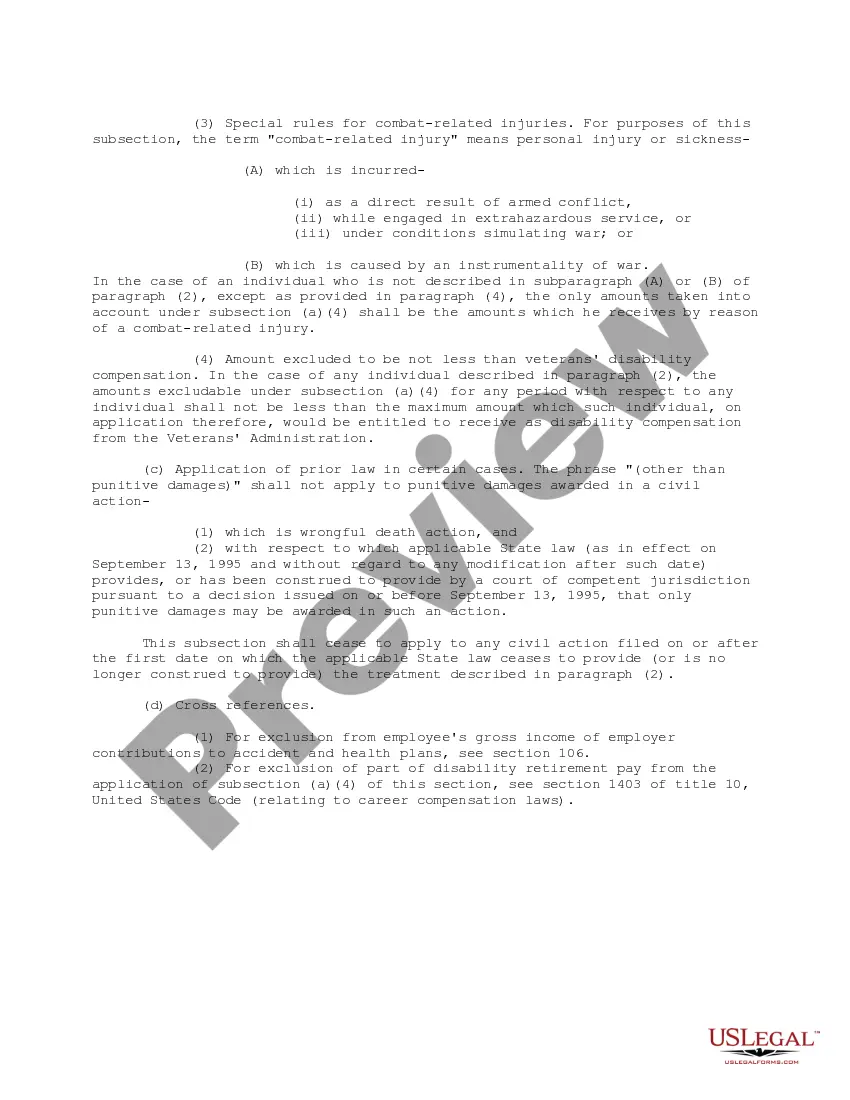

Statutory Guidelines [Appendix A(1) IRC 104] regarding compensation for injuries or sickness under workmen's compensation acts, damages (other than punitive damages), accident or health insurance, etc. as stated in the guidelines.

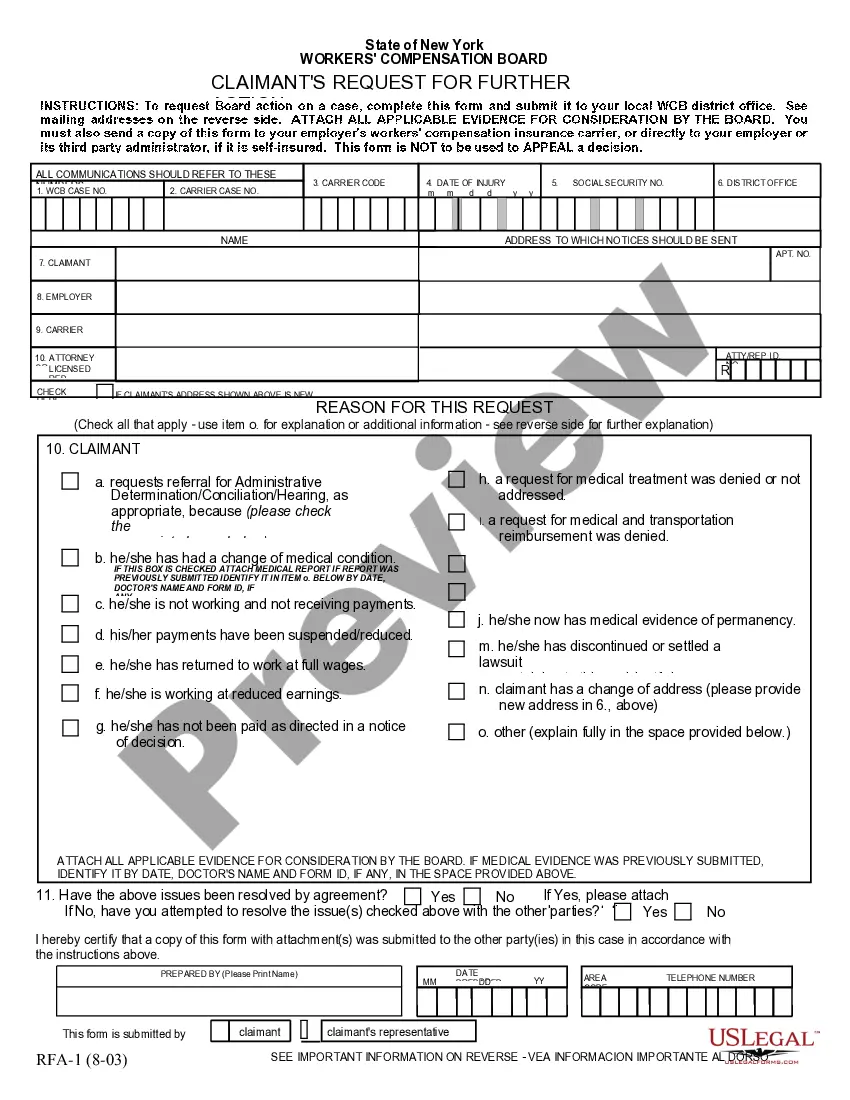

Wake North Carolina Compensation for Injuries or Sickness IRS Code 104 is a provision under the Internal Revenue Service (IRS) code that allows individuals in Wake County, North Carolina to claim tax benefits for compensation received due to injuries or sickness. Under IRS Code 104, individuals who have sustained physical or emotional injuries or sickness can receive tax-free compensation or settlements for their losses. This compensation can include medical expenses, pain and suffering, lost wages, and other related expenses. The purpose of this provision is to provide financial relief to individuals who have experienced harm or suffering due to accidents, negligence, or intentional acts. There are different types of Wake North Carolina Compensation for Injuries or Sickness under IRS Code 104, each of which merits careful consideration: 1. Personal Injury Compensation: This refers to compensation received for physical or emotional injuries resulting from accidents, medical malpractice, defective products, or other incidents caused by someone else's negligence. It may include compensation for medical bills, rehabilitation costs, lost wages, and pain and suffering. 2. Workers' Compensation: This type of compensation is specifically for individuals who have suffered work-related injuries or illnesses in Wake County, NC. It covers medical expenses, disability benefits, vocational rehabilitation, and lost wages resulting from on-the-job accidents or occupational diseases. 3. Wrongful Death Compensation: In cases where an individual's death is caused by another person or entity's wrongful actions or negligence, the deceased person's beneficiaries may be entitled to compensation. This compensation helps cover funeral expenses, loss of financial support, and other related costs. 4. Disability Benefits: Individuals who are unable to work due to a physical or mental impairment may be eligible for disability benefits. These benefits can provide financial support to cover living expenses, medical care, and other necessary costs. 5. Social Security Disability Insurance (SDI): This is a federal program that provides income support to disabled individuals who have worked and paid Social Security taxes. Wake County residents may apply for SDI benefits to assist with their everyday expenses and medical bills. It's important to note that consulting with a qualified tax professional or attorney is recommended to ensure compliance with IRS regulations and understand the specific eligibility criteria when claiming Wake North Carolina Compensation for Injuries or Sickness under IRS Code 104. Each case may vary, and the extent of compensation will depend on the circumstances of the injury or sickness.Wake North Carolina Compensation for Injuries or Sickness IRS Code 104 is a provision under the Internal Revenue Service (IRS) code that allows individuals in Wake County, North Carolina to claim tax benefits for compensation received due to injuries or sickness. Under IRS Code 104, individuals who have sustained physical or emotional injuries or sickness can receive tax-free compensation or settlements for their losses. This compensation can include medical expenses, pain and suffering, lost wages, and other related expenses. The purpose of this provision is to provide financial relief to individuals who have experienced harm or suffering due to accidents, negligence, or intentional acts. There are different types of Wake North Carolina Compensation for Injuries or Sickness under IRS Code 104, each of which merits careful consideration: 1. Personal Injury Compensation: This refers to compensation received for physical or emotional injuries resulting from accidents, medical malpractice, defective products, or other incidents caused by someone else's negligence. It may include compensation for medical bills, rehabilitation costs, lost wages, and pain and suffering. 2. Workers' Compensation: This type of compensation is specifically for individuals who have suffered work-related injuries or illnesses in Wake County, NC. It covers medical expenses, disability benefits, vocational rehabilitation, and lost wages resulting from on-the-job accidents or occupational diseases. 3. Wrongful Death Compensation: In cases where an individual's death is caused by another person or entity's wrongful actions or negligence, the deceased person's beneficiaries may be entitled to compensation. This compensation helps cover funeral expenses, loss of financial support, and other related costs. 4. Disability Benefits: Individuals who are unable to work due to a physical or mental impairment may be eligible for disability benefits. These benefits can provide financial support to cover living expenses, medical care, and other necessary costs. 5. Social Security Disability Insurance (SDI): This is a federal program that provides income support to disabled individuals who have worked and paid Social Security taxes. Wake County residents may apply for SDI benefits to assist with their everyday expenses and medical bills. It's important to note that consulting with a qualified tax professional or attorney is recommended to ensure compliance with IRS regulations and understand the specific eligibility criteria when claiming Wake North Carolina Compensation for Injuries or Sickness under IRS Code 104. Each case may vary, and the extent of compensation will depend on the circumstances of the injury or sickness.