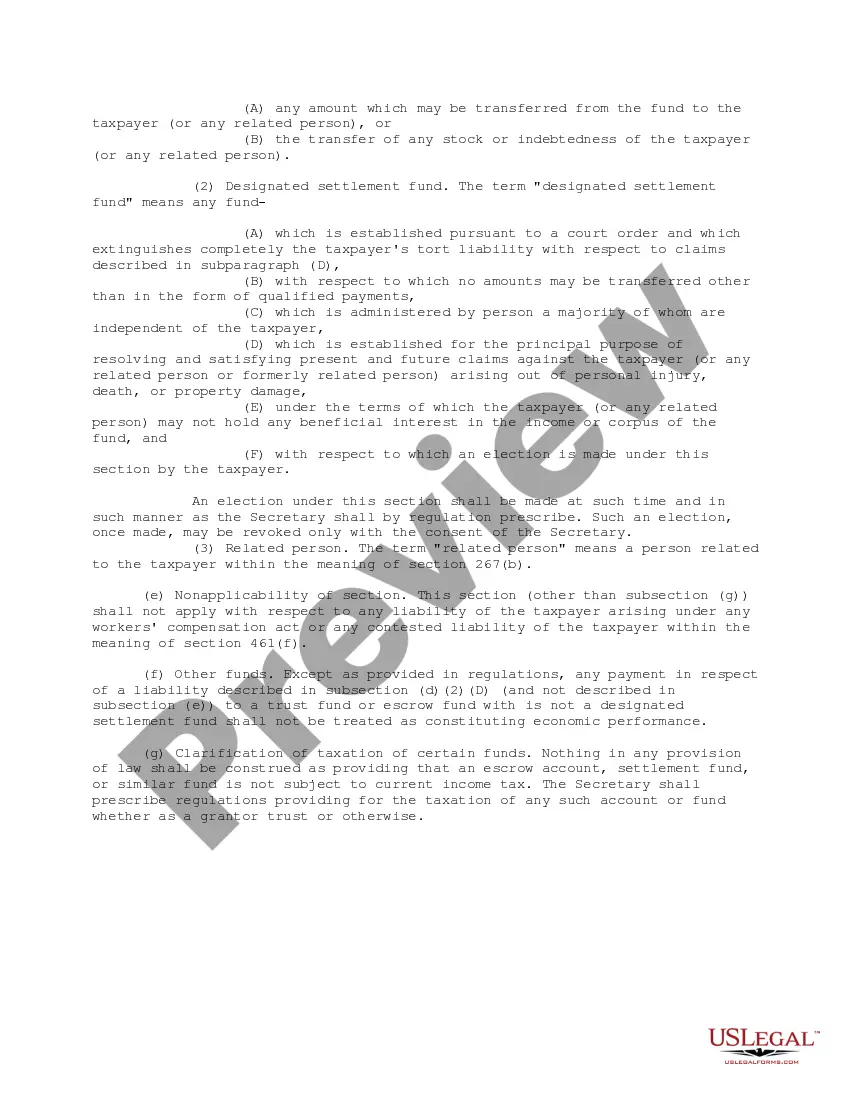

Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Los Angeles, California — Special Rules for Designated Settlement Funds: Understanding IRS Code 468B In Los Angeles, California, Special Rules for Designated Settlement Funds are governed by the Internal Revenue Service (IRS) Code 468B. These rules are designed to provide specific guidelines for managing settlement funds derived from legal claims or lawsuits, ensuring tax compliance and efficient handling of such funds. Under the IRS Code 468B, there are several types of Special Rules for Designated Settlement Funds applicable in Los Angeles, California. Let's explore them in detail: 1. Qualified Settlement Funds (SF): A Qualified Settlement Fund, often called an SF, is established to facilitate the orderly distribution of settlement proceeds. It allows settlement funds to be placed in a trust or escrow account managed by an independent trustee before the allocation to individual claimants. MSFS provide a temporary tax-exempt status for the settlement funds, relieving participants from immediate tax obligations. 2. Single-Claimant Qualified Settlement Funds (SCSI): Scoffs are a specific type of Qualified Settlement Funds designed for settlements involving only one claimant. These funds are used when a single individual or entity is the sole beneficiary of a settlement or judgment. Scoffs offer similar features as MSFS, providing a streamlined mechanism to segregate and distribute settlement proceeds while adhering to IRS guidelines. 3. Structured Settlements: While not specifically categorized under the IRS Code 468B, structured settlements are commonly utilized in conjunction with designated settlement funds. Structured settlements involve the payment of settlement funds over a specified period, rather than as a lump sum. These arrangements can provide long-term financial security and potentially favorable tax treatment by spreading out tax obligations over time. Los Angeles, being a region with a high frequency of legal claims and lawsuits, recognizes the significance of adhering to IRS regulations. The Special Rules for Designated Settlement Funds allow claimants involved in legal matters to efficiently manage their settlement proceeds in a tax-compliant manner. To take advantage of the various Special Rules for Designated Settlement Funds, it is essential to consult with experienced attorneys, tax professionals, or settlement administrators who possess a comprehensive understanding of these regulations. These experts can guide claimants through the complex process of establishing and managing designated settlement funds while ensuring adherence to IRS Code 468B. In conclusion, the Special Rules for Designated Settlement Funds under IRS Code 468B in Los Angeles, California, provide a structured framework for managing settlement funds derived from legal claims or lawsuits. Whether through Qualified Settlement Funds, Single-Claimant Qualified Settlement Funds, or structured settlements, these rules offer a way to efficiently handle settlement proceeds and remain compliant with tax obligations. Seek professional advice when dealing with designated settlement funds to optimize financial outcomes and ensure legal compliance.Los Angeles, California — Special Rules for Designated Settlement Funds: Understanding IRS Code 468B In Los Angeles, California, Special Rules for Designated Settlement Funds are governed by the Internal Revenue Service (IRS) Code 468B. These rules are designed to provide specific guidelines for managing settlement funds derived from legal claims or lawsuits, ensuring tax compliance and efficient handling of such funds. Under the IRS Code 468B, there are several types of Special Rules for Designated Settlement Funds applicable in Los Angeles, California. Let's explore them in detail: 1. Qualified Settlement Funds (SF): A Qualified Settlement Fund, often called an SF, is established to facilitate the orderly distribution of settlement proceeds. It allows settlement funds to be placed in a trust or escrow account managed by an independent trustee before the allocation to individual claimants. MSFS provide a temporary tax-exempt status for the settlement funds, relieving participants from immediate tax obligations. 2. Single-Claimant Qualified Settlement Funds (SCSI): Scoffs are a specific type of Qualified Settlement Funds designed for settlements involving only one claimant. These funds are used when a single individual or entity is the sole beneficiary of a settlement or judgment. Scoffs offer similar features as MSFS, providing a streamlined mechanism to segregate and distribute settlement proceeds while adhering to IRS guidelines. 3. Structured Settlements: While not specifically categorized under the IRS Code 468B, structured settlements are commonly utilized in conjunction with designated settlement funds. Structured settlements involve the payment of settlement funds over a specified period, rather than as a lump sum. These arrangements can provide long-term financial security and potentially favorable tax treatment by spreading out tax obligations over time. Los Angeles, being a region with a high frequency of legal claims and lawsuits, recognizes the significance of adhering to IRS regulations. The Special Rules for Designated Settlement Funds allow claimants involved in legal matters to efficiently manage their settlement proceeds in a tax-compliant manner. To take advantage of the various Special Rules for Designated Settlement Funds, it is essential to consult with experienced attorneys, tax professionals, or settlement administrators who possess a comprehensive understanding of these regulations. These experts can guide claimants through the complex process of establishing and managing designated settlement funds while ensuring adherence to IRS Code 468B. In conclusion, the Special Rules for Designated Settlement Funds under IRS Code 468B in Los Angeles, California, provide a structured framework for managing settlement funds derived from legal claims or lawsuits. Whether through Qualified Settlement Funds, Single-Claimant Qualified Settlement Funds, or structured settlements, these rules offer a way to efficiently handle settlement proceeds and remain compliant with tax obligations. Seek professional advice when dealing with designated settlement funds to optimize financial outcomes and ensure legal compliance.