Mecklenburg North Carolina Venture Capital Package is an exceptional opportunity for entrepreneurs and businesses seeking financial support to fuel their growth and innovation. This comprehensive package offers a range of services and resources designed to help startups and high-growth companies thrive in the dynamic business landscape of Mecklenburg County, located in North Carolina. The Mecklenburg North Carolina Venture Capital Package consists of the following key components: 1. Financial Investment: This package provides access to substantial financial investment from venture capital firms, angel investors, or private equity firms located in Mecklenburg County. These investment funds are specifically allocated to support startups, early-stage ventures, and high-potential companies looking to expand their operations or launch new products/services. 2. Business Networking Opportunities: The Mecklenburg North Carolina Venture Capital Package facilitates networking events, conferences, and workshops where entrepreneurs can connect with potential investors, mentors, industry experts, and other like-minded individuals. These networking opportunities help foster valuable relationships, exchange ideas, and gain crucial insights into current market trends and investment strategies. 3. Mentoring and Guidance: To enhance the chances of success, this package offers personalized mentorship and guidance from seasoned entrepreneurs, industry veterans, and successful business leaders within Mecklenburg County. These mentors provide valuable advice, share their experiences, and offer practical solutions to address challenges faced by startups and emerging companies. 4. Business Development Resources: The package includes access to a wide range of resources that aid in business development and growth. These resources may include co-working spaces, incubators, accelerators, research facilities, access to innovative technologies, marketing support, legal and accounting services, and assistance with intellectual property protection. 5. Educational and Training Programs: Mecklenburg North Carolina Venture Capital Package also offers educational and training programs tailored to the needs of entrepreneurs and business owners. These programs cover various aspects of business management, leadership, marketing, funding strategies, financial planning, and product development, among others. Through these programs, participants can acquire essential skills and knowledge needed to navigate the competitive business environment more effectively. Different types of Mecklenburg North Carolina Venture Capital Packages may include variations in the level of financial investment offered, the specific industry focus (such as technology, healthcare, renewable energy, etc.), eligibility criteria for applicants, and the duration of support provided. These variations cater to the diverse needs and preferences of entrepreneurs operating in various sectors and stages of business development within Mecklenburg County. In summary, the Mecklenburg North Carolina Venture Capital Package provides a comprehensive support system for entrepreneurs and businesses, encompassing financial investment, networking opportunities, mentorship, resources, and educational programs. This package aims to empower innovative ventures, generate economic growth, and position Mecklenburg County as a hub for entrepreneurial success.

Mecklenburg North Carolina Venture Capital Package

Description

How to fill out Mecklenburg North Carolina Venture Capital Package?

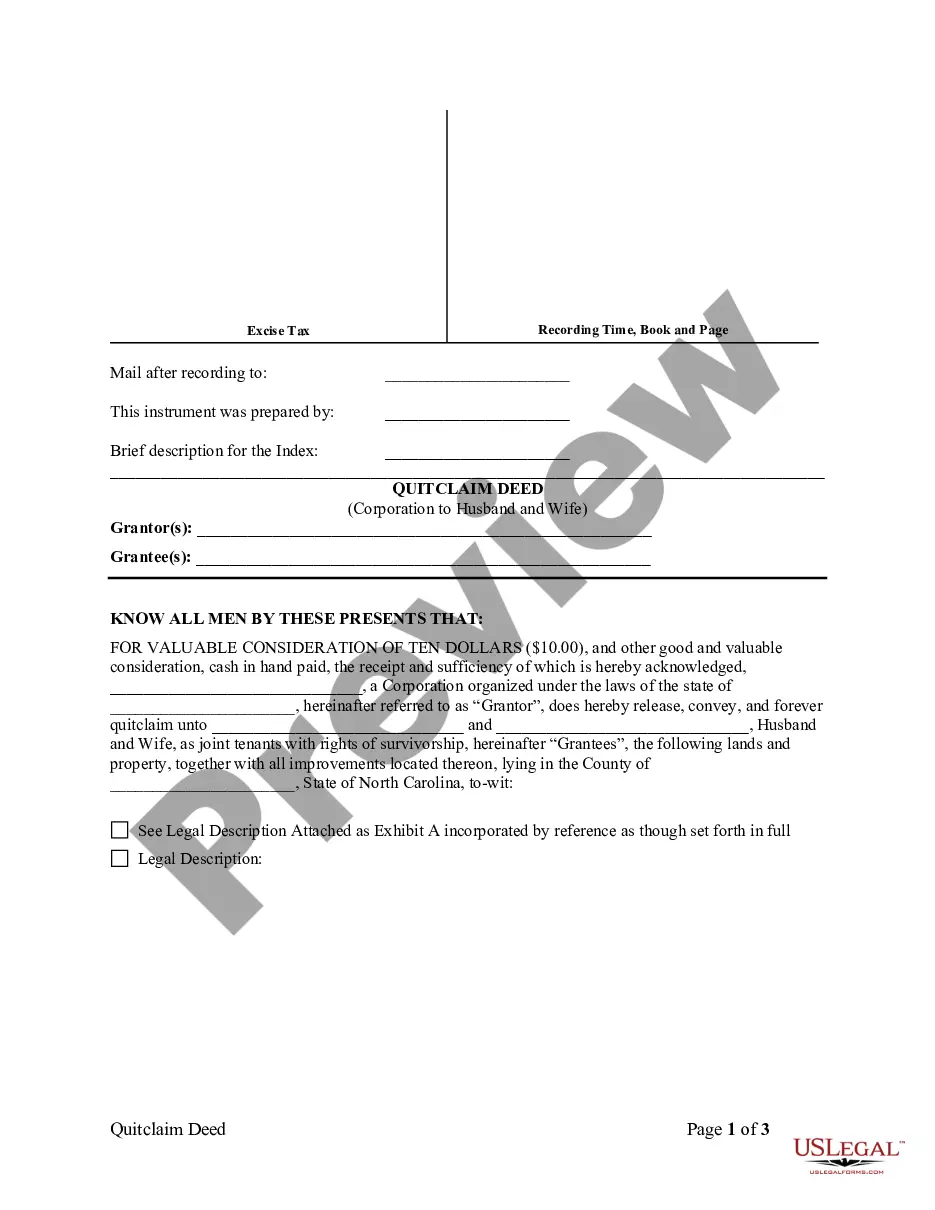

Are you looking to quickly create a legally-binding Mecklenburg Venture Capital Package or maybe any other form to manage your own or business matters? You can go with two options: contact a professional to draft a legal paper for you or create it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant form templates, including Mecklenburg Venture Capital Package and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, carefully verify if the Mecklenburg Venture Capital Package is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's intended for.

- Start the searching process over if the document isn’t what you were looking for by using the search bar in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Mecklenburg Venture Capital Package template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the documents we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Breaking into venture capital is hard. It's a small, closed industry and many jobs aren't even advertised. But it is possible. We asked three young VCs who've just secured their first jobs in the industry for top tips on how to do the same.

The answer varies from firm to firm, but most venture capital firms want to see most of the following: proprietary intellectual property. a large market size. management team members with expertise and experience. a scalable business model. the ability to exit for $50 million or more within 5 years.

A venture capitalist helps drive innovation by funding the needs of a startup. VCs invest funds into a company in exchange for a share in the profits and decision-making power within the business. Venture capitalists usually work within a firm to seek out investment opportunities for their own clients.

There are five common stages of venture capital financing: Seed stage. Start-up stage. Early stage (also called first stage or second stage capital)

VC firm NFX reminds startup founders that investors are looking for the following 12 data points before taking a meeting with a startup: Team. Company description. Market opportunity. Business model (how you make $ + your financial projections) Geography (less important post COVID) Team size (FTEs) Timing of the fundraise.

Here's the necessary skills checklist: Being able to raise money. Solid networks of Limited Partners. Domain experience (and with any luck, in a sector the VC partners find exciting). Prior investing track record. Strong access to high quality deal flow. Relationships with seasoned, all-star serial entrepreneurs.

If You're Accredited You've Got the Most Options By simply meeting accreditation requirements, you're free to invest into a venture capital fund, equity crowdfunding, or as an angel investor into individual private companies.

5 Key Components To Help Your Business Attract Venture Capital Investors Unique Idea.Show Experience.Build a Strong, Dependable Team.Growth Potential.Defensible Business Model.

Eligibility Criteria for Venture Capital Fund A new company provided that the new Company is a successor entity of a Proprietary Firm/Partnership Firm/One Person Company (OPC)/Limited Liability Partnership (LLP) of any other establishment incorporated under any law in force.

Stages of Venture Capital Financing Pre-Seed/Accelerator-stage Capital. Pre-Seed-stage is capital provided to an entrepreneur to help them develop an idea.Seed-stage Capital.Early-stage Capital.Later-stage Capital.