Allegheny Pennsylvania Financial Package is a comprehensive set of financial services and resources offered in the region of Allegheny, which is located in the state of Pennsylvania. This package aims to provide individuals, businesses, and organizations with a wide range of financial solutions to meet their unique needs and requirements. Key Features: 1. Banking Services: The financial package includes a variety of banking services such as checking accounts, savings accounts, loans, mortgages, and credit cards. These services are designed to cater to both personal and business banking needs. 2. Investment Opportunities: The Allegheny Pennsylvania Financial Package offers diverse investment options, including stocks, bonds, mutual funds, and retirement plans. These opportunities allow individuals to grow their wealth and plan for their future financial stability. 3. Insurance Solutions: The package includes insurance options like life insurance, health insurance, auto insurance, and property insurance. These insurance solutions provide protection and coverage against unforeseen events, ensuring financial security and peace of mind. 4. Financial Planning and Advisory Services: Allegheny Pennsylvania Financial Package offers financial planning and advisory services that help individuals and businesses make informed decisions about their financial goals. Certified financial planners provide guidance regarding asset allocation, retirement planning, estate planning, and tax optimization. 5. Small Business Support: The financial package also encompasses specific support for small businesses operating in Allegheny, including business loans, merchant services, cash management solutions, and payroll services. These services aim to foster entrepreneurship and facilitate the growth of local businesses. Types of Allegheny Pennsylvania Financial Packages: 1. Personal Financial Package: This type of package caters to the individual financial needs of residents in Allegheny, including banking services, investment opportunities, insurance solutions, and financial planning services. 2. Business Financial Package: Specifically designed for local businesses, this package offers services like small business loans, cash management solutions, merchant services, and financial planning consultancy to support their growth and success. 3. Community Assistance Package: This type of financial package focuses on providing financial aid, counseling, and support to low-income individuals, families, and community organizations in Allegheny. It may include programs for affordable housing, emergency funds, and financial education initiatives. 4. Specialized Financial Package: Allegheny Pennsylvania Financial Package may also include specialized packages tailored for unique circumstances or target groups. Examples include student financial packages, medical professional packages, and senior citizen financial programs, among others. In summary, Allegheny Pennsylvania Financial Package encompasses a comprehensive suite of financial services and resources tailored to meet the diverse needs of individuals, businesses, and communities within Allegheny. From everyday banking operations to robust investment opportunities and specialized support packages, this comprehensive offering aims to promote financial well-being and prosperity in the region.

Allegheny Pennsylvania Financial Package

Description

How to fill out Allegheny Pennsylvania Financial Package?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Allegheny Financial Package, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Allegheny Financial Package from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Allegheny Financial Package:

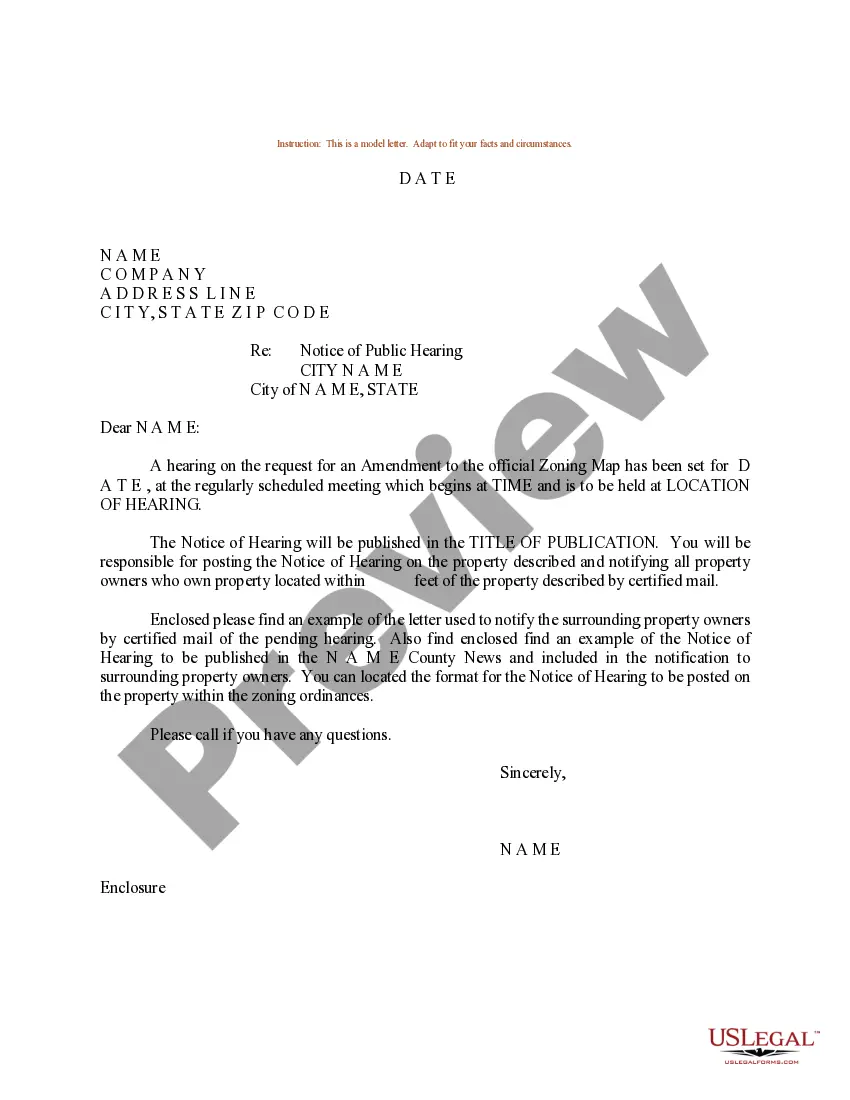

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!