The Harris Texas Notice of Qualifying Event from Employer to Plan Administrator is a crucial document that communicates significant changes in an employee's life to the plan administrator. This notice is essential for ensuring that the employee's benefits and insurance coverage are appropriately updated based on the qualifying event they may have experienced. Keyword examples: Harris Texas, Notice of Qualifying Event, Employer, Plan Administrator. There are several types of qualifying events that may require the employer to send a Harris Texas Notice of Qualifying Event to the Plan Administrator. These events include: 1. Marriage or Civil Union: If an employee gets married or enters into a civil union, their benefits and coverage may need to be modified. The employer must provide a Notice of Qualifying Event to the Plan Administrator to update the employee's status. 2. Birth or Adoption of a Child: When an employee has a baby or adopts a child, their benefits, such as health insurance or dependent care assistance, may need to be adjusted. The employer must submit a Notice of Qualifying Event to the Plan Administrator, including relevant details about the child. 3. Divorce or Legal Separation: In the unfortunate event of an employee's divorce or legal separation, the employer is obligated to notify the Plan Administrator using the Harris Texas Notice of Qualifying Event. This allows for changes in benefits, such as removal of the former spouse from health insurance coverage. 4. Death of a Dependent: If an employee experiences the loss of a dependent, such as a spouse or child, the employer must inform the Plan Administrator through the Notice of Qualifying Event. This allows for necessary modifications to the employee's benefits and coverage. 5. Change in Dependent's Eligibility: If an employee's dependent no longer qualifies for coverage, such as a child reaching the age limit for insurance or a dependent gaining eligibility through their employment, the employer must submit a Harris Texas Notice of Qualifying Event to the Plan Administrator. 6. Change in Employment Status: When an employee experiences a change in employment status, such as transitioning from full-time to part-time, layoff, or termination, this event may necessitate adjustments to benefits. As such, the employer must provide a Notice of Qualifying Event to the Plan Administrator. In conclusion, the Harris Texas Notice of Qualifying Event from Employer to Plan Administrator serves as a vital channel for communicating significant changes in an employee's life to the plan administrator. By submitting this notice, employers ensure that the necessary adjustments are made to the employee's benefits and coverage.

Harris Texas Notice of Qualifying Event from Employer to Plan Administrator

Description

How to fill out Harris Texas Notice Of Qualifying Event From Employer To Plan Administrator?

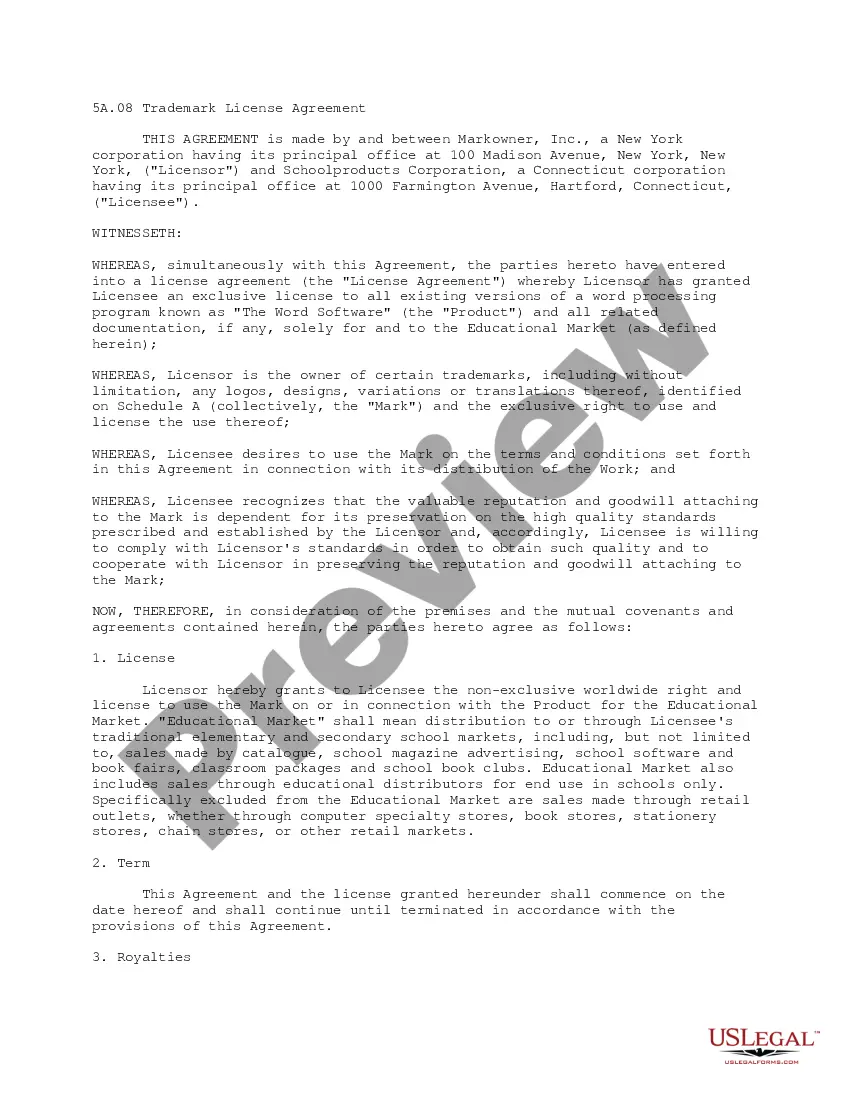

Whether you plan to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Harris Notice of Qualifying Event from Employer to Plan Administrator is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Harris Notice of Qualifying Event from Employer to Plan Administrator. Adhere to the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Notice of Qualifying Event from Employer to Plan Administrator in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

There are several other scenarios that may explain why you received a COBRA continuation notice even if you've been in your current position for a long time: You may be enrolled in a new plan annually and, therefore, receive a notice each year. Your employer may have just begun offering a health insurance plan.

The COBRA election notice should describe all of the necessary information about COBRA premiums, when they are due, and the consequences of payment and nonpayment. Plans cannot require qualified beneficiaries to pay a premium when they make the COBRA election.

Second qualifying events may include the death of the covered employee, divorce or legal separation from the covered employee, the covered employee becoming entitled to Medicare benefits (under Part A, Part B or both), or a dependent child ceasing to be eligible for coverage as a dependent under the group health plan.

COBRA Notice of Early Termination of Continuation Coverage Continuation coverage must generally be made available for a maximum period (18, 29, or 36 months).

In addition, employers can provide COBRA notices electronically (via email, text message, or through a website) during the Outbreak Period, if they reasonably believe that plan participants and beneficiaries have access to these electronic mediums.

The election notice should include the following information: The name of the plan and the name, address and telephone number of the plan's COBRA administrator. Identification of the qualifying event. Identification of the qualified beneficiaries (by name or by status).

COBRA (Consolidated Omnibus Budget Reconciliation Act of 1985) is a federal law that requires employers of 20 or more employees who offer health care benefits to offer the option of continuing this coverage to individuals who would otherwise lose their benefits due to termination of employment, reduction in hours or

COBRA Election The COBRA Notice informs the qualified beneficiary of their rights under COBRA law, and the form allows the qualified beneficiary to elect COBRA coverage to continue enrollment in benefits.

Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

The following are qualifying events: the death of the covered employee; a covered employee's termination of employment or reduction of the hours of employment; the covered employee becoming entitled to Medicare; divorce or legal separation from the covered employee; or a dependent child ceasing to be a dependent under