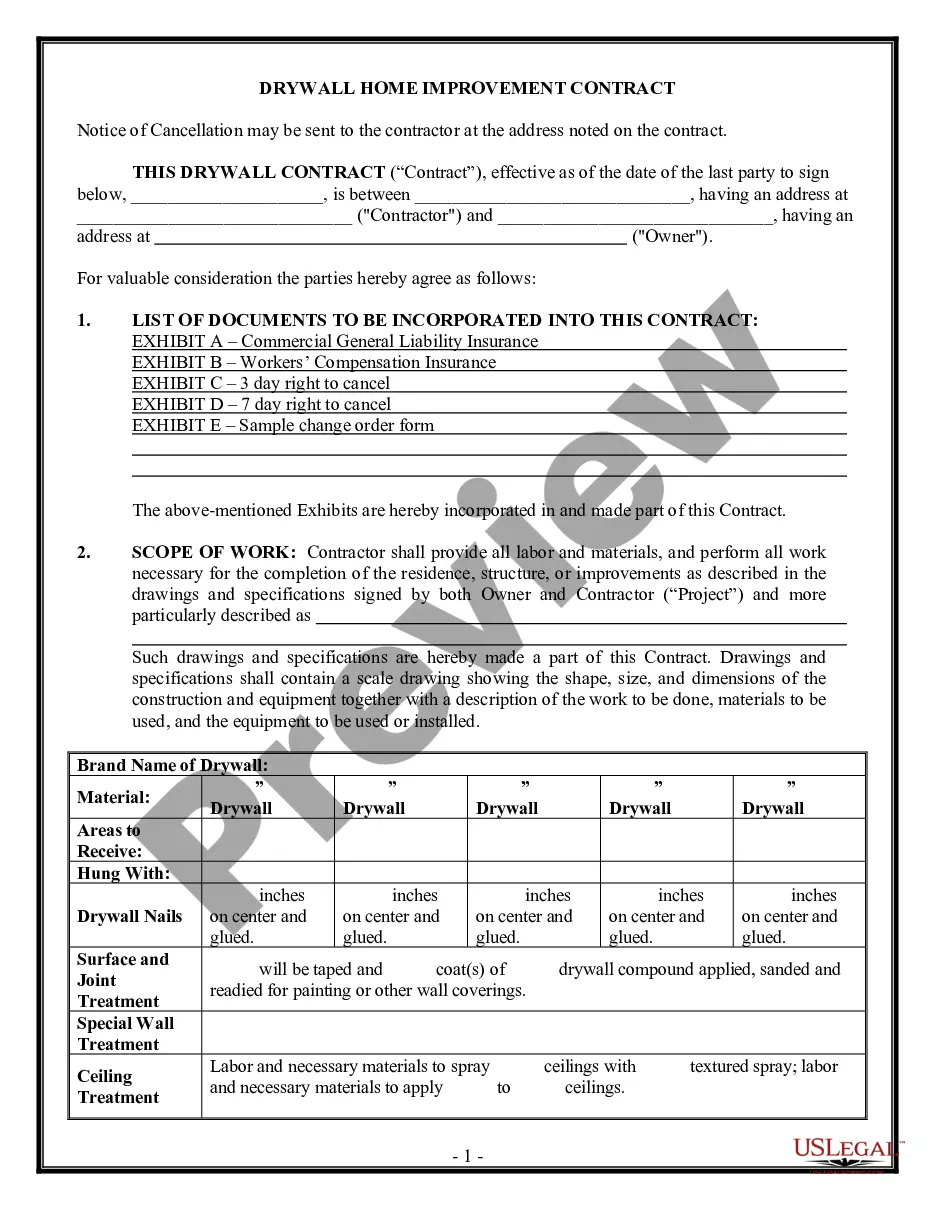

San Diego California Notice of Qualifying Event from Employer to Plan Administrator is a formal communication issued by an employer to inform the plan administrator about significant changes or events that impact an employee's benefits or initiate eligibility for certain benefits. This notice is crucial for maintaining compliance with applicable healthcare and benefit regulations. Here are some different types of San Diego California Notice of Qualifying Event from Employer to Plan Administrator: 1. Birth or adoption: In the event of an employee becoming a new parent through childbirth or adoption, the employer sends a notice to the plan administrator to ensure the addition of the child to the employee's health insurance plan. This notice helps the plan administrator update the employee's coverage and ensure timely access to benefits for the new family member. 2. Marriage or domestic partnership: When an employee gets married or enters into a domestic partnership, a notice is sent to the plan administrator to reflect the change in marital status. This allows the plan administrator to update the employee's health insurance coverage accordingly and make any necessary adjustments to benefits. 3. Divorce or legal separation: In case an employee goes through a divorce or legal separation, the employer provides a notice to the plan administrator, informing them about the change in marital status. This notice helps the plan administrator make the necessary modifications to the employee's benefit coverage, such as removing the former spouse from the health insurance plan. 4. Loss of dependent status: If an employee's child no longer qualifies as a dependent, such as reaching the age limit set by the plan or gaining financial independence, a notice is sent to the plan administrator. This notice ensures that the plan administrator updates the employee's coverage accordingly and removes the ineligible dependent from the health insurance plan. 5. Change in employment status: When an employee experiences a change in employment status, such as termination, retirement, or reduction in work hours, the employer notifies the plan administrator. This notice allows the plan administrator to make appropriate modifications to the employee's benefits, ensuring uninterrupted coverage or enabling the employee to enroll in COBRA continuation coverage where applicable. San Diego California Notice of Qualifying Event from Employer to Plan Administrator serves as a critical communication tool to invoke timely updates and adjustments to employee benefit plans. It helps maintain compliance with relevant healthcare regulations and ensures that employees receive the appropriate coverage and benefits during significant life events.

San Diego California Notice of Qualifying Event from Employer to Plan Administrator

Description

How to fill out San Diego California Notice Of Qualifying Event From Employer To Plan Administrator?

Draftwing paperwork, like San Diego Notice of Qualifying Event from Employer to Plan Administrator, to take care of your legal matters is a challenging and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for different scenarios and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the San Diego Notice of Qualifying Event from Employer to Plan Administrator form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before getting San Diego Notice of Qualifying Event from Employer to Plan Administrator:

- Make sure that your document is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the San Diego Notice of Qualifying Event from Employer to Plan Administrator isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our service and get the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

How do I cancel coverage? Voluntary cancellation (or switching from family to individual coverage which is deemed voluntary cancellation for all insured dependents) requires written, signed notification to the employer denoting a cancellation of coverage. If you are a retiree, you may cancel at any time.

Time employee has to apply: 30 days after termination; 60 days if employer fails to give notice. Employers affected: All employers who offer group health insurance.

You can reach Covered California at (800) 300-1506 or online at . You can apply for individual coverage directly through some health plans off the exchange.

Cal-COBRA administration requires four basic compliance components: Notifying all eligible group health care participants of their Cal-COBRA rights. Providing timely notice of Cal-COBRA eligibility, enrollment forms, and notice of the duration of coverage and terms of payment after a qualifying event has occurred.

The COBRA election notice should describe all of the necessary information about COBRA premiums, when they are due, and the consequences of payment and nonpayment. Plans cannot require qualified beneficiaries to pay a premium when they make the COBRA election.

Cal-COBRA applies to employers and group health plans that cover from two to 19 employees. It covers indemnity policies, preferred provider organizations (PPOs) and health maintenance organizations (HMOs), but not self-insured plans. Unlike federal COBRA, church plans are covered under Cal-COBRA.

In general, then, your health insurance company can drop you if: You commit fraud. This is kind of a no-brainer. If you misuse your insurance coverage in any way, you're breaking the rules of the contract, and the company is under no obligation to continue providing their services.

Covered Employers Under federal COBRA, employers with 20 or more employees are usually required to offer COBRA coverage. COBRA applies to plans maintained by private-sector employers (including self-insured plans) and those sponsored by most state and local governments.

Employees may obtain coverage via Covered California if their employers do not provide health coverage. However, the law does impose reporting and disclosure obligations on employers who do provide coverage.

Large Businesses Under ACA Full-time employees are defined as individuals who work more than 30 hours a week. If you are enrolled in health insurance through your employer and it fits the definition of a large business, it cannot legally cancel your insurance, with or without notice.