Travis Texas Qualifying Event Notice Information for Employer to Plan Administrator plays a crucial role in ensuring effective employee benefit plan administration. When specific qualifying events occur, it becomes essential for employers to promptly notify the plan administrator of the necessary information. This detailed description will outline what Travis Texas Qualifying Event Notice Information entails, along with different types of qualifying events employers might encounter. Travis Texas Qualifying Event Notice Information typically encompasses crucial details related to an employee's qualifying event, including but not limited to: 1. Employee Information: Employers need to provide the complete details of the affected employee, including their full name, employee identification number, date of birth, and contact information. Accurate employee identification ensures seamless plan administration. 2. Event Description: Employers must provide a detailed description of the qualifying event, clearly articulating the nature of the event that triggered the need for plan modification. Possible qualifying events include changes in marital status, birth or adoption of a child, termination of employment, reduction in work hours, and loss of dependent status due to age. 3. Event Date: It is crucial to specify the date on which the qualifying event occurred. This allows the plan administrator to determine the eligibility period for any required plan adjustment. 4. Dependent Information: If the qualifying event involves changes to dependents, the employer must provide accurate information regarding the dependents affected. This includes their names, dates of birth, and relationship to the employee. 5. Plan Modification Request: Employers should clearly state the required plan modifications resulting from the qualifying event. Whether it involves adding or removing dependents, changing coverage levels, or altering contribution amounts, the plan administrator needs concise instructions to ensure accurate plan administration. Different Types of Travis Texas Qualifying Event Notice Information: 1. Marriage or Divorce: When an employee experiences a change in marital status, they must promptly notify their employer. Employers should then provide relevant information about the employee and their spouse, along with a clear description of the event and the requested modifications. 2. Birth or Adoption: If an employee welcomes a new child through birth or adoption, they should inform their employer to initiate necessary plan adjustments. The employer must provide employee information, details of the new dependent, and specify the required plan modifications. 3. Termination of Employment: When an employee's employment is terminated, employers should provide the plan administrator with complete details. This includes the employee's information, termination date, and any required modifications in coverage levels or termination of benefits. 4. Loss of Dependent Status: If an employee's dependent loses eligibility due to age restrictions, employers are responsible for promptly notifying the plan administrator. This information should include the dependent's details, the date they lose eligibility, and any adjustments required regarding coverage or contributions. By adhering to the Travis Texas Qualifying Event Notice Information guidelines, employers can ensure that plan administrators receive accurate and timely information. Effectively communicating the necessary details helps guarantee smooth plan administration, prevents potential plan errors, and maintains compliance with relevant regulations.

Travis Texas Qualifying Event Notice Information for Employer to Plan Administrator

Description

How to fill out Travis Texas Qualifying Event Notice Information For Employer To Plan Administrator?

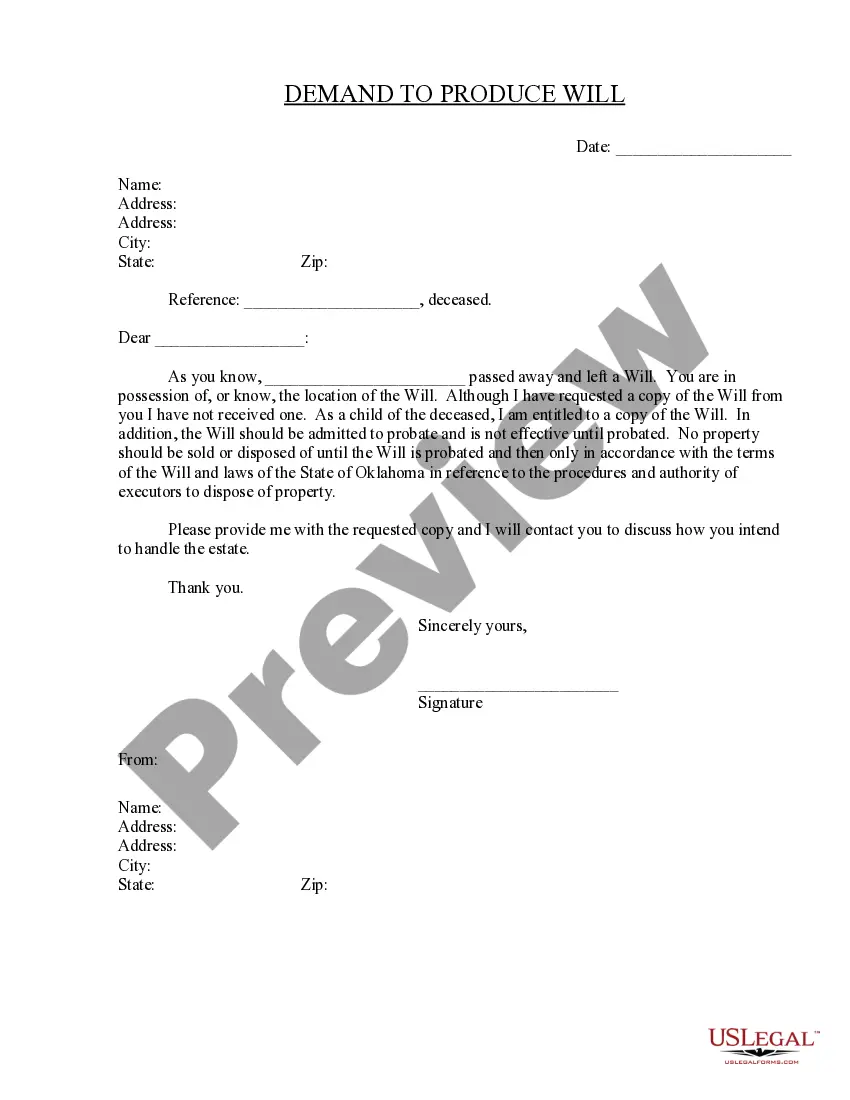

Do you need to quickly draft a legally-binding Travis Qualifying Event Notice Information for Employer to Plan Administrator or maybe any other form to handle your personal or business matters? You can select one of the two options: hire a legal advisor to write a legal document for you or draft it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific form templates, including Travis Qualifying Event Notice Information for Employer to Plan Administrator and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, carefully verify if the Travis Qualifying Event Notice Information for Employer to Plan Administrator is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Travis Qualifying Event Notice Information for Employer to Plan Administrator template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the templates we provide are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

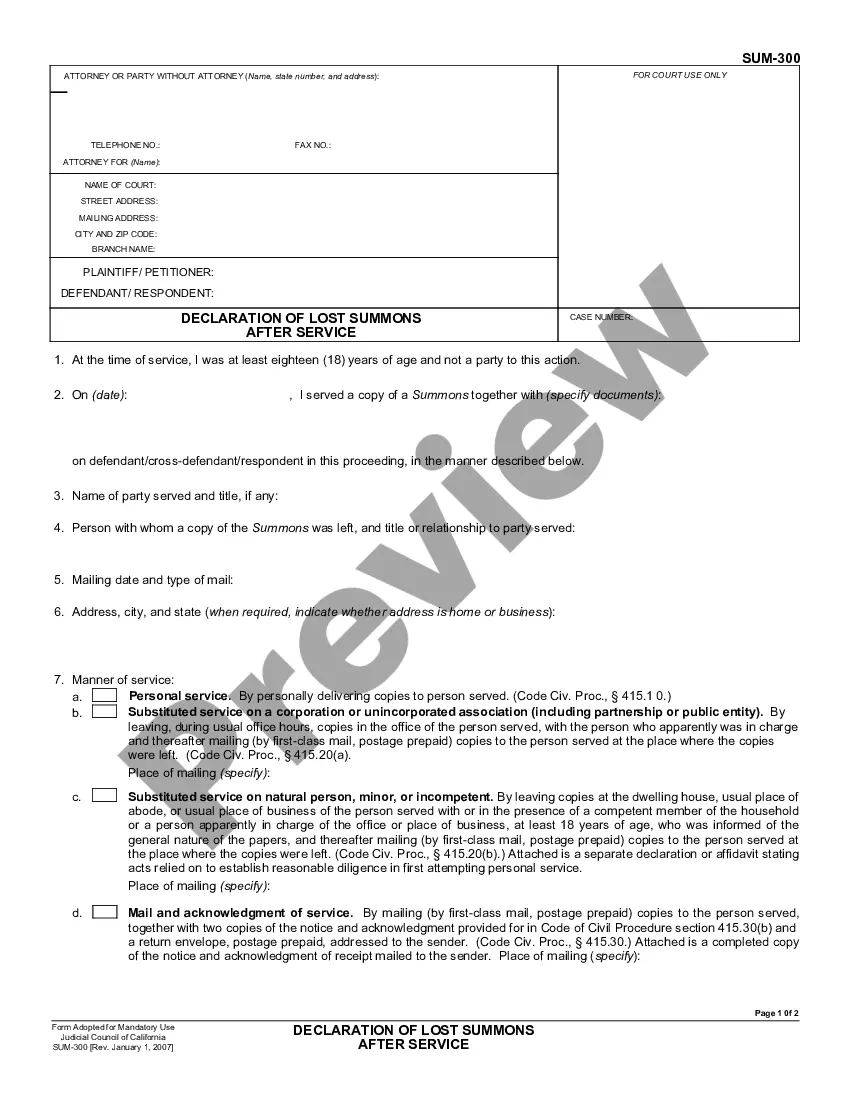

Model COBRA notices are provided on the U.S. Department of Labor's COBRA Continuation webpage under the Regulations section. Step 1: Initial Notification.Step 2: Qualifying Event Notices.Step 3: Insurance Carrier Notification.Step 4: Election and Payment.Step 5 (if needed): Late or Missing Payments.

COBRA is always retroactive to the day after your previous coverage ends, and you'll need to pay your premiums for that period too.

Cal-COBRA administration requires four basic compliance components: Notifying all eligible group health care participants of their Cal-COBRA rights. Providing timely notice of Cal-COBRA eligibility, enrollment forms, and notice of the duration of coverage and terms of payment after a qualifying event has occurred.

COBRA is a federal law about health insurance. If you lose or leave your job, COBRA lets you keep your existing employer-based coverage for at least the next 18 months. Your existing healthcare plan will now cost you more. Under COBRA, you pay the whole premium including the share your former employer used to pay.

Health & accident QuestionAnswerWhat is issued to each employee of an employer health plan?Certificate25 more rows

Q3: Which employers are required to offer COBRA coverage? COBRA generally applies to all private-sector group health plans maintained by employers that had at least 20 employees on more than 50 percent of its typical business days in the previous calendar year.

The COBRA election notice should describe all of the necessary information about COBRA premiums, when they are due, and the consequences of payment and nonpayment. Plans cannot require qualified beneficiaries to pay a premium when they make the COBRA election.

Key Takeaways COBRA is an acronym for the Consolidated Omnibus Budget Reconciliation Act, which provides eligible employees and their dependents the option of continued health insurance coverage when an employee loses their job or experiences a reduction of work hours.

With employer-provided health insurance, the risk is spread over the employees in the company who participate in the employer-provided plan and the premiums typically increase every year based on the previous year's healthcare costs of the group.

(A single contract for Group Medical Insurance issued to an employer is known as a master policy.)