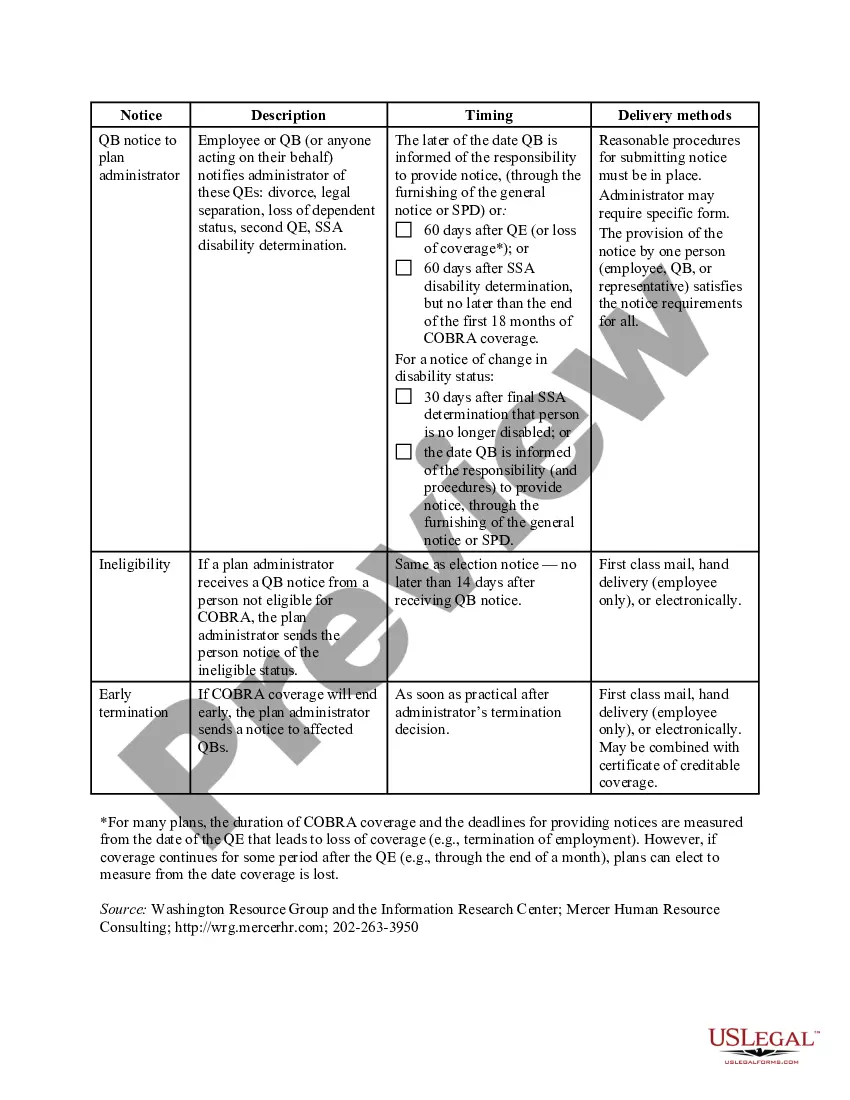

Franklin Ohio COBRA Notice Timing Delivery Chart is a valuable resource that outlines the specific timeline for employers to notify their employees about their rights under the Consolidated Omnibus Budget Reconciliation Act (COBRA). This chart provides clarity on when and how these notices should be delivered, ensuring compliance with COBRA regulations. — COBRA notice timing: The chart breaks down the various deadlines for employers to issue COBRA notices depending on different scenarios such as voluntary termination, involuntary termination, reduction in hours, and divorce or legal separation. It ensures that employers understand the timeframes within which employees should receive these crucial notices. — COBRA notice delivery: ThiFranklinin Ohio chart details the various methods through which employers can deliver COBRA notices to their qualified beneficiaries. It highlights options like hand delivery, first class mail, and electronic delivery, along with their respective requirements and limitations. Types of Franklin Ohio COBRA Notice Timing Delivery Chart: 1. Voluntary Termination Notice: This specific chart provides the deadline for employers to issue COBRA notices to employees who choose to terminate their employment voluntarily. It helps employers understand their responsibilities when an employee resigns and the importance of timely notice delivery. 2. Involuntary Termination Notice: A separate chart focuses on the deadlines for employers to deliver COBRA notices to employees who are terminated involuntarily. This chart emphasizes the significance of promptly notifying employees who have been laid off, fired, or whose positions have been eliminated. 3. Reduction in Hours Notice: This variation of the chart focuses on notifying employees of their COBRA rights when their work hours are reduced, leading to a potential loss of healthcare coverage. It helps employers understand the specific timeline within which these employees should receive the necessary notices. 4. Divorce or Legal Separation Notice: The Franklin Ohio COBRA Notice Timing Delivery Chart also considers situations where an employee's divorce or legal separation may affect their healthcare coverage. This chart highlights the deadlines and delivery methods for providing COBRA notices to employees experiencing such life events. In conclusion, the Franklin Ohio COBRA Notice Timing Delivery Chart is a comprehensive and informative tool for employers in Franklin, Ohio to ensure compliance with COBRA regulations. By clearly outlining the timing and delivery requirements for different types of COBRA notices, it serves as a practical reference guide to better understand and fulfill their obligations.

Franklin Ohio COBRA Notice Timing Delivery Chart

Description

How to fill out Franklin Ohio COBRA Notice Timing Delivery Chart?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Franklin COBRA Notice Timing Delivery Chart, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Franklin COBRA Notice Timing Delivery Chart from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Franklin COBRA Notice Timing Delivery Chart:

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Late Paying for Ongoing COBRA Health Insurance There's a minimum 30-day grace period for late premium payments, so the plan cannot terminate your coverage if, for example, you're 10 days late in paying your premium one month.

You should get a notice in the mail about your COBRA and Cal-COBRA rights. You have 60 days after being notified to sign up. If you are eligible for Federal COBRA and did not get a notice, contact your employer.

Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event. You are responsible for making sure your COBRA coverage goes into and stays in effect - if you do not ask for COBRA coverage before the deadline, you may lose your right to COBRA coverage.

You May Cancel COBRA At Any Time To cancel your your COBRA coverage you will need to notify your previous employer or the plan administrator in writing. After you stop your COBRA insurance, your former employer should send you a letter affirming termination of that health insurance.

How soon do I have to respond to the COBRA Election and notification letter? You have 60 days from the date of your COBRA letter to elect continuation of coverage. During this time your coverage is in a pending state.

The election notice should include the following information: The name of the plan and the name, address and telephone number of the plan's COBRA administrator. Identification of the qualifying event. Identification of the qualified beneficiaries (by name or by status).

Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

In addition, employers can provide COBRA notices electronically (via email, text message, or through a website) during the Outbreak Period, if they reasonably believe that plan participants and beneficiaries have access to these electronic mediums.

COBRA continuation coverage notices are documents that explain employees' rights under the Consolidated Omnibus Budget Reconciliation Act of 1985. These documents generally contain a variety of information, including the following: The name of the health insurance plan.

The employer penalties for not complying with the COBRA: The IRS can charge you $100 tax per day of noncompliance per person or $200 tax per day per family.