Maricopa, Arizona Waiver of the Right to be Spouse's Beneficiary is a legal document that allows individuals to renounce their rights as a spouse's beneficiary in the event of their partner's death. By signing this waiver, individuals voluntarily give up their claim to any assets, property, or benefits that would typically be received as a spouse's beneficiary. This waiver serves various purposes depending on the specific circumstances and needs of the parties involved. Some individuals may choose to waive their rights as a spouse's beneficiary to protect their personal assets or financial interests. Others may have alternative arrangements in place, such as life insurance policies or trusts, which eliminate the need to be a beneficiary through marital ties. It allows individuals to have greater control and flexibility over their estate planning. Whether it is a prenuptial agreement, postnuptial agreement, or a standalone waiver, Maricopa, Arizona offers different types of Waiver of the Right to be Spouse's Beneficiary to cater to the diverse needs of couples. A prenuptial agreement is executed before marriage, outlining financial rights and obligations during and after the marriage. This agreement may include a provision for waiving the right to be a spouse's beneficiary. A postnuptial agreement, on the other hand, is executed after marriage and involves similar provisions. By waiving the right to be a spouse's beneficiary, individuals can ensure their estate is distributed according to their wishes and intentions, rather than through predetermined martial laws. This waiver can protect individuals from potential disputes and complications arising from the distribution of assets during divorce or estate settlements. In summary, the Maricopa, Arizona Waiver of the Right to be Spouse's Beneficiary is a legal document that allows individuals to voluntarily renounce their rights as a spouse's beneficiary. It offers various types, including prenuptial agreements, postnuptial agreements, and standalone waivers. This waiver provides increased control over estate planning and protection of personal assets and financial interests.

Maricopa Arizona Waiver of the Right to be Spouse's Beneficiary

Description

How to fill out Maricopa Arizona Waiver Of The Right To Be Spouse's Beneficiary?

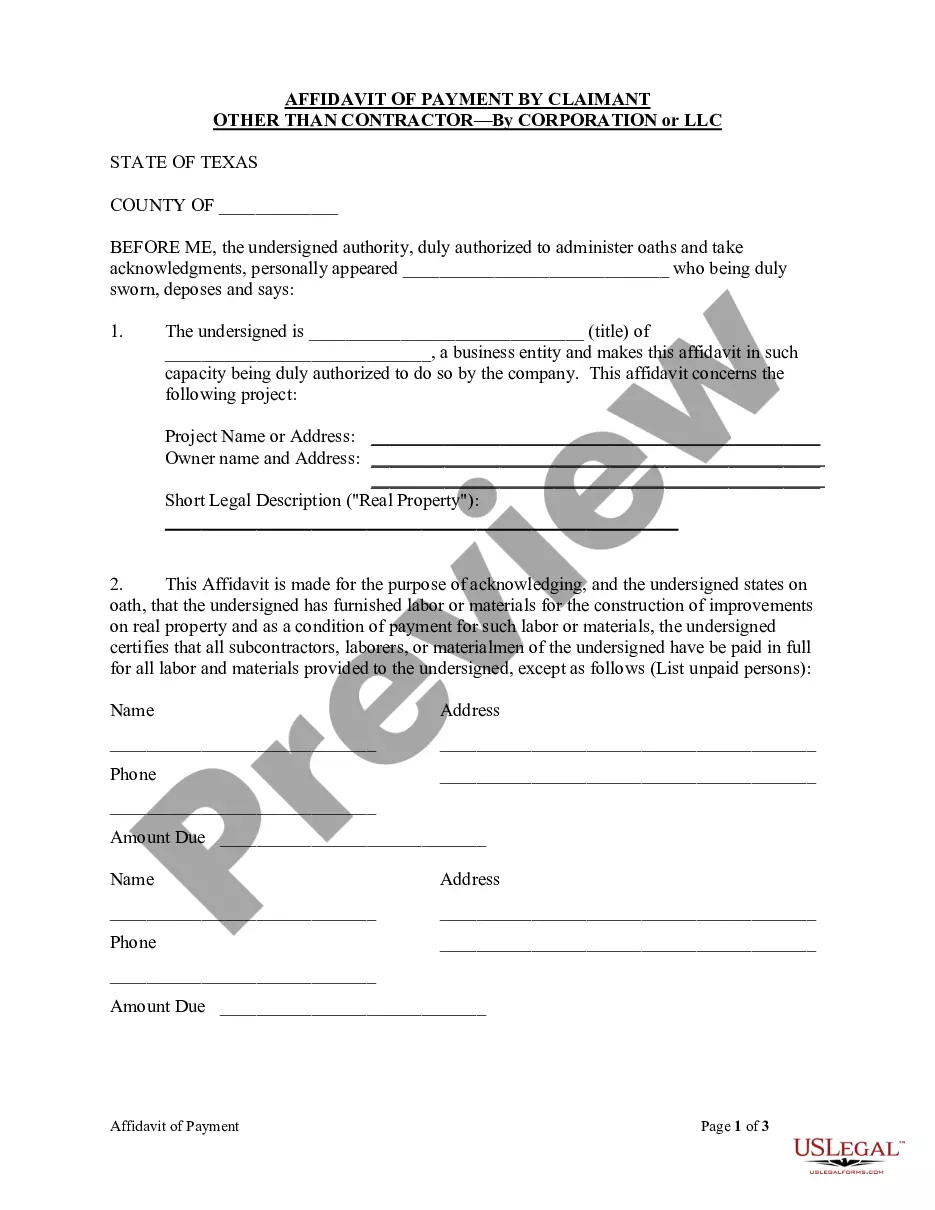

Are you looking to quickly draft a legally-binding Maricopa Waiver of the Right to be Spouse's Beneficiary or probably any other document to take control of your own or business affairs? You can select one of the two options: contact a legal advisor to draft a valid paper for you or create it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Maricopa Waiver of the Right to be Spouse's Beneficiary and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra hassles.

- First and foremost, double-check if the Maricopa Waiver of the Right to be Spouse's Beneficiary is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were looking for by using the search box in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Maricopa Waiver of the Right to be Spouse's Beneficiary template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!