Phoenix Arizona Waiver of the Right to be Spouse's Beneficiary

Description

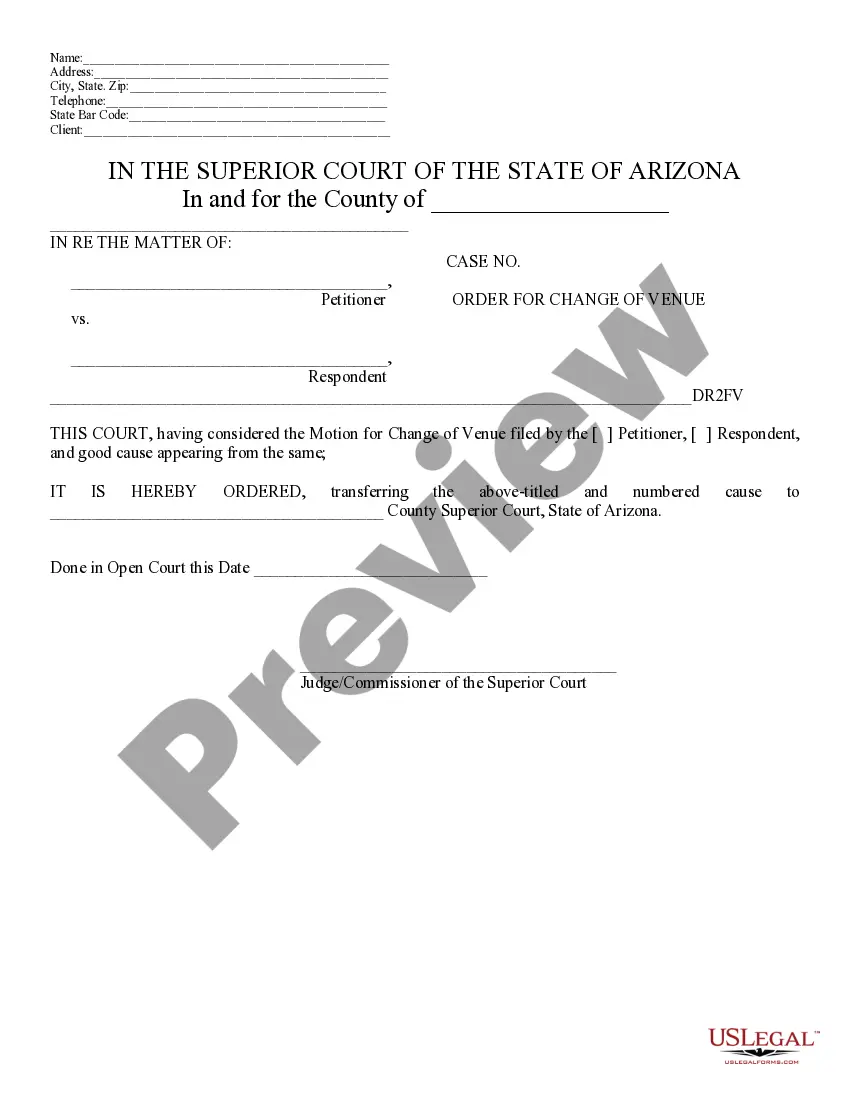

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

A document procedure consistently accompanies any legal action you undertake.

Establishing a business, submitting or accepting a job proposal, transferring ownership, and numerous other life situations necessitate that you prepare formal documentation that varies by region.

That is the reason why having everything compiled in one location is incredibly advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal forms.

This approach is the simplest and most dependable method to obtain legal documents.

- Here, you can effortlessly find and acquire a document for any personal or commercial objective utilized in your county, including the Phoenix Waiver of the Right to be Spouse's Beneficiary.

- Finding samples on the platform is remarkably simple.

- If you already possess a subscription to our library, Log In to your account, locate the sample using the search bar, and click Download to store it on your device.

- Subsequently, the Phoenix Waiver of the Right to be Spouse's Beneficiary will be available for further use in the My documents tab of your profile.

- If you are accessing US Legal Forms for the first time, follow this straightforward guide to procure the Phoenix Waiver of the Right to be Spouse's Beneficiary.

- Ensure you have opened the correct page with your localized form.

- Employ the Preview mode (if accessible) and peruse the template.

- Examine the description (if present) to confirm the template suits your requirements.

- Seek another document using the search tab if the sample is not suitable.

- Click Buy Now when you find the necessary template.

Form popularity

FAQ

Arizona law considers an inheritance payable only to one spouse to be the spouse's separate property rather than marital property divisible between the spouses. However, this classification becomes murky when money received from an inheritance is commingled with marital assets ? a process known as transmutation.

If you are married and your spouse is not named as your sole primary beneficiary, spousal consent is required in the following states of residence, which are community property states: Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas and Washington.

The Spouse Is the Automatic Beneficiary for Married People A federal law, the Employee Retirement Income Security Act (ERISA), governs most pensions and retirement accounts.

If you have a spouse but no descendants, your spouse will receive your assets. For those who are married and have descendants with their spouse, the spouse will inherit everything. For people with a spouse and children from another partnership, the spouse will inherit half of all separate property.

If someone dies without a will, their estate assets will pass by intestate succession. Intestate succession means that any part of the estate not covered by the decedent's will goes to the decedent's spouse and/or other heirs under Arizona law.

In Arizona, if you are married, and you die without a valid Will, your surviving spouse will inherit your one-half of the community property and all of your separate property if you have no children or if you have children only from your current marriage.

Arizona inheritance laws specify that a decedent's property passes to their spouse and/or descendants. Qualifying descendants could include: Children, including adopted children or ones conceived before marriage.

The only situation in which your children will be given your entire intestate estate is if you are not married at the time of your death. By contrast, the sole way that they will receive no part of your estate is if you are married and your children were all born from your marriage.

In most cases, a person who receives an inheritance is under no obligations to share it with his or her spouse. However, there are some instances in which the inheritance must be shared. Primarily, the inheritance must be kept separate from the couple's shared bank accounts.

Your spouse can waive his or her right to the retirement benefit by signing a waiver. (In this way, they waive their rights as primary and alternate beneficiaries.) You can then designate a beneficiary other than your spouse to receive your retirement benefit.